Check back here all day with live updates.

U.S. stocks moved higher Wednesday, while Treasury yields slipped lower and oil prices plunged, as investors looked to revive Wall Street's November rally into the Thanksgiving holiday.

Updated at 1:28 PM EST

Stocks are extending gains into the final hours of trading, with the S&P 500 now up 22 points, or 0.5%, taking its November advance to just under 8.5% and firmly holding on to the 4,500 point level.

The Dow, meanwhile, was marked 185 points higher while the Nasdaq was up 105 points, or 0.8%.

Updated at 10:28 AM EST

Global oil prices are extending declines after OPEC confirmed it would delay their planned meeting in Vienna, where it was expected to extend production cuts into next year, for at least a week, suggestion cracks in the cartel's previous agreement.

Brent futures contracts for January delivery, the global pricing benchmark, were last seen trading $3.70 lower at $78.71 per barrel while WTI contracts for the same month slumped $3.66 to $74.12 per barrel.

#Crudeoil trades sharply lower after #OPEC+ delayed their planned weekend meeting until next week, raising speculation about challenging behind the scene negotiations, with Saudi Arabia unlikely to make further cuts without sizable support from free riding members of the group…

— Ole S Hansen (@Ole_S_Hansen) November 22, 2023

Updated at 9:35 AM EST

Stocks are higher at the opening bell, with the S&P 500 up 23 points, or 0.5%, and the Dow gaining 141 points. A 1.5% gain for Microsoft is giving the Nasdaq a lift, with the tech-focused benchmark up 120 points, or 0.87%.

Updated at 8:34 AM EST

The job market continues to confound economists, as well as those forecasting a 2024 recession, as the number of Americans filing for new unemployment benefits fell by 14,000 over the week ending November 18 to just 209,000.

That takes the closely-tracked four week average to 220,000, down modestly from the prior tally, with continuing claims slipped to 1.84 million.

Updated at 8:26 AM EST

Global oil prices tumbled lower in early Wednesday trading following reports that OPEC, as well as non-member allies such as Russia, would delay their planned weekend meeting in Vienna.

Traders had bet the monthly gathering would either confirm or extend the cartel's production cuts, which will take some 5 million barrels from the market each day at their peak, into the first quarter of next year.

Brent futures contracts for January delivery, the global pricing benchmark, were last seen trading $3.42 lower at $78.79 per barrel while WTI contracts for the same month slumped $3.49 to $774.28 per barrel.

The AAA driving club, meanwhile, pegged the national average for a gallon of gas at $3.281 heading into the busiest travel day of the year, that's down from $3.55 this time last month and $3.636 on Thanksgiving Day in 2022.

Updated at 7:42 AM EST

Mortgage rates continue to tumble amid the pullback in Treasury bond yields, with the average 30-year fixed rate falling 20 basis points last week to 7.41%, according to data published Wednesday by the Mortgage Bankers' Association.

