The stock market rally took off this past week as Treasury yields plunged on generally weak economic data and soothing words from Fed Chief Jerome Powell Nasdaq staged a follow-through day to confirm the market rally on Wednesday, with the S&P 500 and Dow Jones following through on Thursday. Earnings season remained heavy, with Arista Networks, Roku, Shopify, Palantir Technologies, Cameco, Pinterest, DraftKings and Advanced Micro Devices among the notable winners. But there were plenty of big losers, such as Remitly and Paycom.

Stock Market In Confirmed Rally

The Nasdaq staged a follow-day Wednesday, joined by the S&P 500 and Dow Jones on Thursday. Treasury yields fell sharply on generally weak economic data and as Fed chief Jerome Powell signaled no more rate hikes. A number of stocks flashed buy signals, including Microsoft and Facebook-parent Meta Platforms, as well as DraftKings, Shopify, Arista Networks and many others.

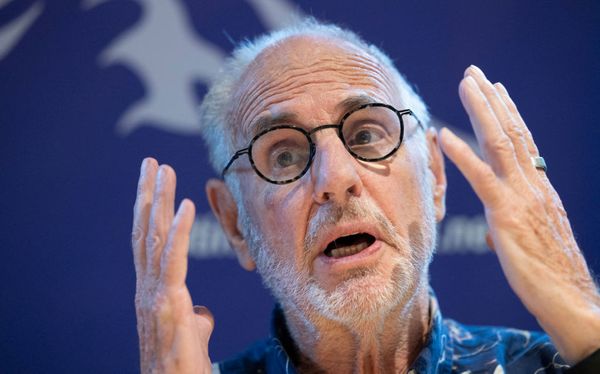

Fed Signals No More Rate Hikes

Federal Reserve chair Jerome Powell gave an inch, and markets took a mile. Fortunately, after Friday's jobs report, it looks like markets were right. The Fed's statement was largely a repetition of the status quo, keeping a rate hike on the table. Yet, as numerous Fed policymakers had done in recent weeks, Powell noted that tighter financial conditions, stemming from the rise in the 10-year Treasury yield, lower stock prices and strong dollar, might avert the need for further interest-rate hikes. But financial conditions ease again, more rate hikes might be needed. Still, Powell's overall message helped spark the easing of bond yields and stock market rally that he seemed to warn against.

Jobs Report, Economic Data Cool

Jobs growth slowed to 150,000 in October, partly due to the now-ending UAW strike. The jobless rate rose to 3.9%, the highest since January 2022. Average hourly wages, after a tepid 0.2% rise in October, are up just 3.2% on an annualized basis over the past three months. Plus, the length of the workweek slipped 0.3%, meaning weekly pay fell slightly during the month. Meanwhile, the Employment Cost Index, the Fed's favorite gauge of labor compensation, showed annual private-sector pay growth slowed to 4.3% in Q3. Productivity growth accelerated in Q3, while unit labor costs cooled. The ISM manufacturing index showed the factory slump worsening, while the services gauge pointed to weaker growth in other parts of the economy.

Arista Soars On Earnings And Oracle Deal

Arista Networks surged to an all-time high after Q3 earnings and revenue topped analyst estimates as Oracle emerged as a new cloud computing customer. Arista earnings popped 46% for a second straight quarter. Revenue jumped 28% to $1.51 billion. The networking giant also guided slightly higher for Q4 revenue. Arista's biggest customers are Microsoft and Facebook-parent Meta Platforms.

Apple Sales Fall For Fourth Quarter

Apple beat fiscal fourth-quarter views, but revenue fell for the fourth consecutive quarter. Apple earnings climbed 13% while sales dipped 1% to $89.5 billion, Apple guided to flat sales in the holiday Q1. In the September quarter, Apple's hardware sales declined 5% year over year to $67.2 billion while services revenue increased 16% to $22.3 billion. Apple's iPhone revenue rose 3% to $43.8 billion. Mac and iPad sales dropped. China sales fell short of forecasts.

