Stock finished sharply lower Tuesday, while oil prices raced to fresh seven-year highs and Treasury yields retreated, as global markets reacted to Russia's provocative actions in Eastern Europe that are likely to result in widespread sanctions from Western leaders and escalating military tensions in the region.

The Dow Jones Industrial Average finished down 482 points, or 1.42%, to 33,596 fell 1.01%. The tech-focused Nasdaq Composite fell 1.23% as 10-year Treasury note yields traded at 1.93%.

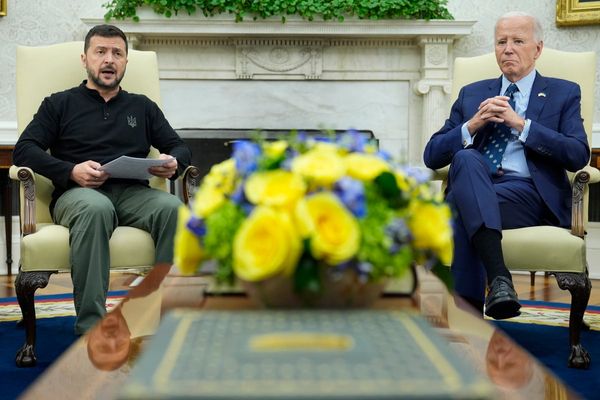

President Joe Biden unveiled a series of targeted sanctions impacting Russian banks and financial firms, as well as family members with close ties to the upper echelons of the government.

Russian President Vladimir Putin said he would recognize the independent sovereignty of two breakaway republics in the Ukraine on Monday, a move that both allows him to annex the pro-Moscow territories with what he called "peacekeeping" troops while simultaneously ruining any near-term chance of negotiating a peaceful settlement in the fast-escalating dispute with Washington.

"We still believe Russia is prepared to go further in its invasion of Ukraine," Biden said during a televised address Tuesday. "I hope we're wrong about that, but it seems to be the case."

Global markets reacted in kind, with benchmark 10-year Treasury bond yields falling below the 1.9% mark in overnight trading as investors ploughed cash into safe-haven assets, while oil prices surged closer to the $100 per barrel mark on fears of disruption in natural gas supplies into Western Europe and sanctions on Russia's 10.2 million barrels in daily crude exports.

Geopolitical risks are likely to trump corporate earnings headlines this week, as well, amid a light calendar of updates and data releases highlighted by holiday quarter profits from Home Depot (HD).

Collective S&P 500 earnings are forecast to rise 31.8% from last year over the fourth quarter to a share-weighted $463.3 billion.

That growth rate is set to slow sharply, however, in the current quarter, with collective profits forecast to rise only 6.7% from last year to $435.6 billon as inflation pressures continue to mount and the Federal Reserve begins what many believe will be a multiple series of rates hikes to tame it.

Europe's Stoxx 600 benchmark fell 1% by mid-morning trading in Frankfurt, following on from a 1.6% slump for the region-wide MSCI ex-Japan index, but recovered most of those losses to close flat on the session as traders tracked U.S. equity futures, which were also influenced by a big jump in the CBOE's key VIX volatility gauge, setting up for an active session on Wall Street.

WTI crude futures for April delivery were marked $1.20 higher on the session at $92.27 per barrel, while Brent contract for the same month, the global benchmark, gained $1.01 to trade at $96.40 per barrel heading into the close of New York dealing.

The leap in crude prices hit U.S. drillers, with Dow components Chevron (CVX) slipping nearly 1% to $132.40 each and Exxon Mobil (XOM) losing 1.18% to trade at $77.45 each.

Macy's (M) shares finished down 5.1% after posting stronger-than-expected fourth-quarter earnings and boosting its dividend and share buyback plans.

Home Depot ended down 8.9% after topping Wall Street earnings forecasts thanks to a big jump in average ticket sales for the home improvement retailer.

Krispy Kreme (DNUT) shares, meanwhile, jumped 8.4% after the coffee and donut chain posted stronger-than-expected fourth quarter sales, and its first profit as a public company, even as Covid and supply chain expenses chipped away at its bottom line.