On Oct. 3, the United Auto Workers held what it called the 'Keep The Promise' Rally in Sterling Heights, MI to send a message to multinational automaker Stellantis (STLA) over promises it says it is failing to fulfill, specifically contractual commitments to keep production of the Dodge Durango in Detroit and to reopen the Belvidere Assembly Plant in Illinois.

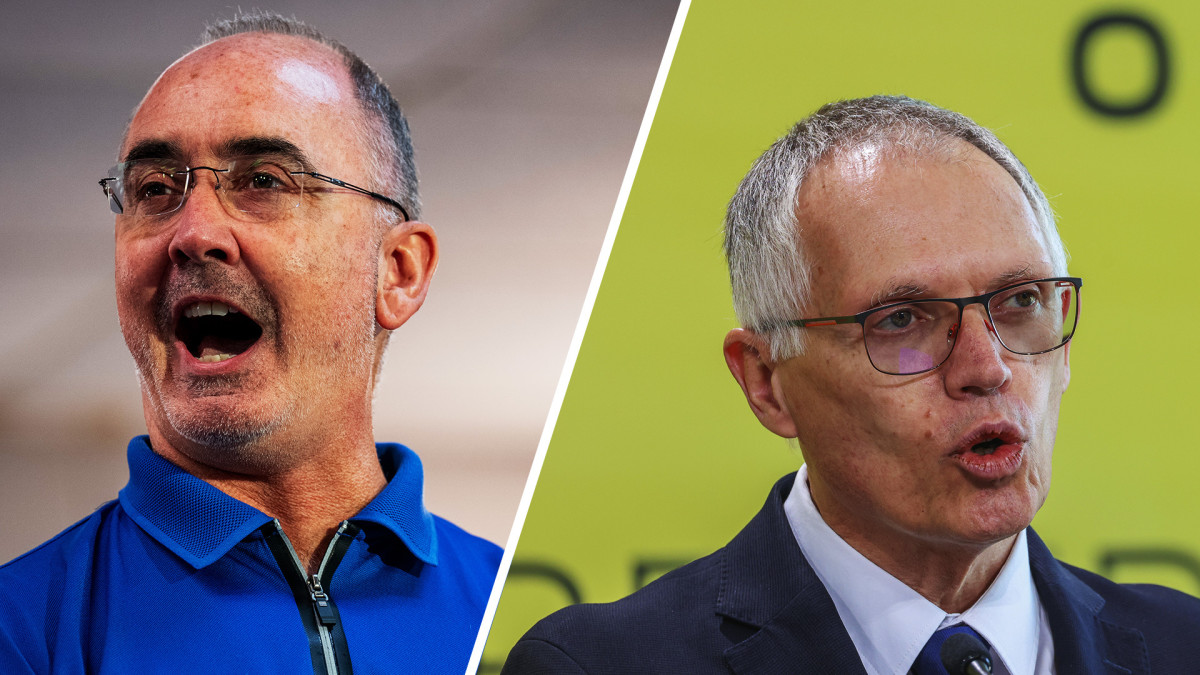

At the rally, UAW president Shawn Fain declared that Carlos Tavares, the CEO of Chrysler, Dodge, and Jeep parent company Stellantis, "is out of control" and that it "is up to UAW members to save this company from itself."

In a statement made shortly after the rally, Stellantis noted that much of Fain's messaging in his 10-minute speech spread "misinformation" regarding the company to UAW membership, further reiterating claims it defended itself within a news release on September 23.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

“Let me be crystal clear, we have abided by and will continue to abide by the 2023 collective bargaining agreement,” Stellantis North America COO Carlos Zarlenga said in its statement. “It is in everyone’s best interest to have a healthy company that can compete in a global marketplace. This is a time for us to work together, not against each other.”

That evening, UAW members at Stellantis’ Los Angeles Parts Distribution Center were the first UAW local to vote to request strike authorization if the automaker does not fulfill the demands made in the grievances that were first filed in August. The union warned that as the grievances proceed, more Stellantis UAW locals could soon hold further strike authorization votes.

“Stellantis made a contractual promise to invest in America and we are not going to let them weasel out of it,” Fain said in a statement. “Our members won those investments during the Stand Up strike, and we will strike again to make Stellantis keep the promise if we have to.”

