U.S. stocks closed lower Tuesday, while the dollar tested a three-month lows against it global peers and Treasury yields held steady, as investors reacted to the release of minutes from the Federal Reserve's November rate decision while tracking the ongoing surge in mega-cap tech stocks.

Updated at 4:40 PM EST

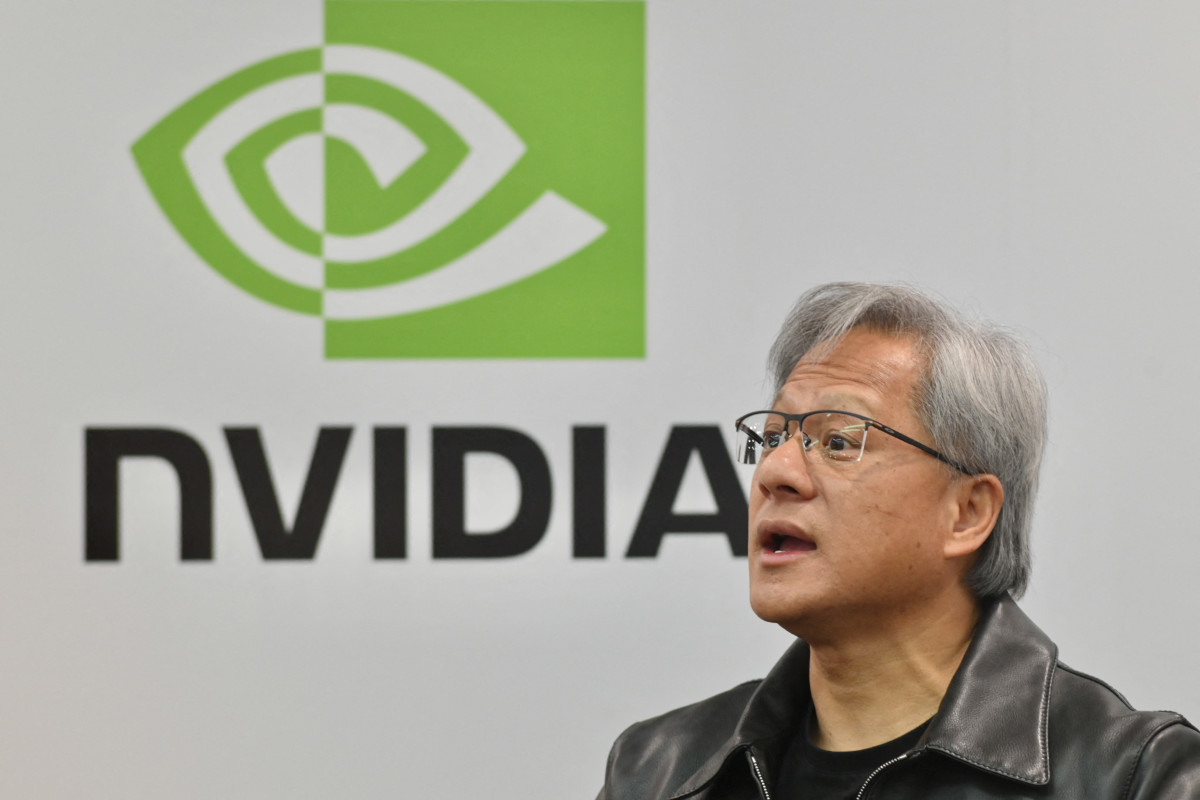

Nvidia blasted Street forecasts in its third quarter earnings update, posting a bottom line of $3.37 per share on record revenues of $18.1 billion.

Looking into the current quarter, the group also forecast sales of $20 billion, a near fourfold increase from last year, with profit margins hovering around 74% to 74.5%.

A subdued warning about China sales, however, which are set to slow "significantly" as a result of U.S. tech export restrictions, is keeping a lid on the stock in after-hours trading, with shares last marked 0.9% lower at $495.00 each.

Related: Nvidia earnings crush forecasts, outlook tops estimates, amid surging AI demand

Updated at 4:15 PM EST - Justin Maiman

We're waiting for Nvidia earnings to be released.

Nvidia (NVDA) -) earnings should be out in the next ten minutes or so. Check out the chip maker's terrific soaring stock so far this year.

Yahoo Finance/TheStreet

Updated at 2:09 PM EST

Fed officials continue to see upside inflation risks and muted growth prospects for the U.S. economy, minutes from the central bank's policy meeting indicated Tuesday, while expressing the need to see more data before the can confidently declare that price pressures are moving towards their preferred 2% target.

Stocks pared some declines following the release of the minutes, which echoed recent public comments from policymakers, including Chairman Jerome Powell, with the S&P 500 last marked 9 points lower, or 0.21%, for the session.

