Jeremy Hunt’s 2023 spring budget covers employment, energy, enterprise and much more besides. The plan has already been dubbed his “back to work budget”, although he has called it a “budget for growth”.

Hunt was appointed chancellor in a bid to calm financial markets after last year’s dramatic mini-budget under previous prime minister Liz Truss. His ongoing efforts to maintain this mood have included giving away several major chunks of this announcement beforehand. Now that Hunt has provided more of the detail, here’s what our panel of academic experts think of the government’s plans for the economy:

Evidence for ‘levelling up’ measures is mixed

Phil Tomlinson, Professor of Industrial Strategy, School of Management, University of Bath

The short-term outlook for the UK economy is better than expected. Economic growth picked up in January, falling gas prices have reduced the cost of the government’s energy support package, and public borrowing is likely to be £30 billion lower than last November’s Office for Budget Responsibility (OBR) forecast. This has allowed the chancellor some leeway to deal with some of the economy’s long-standing challenges.

Since the 2008 global financial crisis, the UK economy has been largely stagnant. It remains the only country in the G7 not to have recovered to its pre-pandemic level of national income. Business investment has been weak for decades (and especially so, since the 2016 Brexit referendum), while the labour market has lost almost a million workers since 2019. And then there is the “levelling up” needed to reduce the UK’s wide regional inequalities.

Today’s budget seeks to address some of these issues. The childcare support package is geared towards helping young parents return to the labour market. And while benefiting higher earners, changes to the lifetime tax-free pension allowance and the annual cap on contributions are intended to encourage older and highly skilled professionals – especially NHS doctors – to remain in their posts, rather than take early retirement.

The chancellor also announced 12 new investment zones in the combined authority regions of the north of England and Midlands, and in Scotland, Wales and Northern Ireland. Each will receive £80 million of funding for upgrading skills, specialist business support, local infrastructure and for tax incentives. The goal is to attract new business investment and build innovation clusters in key sectors (such as advanced manufacturing and life sciences) to generate dynamic growth in “left behind” regions.

The funding itself, however, is not overly generous, while the evidence on similar initiatives (including freeports and enterprise zones) is mixed. For instance, there are concerns such zones merely shift business activity from places located outside a zone to places located inside a zone (rather than attracting new investment). Many “left behind” towns and cities not in a combined authority region will also miss out on this initiative.

Too little, too late for business?

Steven McCabe, Associate Professor, Birmingham City Business School

Will businesses, which have suffered so much in recent years, welcome chancellor Jeremy Hunt’s spring statement?

Many will claim what’s offered is too little, too late. Indeed, a lot of businesses are merely surviving because of spiralling energy costs and increased wages.

Hunt, who owes his political renaissance to the disastrous consequences of his predecessor Kwasi Kwarteng’s “mini-budget” in 2022, attempts to continue the return to stability with optimism of better times ahead.

He will continue with the intention, which Rishi Sunak set out when he was chancellor, of raising corporation tax from 19% to 25%. This will help to repair damage to public finances caused by the pandemic and made worse by Russia’s invasion of Ukraine – as well as Liz Truss’s ill-considered dash for growth. This announcement will be greeted with mixed emotions by businesses.

Changes to pension pots and contributions may help to retain and attract high earners. Hunt also hopes to encourage a significant number of the nine million “economically inactive” (people who are neither working nor looking for work) into employment.

Undoubtedly the most eye-catching announcement made by the chancellor is funding for 12 investment zones to “supercharge” high-tech growth across the UK.

Cynics may stress that Hunt’s assertion of the importance of investing in growth and opportunity comes from a government that’s been in power for 13 years. Indeed, the fact remains that the UK is the only G7 country with a smaller economy than before COVID. And political inability, striking workers and a disappearing public health system certainly haven’t helped.

Not not a recession

Alan Shipman, Senior Lecturer in Economics, Open University

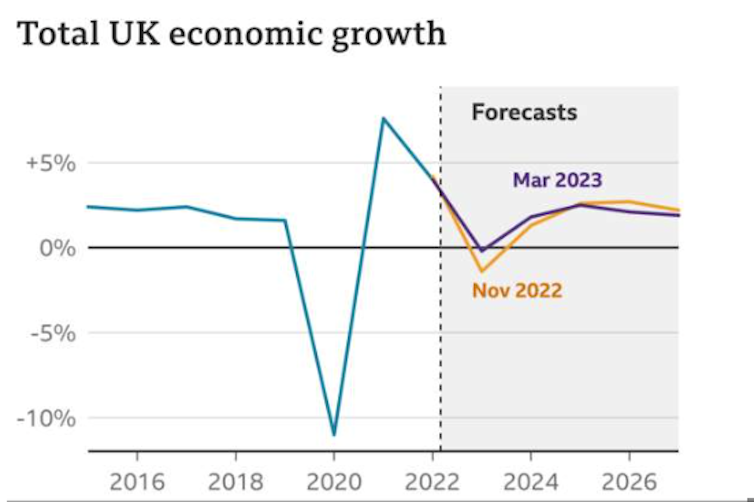

The chancellor has announced that the economy will avoid a “technical recession” this year. This is because that requires two-quarters of falling GDP, whereas the OBR, which provides independent economic forecasts and analysis of the public finances, now shows falls in just one-quarter.

