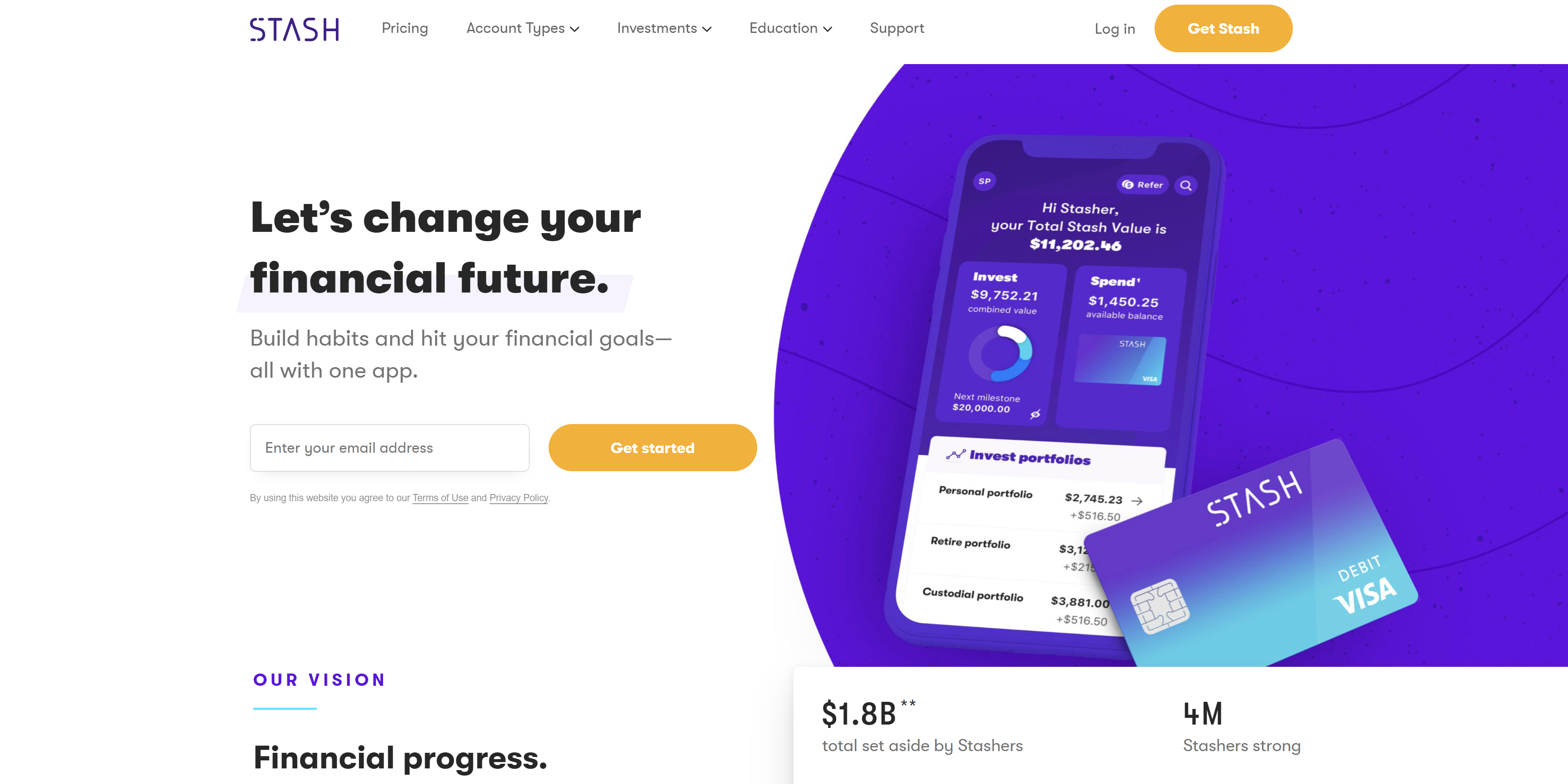

Stash is an excellent option for those interested in micro-investing. It lets you buy a fraction of a stock, which should be an exciting opportunity in itself. Imagine you want to buy a share of Walmart, which would need you t shell out $1000 or so, and you do not have that sort of solid financial strength. No worries, with Stash, you can buy a fraction of that share.

