KEY POINTS

- Stablecoins can release $11.6 billion of working capital trapped in slow cross-border payment systems: CEBR and BVNK report

- Cross-border stablecoin payments are expected to hit $2.8 trillion this year alone

- Stablecoin payment volumes could reach $15 trillion by 2030, said BVNK co-founder Chris Harmse

Ten years since the first stablecoin went live in July 2014, stablecoins have burgeoned into a key class of cryptocurrencies that provide investors with price stability, largely through the backing of the US dollar and other specific assets. Most crypto tokens have been weathering the storms of volatility, but stablecoins have become the epitome of endurance.

Coinciding with the 10th anniversary of stablecoins was the release of a new report by leading economics consultancy the Center for Economics and Business Research (CEBR) and B2B payments provider BVNK. The report found that stablecoins can release some $11.6 billion of business capital trapped in slow payment systems at any given second. The report demonstrates, for the first time, the quantitative link between increasing stablecoin use and economic impact.

Freeing trapped capital

Cross-border payment systems today are haunted by long delays in fund transfers that trap working capital and require financial services providers to hold money in pre-funded accounts to offset risk. CEBR analysts examined four major routes (U.S. – Latin America, Europe – Africa, Europe – Southeast Asia, and Europe – Latin America) with settlement delays where at any given moment, $11.6 billion of working capital is trapped – capital unavailable for growth that represent a significant opportunity cost for businesses.

Through stablecoins, global settlements are speeding up. This year is particularly expected to be huge for stablecoin settlements. It is expected that there will be $2.8 trillion cross-border stablecoin payments in 2024. Such payments improve liquidity for businesses, especially SMEs. They reduce the costs of borrowing and also enhance operational efficiency.

Beyond costs and operations, stablecoin payments also have a "direct financial benefit." They are expected to generate a $2.9 billion return for businesses by 2027 across the four routes studied. Since stablecoins bypass the need to pre-fund accounts, near instant settlement can potentially release more than $5 trillion in locked capital, the analysis found.

"Businesses and economies lose out when funds are locked up in slow payment systems and can suffer from local currency volatility. Cebr partnered with BVNK to explore how the increasing global adoption of stablecoins alleviates these problems. Among other benefits, stablecoins can streamline the payments process, releasing idle capital that can be put to a productive purpose. In selected routes representing approximately 10% of cross-border payments, we find that faster stablecoin transactions will unlock $2.9 billion in increased economic output by 2027," Nina Skero, Chief Executive at CEBR, told International Business Times in a statement.

Mitigating costs of currency volatility

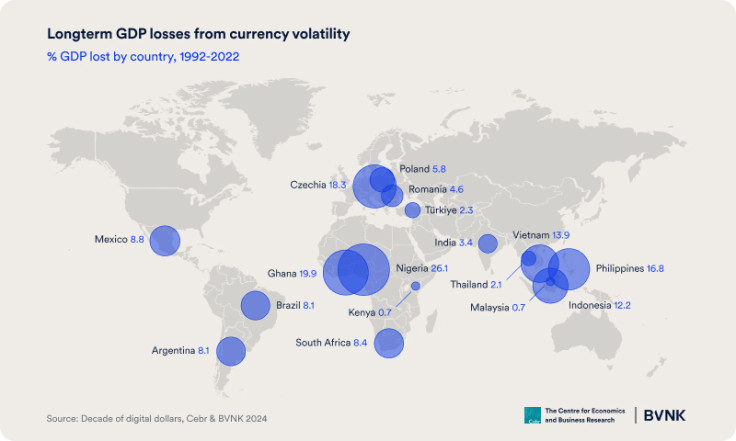

Volatility has long been a problem for many emerging economies. The report found that stablecoins, which are predominantly pegged to the US dollar, can help offset GDP losses from local currency volatility in emerging economies. The losses reached 9.4% of GDP on average since 1992 across 17 countries studied, including Nigeria, the Philippines, South Africa, and more. The biggest impacts were observed in Indonesia ($184 billion) and Brazil ($172 billion).

With stablecoins, emerging economies have a chance to protect consumer savings and business balance sheets from the impacts of inflation, while also enabling businesses to avoid unfavorable commercial contracts due to currency devaluation.

"With industry leaders already predicting the stablecoin market cap will grow from $160bn to $1 trillion in the next few years, stablecoin payment volumes could reach $15 trillion by 2030. We believe the rise of yield-bearing stablecoins will also have a huge industry impact. At 3% interest rates, stablecoin issuers could generate $30bn a year in economic value on stablecoin deposits through yield alone by 2030," said Chris Harmse, co-founder at BVNK.

Bridging the dollar gap

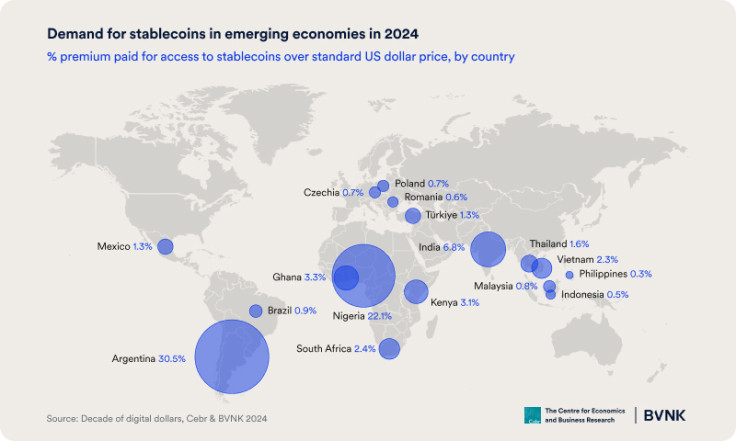

There is strong international demand for a stable, global currency, and as a digital substitute for the US dollar, stablecoins bridge the gap where access is limited.

CEBR analysts examined 17 countries that showed significant demand for stablecoins. In the said emerging economies, businesses and consumers were willing to pay an average premium of 4.7% over the standard dollar price to access stablecoins. In countries like Argentina, the figures reach up to 30%. It is estimated that the 17 countries, which include Malaysia, Mexico, Romania, Poland, and Thailand, will pay a $25.4 billion premium alone to access stablecoins.

"Businesses are diversifying their supply chains, and growing their customer bases globally. For many, it's hard to get access to strong fiat currencies, and it's hard to move money quickly across borders. These aren't just inconveniences, they directly impact capital efficiency and liquidity. Stablecoins bring the full utility of the internet to payments, connecting buyers and sellers globally in an instant. For businesses, they offer a powerful alternative to today's slow, clunky cross-border payment systems," said Ben Reynolds, managing director at BVNK U.S.

Stablecoins 10 years and beyond

When they first launched, stablecoins were primarily used to purchase crypto tokens on trading platforms that didn't have fiat currency trading pairs. As more people adopt stablecoins, they have evolved and can now be used to pay for some goods and services.

The stablecoin industry's potential in resolving cross-border payment issues is apparent, and as more studies emerge about other potential use cases 10 years into the stablecoin industry, it can be safe to say stablecoins are standing the test of time.