Updated at 7:00 AM EST

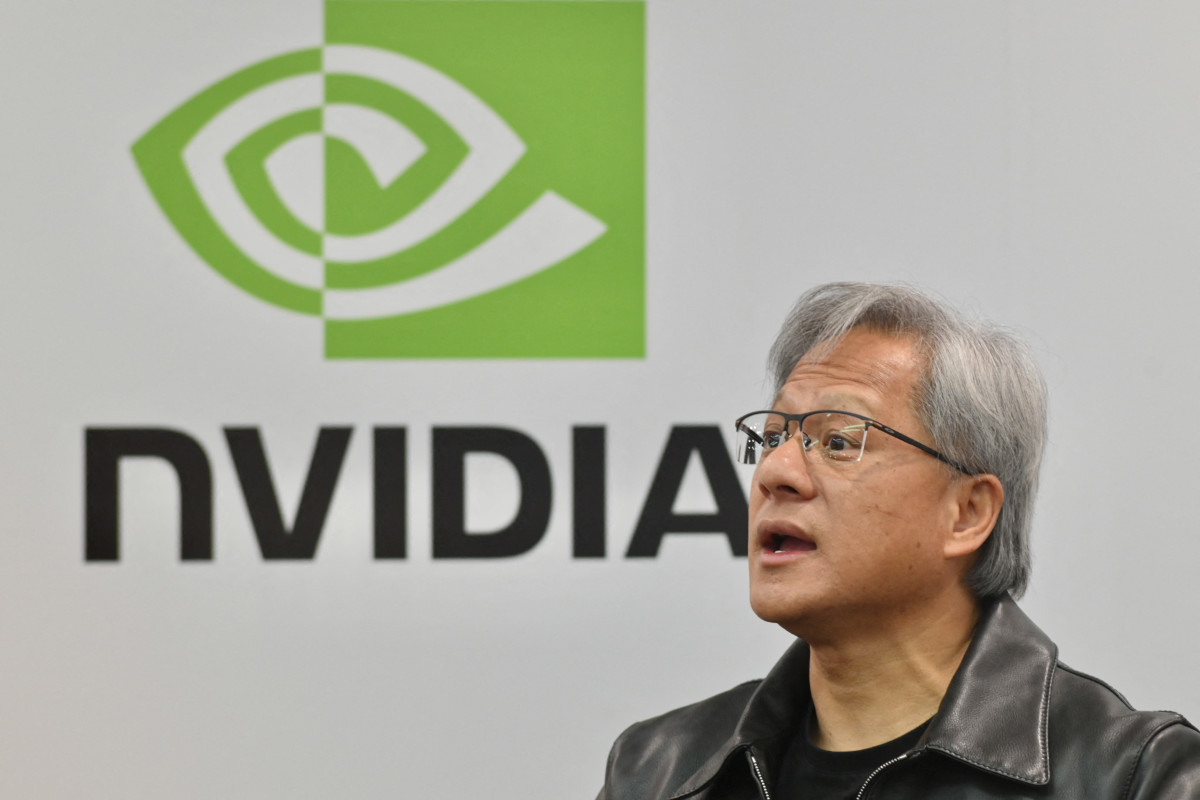

Nvidia shares could open at a fresh record high Wednesday after the AI chipmaker's blowout third quarter earnings, which included a near-term forecast for $20 billion in sales, offset concerns over the impact of U.S. restrictions on tech exports to China.

Nvidia shares were marked 1.2% higher to indicate an opening bell price of $505.43 each, just shy of the all-time high of $505.48 from earlier this week.

Related: Nvidia higher as blowout Q3 earnings overtake concern for restricted China sales

Stocks snapped a five-day winning streak last night in thin pre-holiday trading following minutes from the Federal Reserve's November policy meeting that revived concerns for a near-term rate while echoing some hawkish messaging on inflation risks from recent public comments.

The minutes added some heft to the U.S. dollar, which rose from a near three-month low against a basket of its global peers and added 0.16% in overnight dealing to change hands at 103.729.

The gains didn't flow-through into the bond market, however, and while a mixed auction of inflation-linked bonds provided some concern, yields were steady throughout the session and slipped lower in overnight trading, taking benchmark 10-year notes to around 4.375% and 2-year paper to around 4.885% heading into the start of the New York session.

Tech stocks are likely to be in focus again Wednesday following a solid third quarter earnings report from AI chipmaker Nvidia (NVDA) -) that sent shares lower after hours as it warned that U.S. export restrictions on China-bound gear would 'significantly' hit its current quarter sales.

Microsoft (MSFT) -) was also on the move, rising around 1.5% after scoring a big win with the return of OpenAI founder Sam Altman as CEO of the AI market leader, while orchestrating a beefed-up board that ensures its 49% stake is better protected going forward.

In overseas markets, Europe's Stoxx 600 rose 0.31% in early Frankfurt trading to lift the regional benchmark to a two-week higher, while Britain's FTSE 100 was little-changed ahead of a key government budget statement that could include around £20 billion ($25 billion) in new tax cuts to help the country's post-Brexit economy avoid recession.

- Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.