Stash is aimed at making investment approachable for the beginners. It can be an excellent option for those of you who do not have enough money to make huge investments or do not really know what to invest in. It, in essence, acts as a hand holder to help you gain entry into the world of investments.

What does Stash do?

Stash is an investment app and helps you select investments quickly and easily for beginners to investments. It was founded in 2015 and was aimed at simplifying the task of investing in multiple portfolios. Most of us find investing an intimidating and expensive option to grow wealth.

Stash lets you sign up for free, and enables you to choose investment options rather quickly. It follows the concept of robo-advisers, where you have no human investment advisers and lets you begin investing by building a portfolio. However, in sharp contrast to other robo-adviser services, it does not manage your accounts by itself but suggests you the ways to achieve it. From that perspective, it isn’t actually a robo-adviser in the real sense of the word.

How does it work?

Once you've installed the app, you will be asked a few questions to analyze the kind of investor you are. Are you a traditional investor or an aggressive one who does not fear taking risks? You will then need to connect your checking account to fund your investments. Do note that Stash does not accept any other forms of investment funding.

After you have set up your details and linked the checking account, you will be presented with the recommended ETFs you can invest in. The investment options you are suggested would be in tune with the answers you provided during the initial setup.

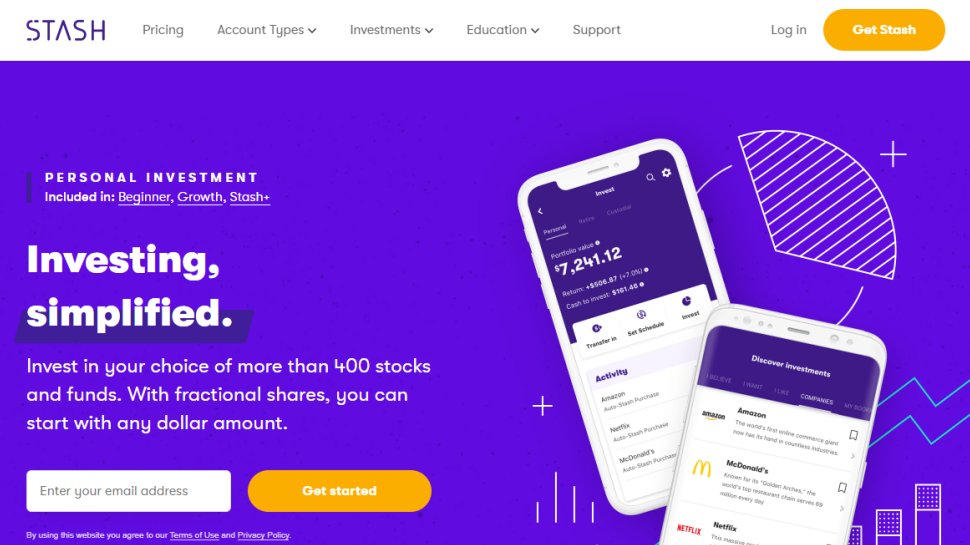

It will offer you the list of ETFs and individual stocks in an easy to read format. You will have access to every detail related to the stock:

- a complete synopsis of what the investment is all about.

- a visual indication of the risk involved.

- a ticker to indicate the last price, the symbol for the stock or investment and expense ratio

Features

Some of the features that Stash offers includes:

- Effective guidance – Stash was established with the aim of introducing beginners to the concept of investment, and this is the area in which it excels in. The Stash Coach is one of the unique and innovative features that simplify the task of providing you with enough education in investing.