Stellantis taking the UAW to Federal court

In a statement made early on Oct. 7, Stellantis announced that it has filed eight additional lawsuits against the UAW and 23 local chapters, just a day after it filed a suit against the UAW and UAW Local 230, which represents the Los Angeles Parts Distribution Center, on Oct. 3.

The initial suit on Oct. 3 was filed in response to the Local taking a strike authorization vote. The automaker says the action violates the contract terms it reached during its landmark agreement with the union roughly one year ago.

The suit, filed in the U.S. District Court Central District of California, claims that the union "filed sham grievances designed to justify mid-contract strikes against Stellantis" that would violate the no-strike clause in its bargaining agreement.

"Ignoring this negotiated-for and mutually agreed-upon language in Letter 311 [Stellantis's name for the agreement], the UAW and its agents, including President Shawn Fain, have embarked on a sustained, multi-month campaign against the Company to force the planned investments without Company approval and regardless of business factors," the suit read.

In a company email read by CBS Detroit, Stellantis told its employees that it would sue the UAW, saying both the automaker and the union understood the idea of shifting terms according to changing conditions.

"The facts are indisputable: the transition to electrification is happening at a slower pace than expected," Stellantis defended in its email. "We knew that slowing consumer EV adoption could potentially delay our product launches and investment decisions. In fact, many of our competitors know this too and also have announced investment and product delays as well as outright product cancelations."

The email also said the lawsuit would hold both the International and local UAW liable "for the revenue loss and other damages resulting from lost production due to an unlawful strike."

The UAW union won the right to strike in its 2023 agreements with Stellantis, General Motors, and Ford if plant closures or other violations of job protections at any of the Detroit Big Three automakers occur during the contract term.

In its statement, Stellantis said that it "maintains its position that any call for a strike by the UAW would be illegal."

More Automotive:

- The Buick Envista is America's wake-up call for Chinese cars

- Ford CEO says he's sick and tired of making 'boring' cars

- New study reveals a cold, harsh truth for thrifty new car buyers

The Jobs Bank problem

The multinational automaker, noted in its statement that the back-to-back suits prompted a meeting between Stellantis and the UAW on Oct. 5. At the meeting, they stated that the union proposed reinstituting a concept called the Jobs Bank, an initiative designed to prohibit the Detroit Three automakers from laying off employees.

Stellantis says that the UAW is seeking the reinstitution of the Jobs Bank not only for Belvidere employees, but also for about 900 employees who transferred to other Stellantis plant locations.

The automaker rejected the idea because it will be way too expensive for Stellantis, citing past experience with such a safety net before Stellantis even existed.

"By the 2000s, Chrysler had over 2,000 employees in the Jobs Bank at a staggering cost. These employees were on active payroll, but were not allowed to perform any production work," Stellantis said.

"For that reason, the company rejected the UAW’s latest proposal because it would revert to prebankruptcy terms and conditions that would jeopardize the company’s future."

The automaker adds that it "understands that this situation is extremely unsettling for its Belvidere employees," noting that it agreed during the 2023 contract negotiations to put the employees on temporary layoffs, "which provide 74% of pay and full healthcare benefits."

Stellantis closed its statement by saying that the automaker will see the lawsuit go to litigation if necessary. It also says that it remains possible to meet with the UAW to discuss the issues further.

Stellantis's Money Troubles

The lawsuits and the UAW labor proposal come at a crucial time for Stellantis, as it is desperate to boost sales and reduce its overflowing dealer inventories.

On Oct. 4, the Wall Street Journal reported that Stellantis is finding creative ways to conserve its spending.

In an email read by the Journal titled “The Doghouse is back!”, Stellantis CFO Natalie Knight instructed her finance team to sharply scrutinize requests for purchases from outside vendors to rein in expenses.

According to the Journal, the term 'Doghouse' refers to "much stricter attention and control around purchase requisitions.”

“If we apply more discipline, we can ensure big savings for the company," Knight said in the email.

Stellantis NV, which trades on the New York Stock Exchange as STLA, is up 0.75% from the opening bell, trading at $13.42 per share at the time of writing.

Related: Veteran fund manager sees world of pain coming for stocks