Steel Dynamics, Inc. (STLD), headquartered in Fort Wayne, Indiana, functions as a leading steel producer and metal recycler. Valued at $25.6 billion by market cap, the company’s products include flat rolled steel sheet, engineered bar, special-bar-quality, and structural beams. It also recycles scrap metal and manufactures non-residential building components, including steel joists, girders, trusses, and decks, for construction projects. The leading domestic steel producer and metals recycler is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Monday, Jan. 26, 2026.

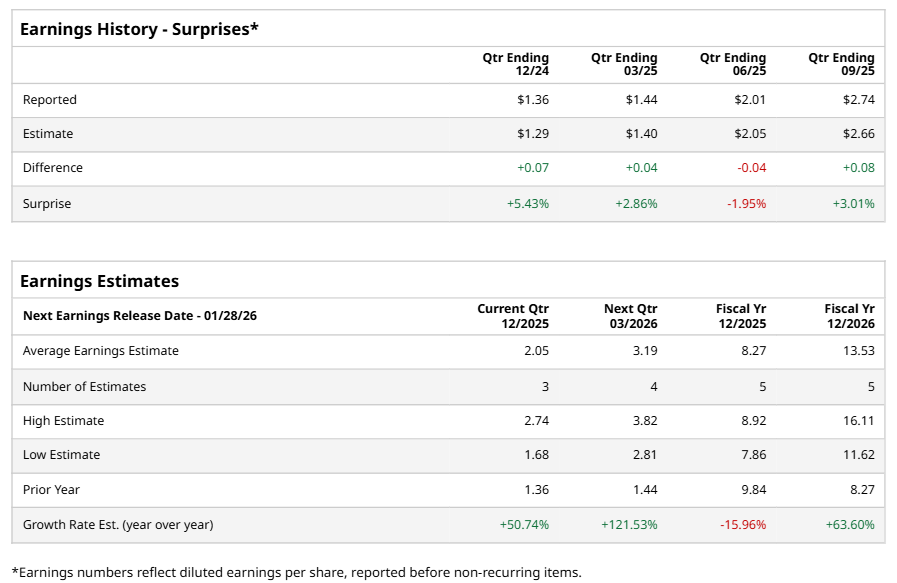

Ahead of the event, analysts expect STLD to report a profit of $2.05 per share on a diluted basis, up 50.7% from $1.36 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect STLD to report EPS of $8.27, down 16% from $9.84 in fiscal 2024. However, its EPS is expected to rise 63.6% year over year to $13.53 in fiscal 2026.

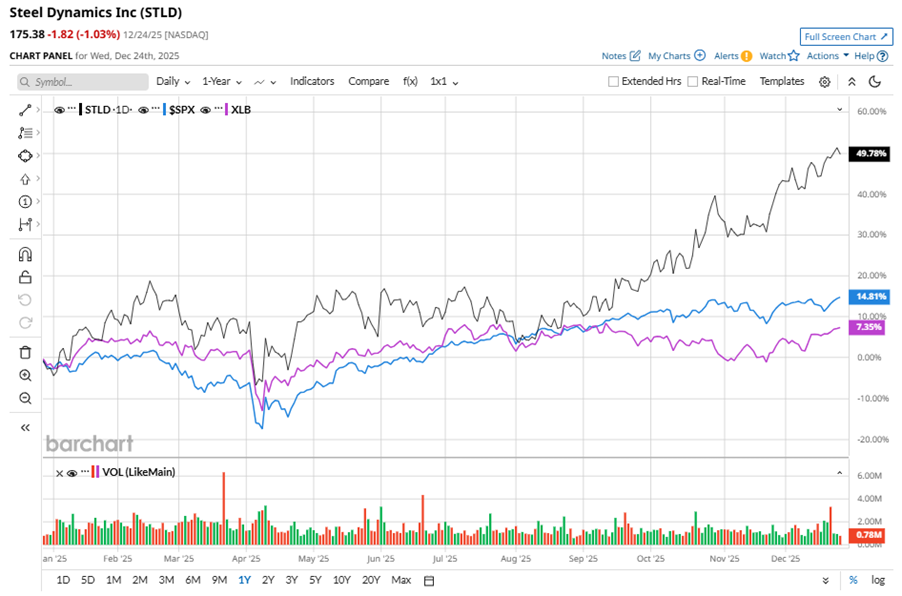

STLD stock has outperformed the S&P 500 Index’s ($SPX) 14.8% gains over the past 52 weeks, with shares up 49.8% during this period. Similarly, it notably outperformed the Materials Select Sector SPDR Fund’s (XLB) 7.2% returns over the same time frame.

On Oct. 20, STLD shares closed up by 2.5% after reporting its Q3 results. Its EPS of $2.74 surpassed Wall Street expectations of $2.66. The company’s revenue was $4.8 billion, topping Wall Street forecasts of $4.7 billion.

Analysts’ consensus opinion on STLD stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 13 analysts covering the stock, eight advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and four give a “Hold.” STLD’s average analyst price target is $179.17, indicating a potential upside of 2.2% from the current levels.