- Zero minimum Account – You do not need a considerable amount to begin investing. In fact, even a small amount is enough to start investing. The fractional shares are what would make it a great choice. Stash buys the stocks and ETFs. It then splits these stocks for the investors. That would be helpful in building a diverse portfolio with little enough money.

- Automated Investments – If you opt for the option, the app will round up your purchases to the nearest dollar. For instance, if you make a purchase of $ 1.53 from linked accounts, it will round it up to $ 2.0 and withdraws these roundups. Once these roundups reach $5, it will be moved to your investment account. The SmartStash feature lets you analyze your bank account, and if it finds any extra money, the amount is directed to an investment account.

The Stash online platform works in an efficient manner with a mobile device as well. Of course, you do not have access to real-time updates. However, it is a fully featured app and does everything you would do with the online platform.

The customer support is also good enough. You will get access to a phone, and email support Monday to Friday between 8.30 am to 6.30 pm. The support channels will work even on weekends (Saturday and Sunday) between 11 am to 5 pm.

How much does it cost?

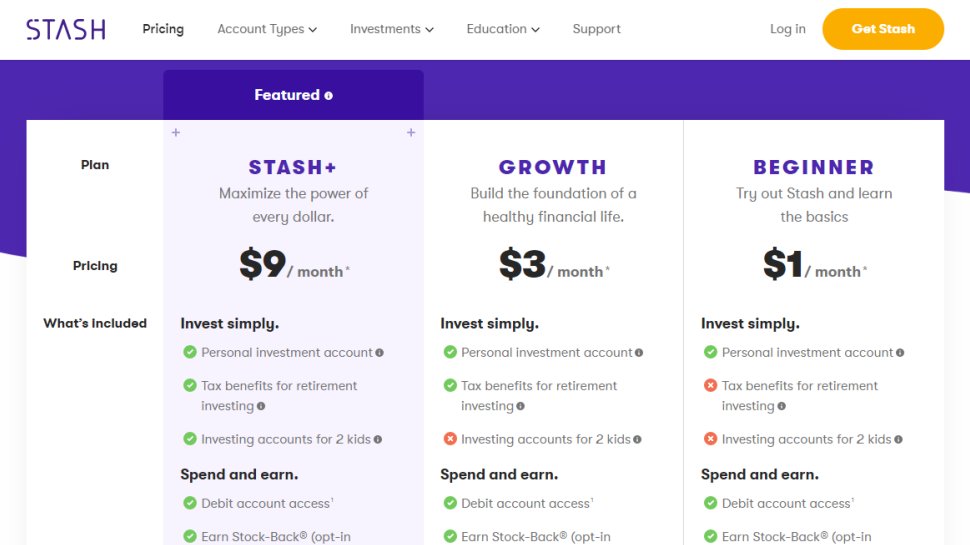

Stash offers you three plans to choose from. In sharp contrast to the earlier AUM fee structure, the platform has now moved to a flat fee structure.

- Beginner – The plan costs $1 a month and provides you access to a basic brokerage account along with the Stash Banking account. It will also offer you free financial guidance

- Growth – This plan will cost $3 a month. You can get access to a taxable brokerage account and banking options. It also provides you access to retirement investment options

- Stash+ - This is the topmost plan and offers excellent functionality. It will cost you $9 a month. In addition to the options available under the above plans, it also offers two custodial investment accounts for your children

The plans are competitive enough when compared to Acorns, but tend to be a little more expensive.

Final verdict

If you are new to stock investing and are looking for an app to handhold you into learning the tricks of the trade, Stash could be a useful option for you. The educational resources offered by the platform would make it a great choice and assist you in making money-saving moves going forward.

The concept of fractional shares is what should help you make a beginning in the concept of diversifying with little money. Of course, once you have gained enough knowledge in the investment arena, you can then move ahead to make your own plan.

- We've featured the best forex trading apps.