Weight-Loss Giants Beat Views

Novo Nordisk and Eli Lilly easily beat third-quarter forecasts. Novo's sales climbed 29% to $8.37 billion, while adjusted earnings grew 57%. Bullishly, sales of weight-loss drug Wegovy beat forecasts and surged by a triple-digit percentage. But sales of diabetes drug, Ozempic, came in light, though it grew 46% to about $3.31 billion. Lilly's surprise earnings came in at 10 cents a share on $9.5 billion, up 37%. Its Ozempic rival, Mounjaro, brought in $1.41 billion in sales, surging 652% and topping expectations. NVO and LLY stock rose following earnings, but pared gains Friday.

Drug Distributors Rally On Earnings

Cardinal and Cencora broke out on earnings, while McKesson ultimately rose within a buy zone despite mixed results. Cardinal Health reported a 44% EPS gain, well above views, sending shares racing through a buy zone. Cencora, formerly AmerisourceBergen, topped with a 10% EPS gain while sales growth slowly accelerated for a fourth straight quarter, to 13%. McKesson's 3% EPS growth fell short. Drug distributors are low-profile beneficiaries of the weight-loss drug boom.

Industrial Slowdown Hits Chip Stocks

A raft of semiconductor stocks fell after reporting in-line or better results for the September quarter but guiding well short of views for December quarter. Many cited a slowdown in industrial chip sales. Those chipmakers included Allegro MicroSystems, Lattice Semiconductor, Microchip Technology, ON Semiconductor and Silicon Labs. Several chipmakers posted beat-and-raise reports thanks to healthy iPhone chip sales. They included Cirrus Logic, Qorvo and Qualcomm. Meanwhile, AMD beat Wall Street's targets for the third quarter thanks to resurgent PC chip sales, but guided low. However, AMD excited investors with a robust 2024 outlook for its data center accelerator product for artificial intelligence applications, the MI300.

Biotechs Top Earnings Views

Amgen topped Q3 EPS estimates with a 6% gain, while sales met views with a 4% rise to $6.9 billion, up 4%. Argenx reported narrower-than-expected losses at $1.25 per share. Sales nearly tripled to $329.1 million and topped projections. Regeneron Pharmaceuticals beat expectations with adjusted EPS up 4% and sales rising 15% to $3.36 billion in sales. All rose following earnings.

Fortinet Dive Again

Fortinet reported a 41% EPS gain in Q3, but sales, billings and guidance fell short. The market for network "firewall" appliances has slowed amid a shift to cloud-based cybersecurity sytems. FTNT stock plunged, after crashing on the Q2 report. Earlier, Check Point Software, another network firewall specialist, reported Q3 EPS rose 17% from a year earlier while revenue climbed 3% to $596.3 million, both beating. But billings slid 5%, falling short. CHKP tumbled on earnings but rebounded higher for the week. Meanwhile, Cloudflare reported Q3 earnings up 166% with revenue up 32% to $335.6 million, both beating. Q4 guidance was mixed, but NET stock jumped.

Shopify Earnings Strong

Shopify reported Q3 earnings of 24 cents, swinging to a profit from a 2-cent loss a year earlier and well above views. Revenue rose 25% to $1.7 billion, slightly beating. Shopify said Q3 gross merchandise volume from merchant transactions rose 22% to $56.2 billion, also topping. Shopify sets up e-commerce websites for small businesses, and partners with others to handle digital payments and shipping. It recently sold its delivery and logistics business to Flexport, easing Wall Street worries over rising capital spending. SHOP stock skyrocketed.

MercadoLibre Surges On Earnings

MercadoLibre reported Q3 EPS surged 180% while sales jumped 40%, both showing accelerating growth. Shares for the Latin American e-commerce and payments giant vaulted higher within a base. New York-based Etsy continues to face a difficult market. Third-quarter EPS grew 10% and sales 7%, topping expectations. But the arts and crafts e-commerce site guided lower on holiday sales, warning of an "incredibly challenging environment for spending on consumer discretionary items." ETSY stock reversed sharply after hitting a three-year low.