But most people would probably still view a 0.2% drop in the size of the economy across the year as a recession.

Hunt has responded to post-Brexit labour shortages with measures to push more of the eight million inactive working-age people into paid employment. That includes the half million sidelined by health problems since the pandemic.

The need for more workers to revive output reflects the stagnation of UK labour productivity since 2008, which has prevented real wage growth in the UK and left it unusually vulnerable to last year’s jump in living costs.

The chancellor’s hands are increasingly tied not only by higher public borrowing costs after last year’s inflation and interest rate rise, but also by the need to prioritise extra spending and tax breaks for groups whose votes are needed for the government’s electoral revival.

So there will be more funds for childcare to help new parents return to work and attract younger voters. But still no strategy for the rising and unequally-distributed costs of social care. This is 12 years after the Dilnot Report which found that the adult social care system in the UK is not fit for purpose and requires more funding.

And nothing to addresses that other early-life constraint, the high cost of renting or buying homes in towns and cities with jobs.

The government’s desire to not hit homeowners or landlords any harder is heightened by the property-market correction that’s already happening with prices predicted to fall further over the coming month.

Any worsening of this slide could turn this year’s projected 0.2% GDP decline into outright recession and worsen the already extremely weak growth outlook for the next five years.

What the budget means for your energy bills

Catherine Waddams, Emeritus Professor, Norwich Business School, and Andrew Burlinson, Lecturer in Energy Economics, University of East Anglia

There’s good news and bad news for household energy prices. The chancellor has confirmed that the government will extend support for energy bills for a further three months. But a £400 winter fuel payment will not be renewed, so household costs will still rise in the short term.

The government has also said it will bring energy costs for prepayment meter customers in line with comparable direct debit charges until April next year, while the regulator develops social tariff proposals.

Such targeted support is crucial, not least because some of the most vulnerable people use prepayment meters and experience the difficult choice between heating and eating.

The UK has less effective safety nets for financially vulnerable households than elsewhere. This has resulted in more generous but less targeted support compared with other European countries affected by rising gas prices following the Russian invasion of Ukraine. The government’s recognition of its responsibility for the distributional implications of energy prices is particularly welcome.

A budget boost for nuclear power

Jim Watson, Director, UCL Institute for Sustainable Resources

Against the backdrop of Russia’s war against Ukraine and the growing impacts of climate change, Jeremy Hunt is right to emphasise alternatives to fossil fuels. Most of the specific announcements are not entirely new, and they had a narrow focus on nuclear power and carbon capture and storage. There are only hints at a more comprehensive strategy, with further announcements promised for later this month.

As the government’s advisory Climate Change Committee made clear last week, the UK is going to fall short on decarbonising the power sector by 2035 unless policies are beefed up.

The chancellor said in his speech that nuclear will have “access to the same investment incentives as renewable energy”. In reality, large-scale nuclear already receives significant policy support, including for two projects at Hinkley and Sizewell. Hinkley is the only nuclear project under construction in the UK, and has a generous 35-year contract for the power it will produce.

He also prioritised smaller nuclear plants – known as small modular reactors (SMRs) – which were first championed by George Osborne in 2015. More than eight years later, momentum has dissipated. Today’s announcement is an attempt to rectify that. While SMRs may form part of the UK’s energy future, it would be unwise to rely on them until their developers demonstrate they can deliver them on time and at a reasonable cost.

Successive governments have tried to get carbon capture and storage deployed for even longer – since the late 2000s. Today’s announcement confirms the government’s high level of ambition, with £20 billion of support over two decades. Many analysts think this technology will be required to reach net zero. But, just as with small reactors, the construction of real projects is required before we know whether carbon capture can actually deliver.

Business tax rise comes with counterbalances

Gavin Midgley, Senior Teaching Fellow in Accounting, University of Surrey

This was a budget with very few tax policy surprises. Given the recent decline in economic confidence, it was possibly the best the chancellor could hope for. The government may be hoping that anticipated GDP rises and inflation falls will come to pass, distracting voters from a still relatively high tax burden.

The increase in the main corporation tax rate from 19% to 25% – on which the government has flip-flopped in recent months – has now come to pass. Hunt’s justification is that it will only affect 10% of companies and that it remains the smallest rate in the G7.

But this might not be enough to allay Conservative backbenchers’ concerns about their party being responsible for the largest rate increase in the tax’s history. Recent polls suggest the public has little opposition to such as raise, so this increase may only be a problem for internal Tory unity.

The announced rise in the corporation tax rate has been accompanied by two potential major counterbalances: small and medium-sized firms whose research and development costs are over 40% of their total expenditure can claim significant further tax credits. However, it’s not clear what proportion of total firms that could benefit from this policy.