Updated at 1:15 PM EST

Stocks are largely steady heading into the final hours of the trading day, with Fed minutes up at 2:00 PM eastern, in largely uneventful session highlight be a host of retail earnings and another solid auction of inflation-linked Treasury bonds.

The S&P 500, which is up 7.64% for the month, was last marked 10 points lower, or 0.23%, while the Dow gave back 76 points from last night's close. The Nasdaq, meanwhile, was down 101 points, or 0.71%.

Updated at 11:14 AM EST

Stocks are bond yields are moving in tandem this morning in a rare move that likely reflects thin pre-Thanksgiving volumes as opposed to the start of a significant de-coupling.

Benchmark 10-year Treasury note yields are holding at 4.410% in late-morning trading, while 2-year notes eased to 4.881%. Normally, the higher Treasury prices would correspond with an upside move in stocks, but having booked gains for five consecutive sessions, and with Fed minutes and Nvidia earnings on deck, investors seem content taking a defensive tenor into the afternoon session.

Updated at 10:14 AM EST

The housing market continued its mixed performance into the autumn, with October existing home sales falling 4.1% to an annualized rate of 3.79 million, missing Street forecasts, as sellers remain reluctant to refinance amid multi-decade high mortgage rates and buyers are put off by home prices pegged at the highest-ever levels for the month of $391,800.

Last week, Commerce Department data showed October housing starts nudged 1.9% higher, to an annualized rate of 1.372 million units, while permits for new construction, a key indicator of demand, were up 1.1% to 1.487 million units.

Updated at 9:52 AM EST

The S&P 500 slipped 11 points, or 0.24%, in the opening minutes of trading while the Dow was marked 80 points to the downside. The Nasdaq, meanwhile, was down 50 points, or 0.35%.

Updated at 9:22 AM EST

Kohl's (KSS) -) added to parade of retail earnings prior to the opening bell with a third quarter update that fell shy of analysts' estimates as comparable sales for the upscale group fell 5.5%, extending their slide to a seventh consecutive quarter.

Shares in the group were marked 5.9% lower and indicating an opening bell price of $23.40 each.

Updated at 8:09 AM EST

Retail earnings are mixed this morning, with Best Buy (BBY) -) slumping 5.1% following a muted holiday sales outlook compounded a disappointing third quarter update. Apple (AAPL) -), which comprises a large portion of Best Buy sales, was marked 0.2% lower following the earnings release.

Dicks Sporting Goods (DKS) -), meanwhile, surged 8.4% after it lifted its full-year profit forecast to between $12 and $12.60 per share, a 30 cent improvement at the higher-end, following better-than-expected third quarter earnings of $2.85 per share on revenues of $3.04 billion.

Updated at 7:07 AM EST

Stocks are drifting lower into the open, although pre-market volumes looked muted ahead of the Thanksgiving holiday, with the S&P 500 looking at a 5 point opening bell dip.

Lowe's shares are a notable early mover, falling around 4% following a mixed set of third quarter earnings for the home improvement retailer that echoed Home Depot's (HD) -) concern over a pullback in big ticket consumer spending.

Related: Lowe's tumbles as retailer echoes Home Depot warning on big ticket spending

Record highs for Microsoft (MSFT) -) and Nvidia (NVDA) -) helped power the Nasdaq to its best closing level in nearly two years, with the tech-focused index now riding a year-to-date gain of around 36.5%. The gains flowed-through into the S&P 500, as well, with the broadest U.S. benchmark notching its best close since August and taking its November gain to around 7.65%.

AI chipmaker Nvidia, in fact, will post its third quarter earnings update after the closing bell with analysts looking for a bottom line of $3.37 per share on revenues of $16.182 billion a near three-fold increase from the same period last year.

Tame bond yields are also a big part of the broader rally, with Treasuries reacting well to a solid auction of $16 billion in 20-year bonds yesterday that drew the highest level of foreign buyers for the paper in more than two years.

Benchmark 10-year notes were marked at 4.401% in early New York dealing, down around 4 basis points from pre-auction levels, while 2-year notes held at 4.913%.

The U.S. dollar index, meanwhile, fell another 0.14% against a basket of its global peers, despite the first official move higher for China's yuan since July, to trade near a three-month low of 103.296 in early New York dealing

The moves reflect extended bets on a Fed rate cut by the spring, with the odds of any chance to the current 5.25% to 5.5% range over the next three meetings largely erased by slowing inflation and moderating GDP growth.

In overseas markets, European stocks were hovering near a two-month high in thin Tuesday trading, while Asia shares touched a three-month high before retreating into the close.

Japan Nikkei 225, meanwhile, Asia's best-performing market, eased 0.1% from the 33-year high it reached yesterday to close at 33,354.14 points.

- Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.