BYD Earnings Surge, Sales Hit Highs

China's BYD flexed its earnings might, delivering record quarterly earnings. Its profits surged 82% and gross margins reached 22%, the highest since Q3 2020. Analysts cited stronger sales of higher margin models, like the Han and Song electric vehicles. The EV price war also simmered down during the third quarter, though it may be picking up again. BYD itself touted rising brand power, expanding scale advantage and cost controls. For October, BYD posted a 5% EV sales increase to over 300,000 EVs. Tesla's TSLA China-made EV sales fell 2.6% last month, which began deliveries of the updated Model 3 in late October. Among China EV startups, Li Auto and XPeng set monthly delivery records. Nio lagged those rivals, with several new and refreshed models failing to move the needle for this embattled startup.

Auto Sales Sluggish, Strike Ends

U.S. automakers reported sluggish auto sales for October. Ford posted a 5% drop in both total sales and truck sales amid the United Auto Workers strike. Ford, General Motors and Chrysler parent Stellantis have reached tentative deals to end the walkouts, effectively boosting pay by more than 30% over the life of the contracts. The UAW now aims to unionize U.S. plants for Tesla, Toyota Motor and Honda Motor. Toyota lost no time raising U.S. workers' pay by about 9% to $34.80 an hour. Toyota also hiked its annual profit forecast by 50% after reporting hot fiscal Q2 results, citing strong global demand for hybrid vehicles and a weaker yen.

News In Brief

Sarepta Therapeutics reported mixed results for its Duchenne muscular dystrophy gene therapy in a pivotal test. Patients showed a 2.6-point improvement on a 34-point scale of movement a year after receiving the one-time treatment, but the results weren't statistically significant. Sarepta says the results are strong enough it will ask the FDA to expand the gene therapy, dubbed Elevidys, to patients ages 6 and 7. Currently, it has accelerated approval in children ages 4 and 5. SRPT stock dived.

Crispr Therapeutics and Vertex Pharmaceuticals jumped Wednesday-Thursday after an FDA advisory panel discussed the companies' gene-editing treatment for sickle cell disease. The committee didn't make a recommendation on whether to OK the drug, but analysts say sentiment is promising heading into a potential December approval.

Pfizer reported light second-quarter sales and losses that missed some expectations, but beat others. Sales tumbled 42% on a strict, as-reported basis to $13.23 billion, as Covid vaccine demand plunged.

Remitly Global reported a wider-than-expected Q3 loss, though the 43% revenue gain slightly beat. But shares dived.

Super Micro Computer earned $3.43 a share in fiscal Q1 vs. $3.42 a year earlier. Revenue climbed 15% to $2.12 billion. Both beat views. The data center specialist raised full-year revenue guidance, citing strong AI infrastructure demand.

Cameco jumped after the uranium producer reported a 967% EPS gain, easily beating. Q3 revenue swelled 48% to $575.1 million, also topping. Cameco raised full-year sales guidance.

Palantir Technologies reported Q3 earnings and revenue as commercial market growth came in above expectations. Palantir earnings were 7 cents adjusted vs. 1 cent a year earlier. Revenue rose 17% to $558 million, the maker of data analytics software said. Government revenue rose 12% to $308 million, missing. Commercial market revenue climbed 23% to $251 million. PLTR soared.

Roku added 2.3 million new users in the third quarter, ending with 75.8 million active accounts. Analysts had expected 1.8 million. Revenue sales rose 20% year over year to $912 million, topping views of $857 million. However, the streaming video platform posted a worse-than-expected loss of $2.33 a share. Shares spiked higher.

DraftKings gapped higher after reporting a smaller-than-expected Q3 loss with revenue jumping 57% to $790 million, easily beating. The online sports betting giant also raised 2023 guidance and gave a bullish 2024 outlook.

DoorDash reported a smaller-than-expected loss while revenue swelled 27% to $2.16 billion on strong orders. DASH stock skyrocketed.

Sam Bankman-Fried, founder of the failed FTX cryptocurrency exchange, was found guilty on all seven fraud and conspiracy charges Thursday night. He faces up to 110 years in prison.

CBOE Global Markets beat Q3 estimates early Friday, reporting an 18% EPS gain while revenue rose 9% to $480.5 million. The Chicago-based derivatives exchange operator saw both options and futures revenues jump 14%. Shares rose to a new high.