Companies can also “expense” equipment purchases to reduce tax liabilities. This could provide a significant reduction in a firm’s tax liability but, again, without more information it will be difficult for companies to plan their spending to take advantage of this. Businesses may see this change as a missed opportunity as a result.

Difficult to justify new business allowance

Karl Matikonis, Lecturer at Queen’s Management School, Queen’s University Belfast

The super deduction, introduced from April 2021 to March 2023, was the UK’s most generous investment allowance ever. It was created to improve productivity and help pandemic recovery efforts. Companies were able to write off 130% of the cost of investments in machinery and equipment, and 50% for certain other types of capital expenditure.

This budget has replaced the super deduction with an “expensing” allowance. This is designed to avoid a double blow for businesses next month when corporation tax will jump from 19% to 25%. Companies had warned this tax hike could deter growth, particularly after the super deduction allowance expires.

Although the relief is now reduced to 100%, with corporation tax soon to be 25%, the tax savings are fairly similar versus the previous 130%. According to my calculations, companies will now save £2.50 (instead of £2.47) on their tax bill for every £10 invested. A 50% deduction for special rate capital expenditure also stays the same up to March 31 2026.

A recent Treasury consultation deemed this option the costliest out of all allowances to incentivise growth, however. And the UK is the only advanced economy offering such substantial allowances. Corporation tax uplift will result in greater tax revenue (£40 billion in 2021-22 versus £77 billion in 2023-24), but this allowance still swallows £10 billion in tax takings annually.

Because the allowance is temporary, it is likely to encourage businesses to spend, or at least make planned purchases sooner. But it is uncertain if it will contribute to productivity growth. Many factors contribute to productivity, and research also points to many other constraints to productivity growth aside from investments. If such subsidies do not boost productivity levels, it’s difficult to justify this large tax incentive.

No focus on health and the NHS workforce

Karen Bloor, Professor of Health Economics and Policy, University of York

Jeremy Hunt, formerly chair of the health select committee and the longest-ever serving secretary of state for health, knows better than most the challenges currently facing the NHS. Despite this, there were few solutions announced to address the key problems plaguing health and social care in today’s budget.

The NHS currently has 124,000 job vacancies. Tens of thousands of junior doctors are on strike, NHS consultants have voted to strike, and nurses, ambulance staff and other NHS staff are threatening the same. In primary care, patient demand continues to grow faster than the number of GPs.

Around 7.2 million people are on an NHS waiting list, and these figures are unlikely to fall significantly this year. Efforts to clear this record-high waiting list are being severely hampered by long-standing workforce problems and exacerbated by strikes, which delay elective care.

The chancellor’s statement has addressed only one of the workforce challenges facing the NHS directly – that of doctors’ pensions. The pension tax, described as “punitive” by the British Medical Association is believed to be contributing to senior NHS doctors -– both consultants and GPs -– choosing to retire early or work part-time.

But in abolishing the lifetime allowance (for all, not just doctors), the chancellor is rewarding the highest-paid individuals. Retaining staff is crucial to reducing waiting lists and improving NHS performance, but doctors – however well-rewarded – cannot fix the NHS alone.

Targeting a range of voters

Despina Alexiadou, Senior Lecturer at the School of Government and Public Policy, University of Strathclyde

The 2023 spring budget gives “goodies” to the traditional Tory voting base (high earners) but also introduces employment growth policies that should be widely popular.

As of September 2025, the state will provide free childcare for 30 hours a week for children over 9 months old as long as both parents work. This is a significant increase in public spending towards working parents with direct benefits for young mothers.

Childcare support for young children has long-term benefits for women’s careers. The OECD has found “an unambiguous positive correlation between the provision of childcare services for the under-3s and full-time and part-time female participation in the labour force”. This major policy intervention will be welcomed by parties and voters across the ideological spectrum.

Less so for another big announcement, which will mostly benefit high earners. The abolishment of the lifetime cap on pensions and the increase in the annual tax-free pension allowance from £40,000 to £60,000 is a bonus for those lucky enough to be able to save twice the UK median salary.

Though the policy is meant to encourage specialist doctors to stay in the labour market, it is a financial boost for all high earners at a time when average household income is expected to decline at its fastest rate since 1950.

Check back for deeper analysis in the coming days of key issues such as childcare funding, employment measures and what this budget will mean for the UK economy.

Andrew Burlinson currently receives funding from UKERC (UKRI) and previously received relevant funding from EPSRC.

Catherine Waddams currently receives no research funding, but has previously received funding from the EPSRC and the ESRC. She is a member of Ofgem's Academic Panel.

Jim Watson receives funding from the Foreign, Commonwealth and Development Office (FCDO) and UKRI.

Karen Bloor receives funding from the National Institute for Health Research, including funding to provide a fast-response analysis programme for the Department of Health and Social Care.

Karl Matikonis receives funding from ESRC (UKRI) to investigate how the adoption of new technologies impacts businesses in Northern Ireland, including subsidies and tax collections.

Alan Shipman, Despina Alexiadou, Gavin Midgley, Phil Tomlinson, and Steven McCabe do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.