Investors with a lot of money to spend have taken a bearish stance on Salesforce (NYSE:CRM).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 36 uncommon options trades for Salesforce.

This isn't normal.

The overall sentiment of these big-money traders is split between 30% bullish and 41%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $179,534, and 32 are calls, for a total amount of $1,400,137.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $220.0 to $400.0 for Salesforce over the recent three months.

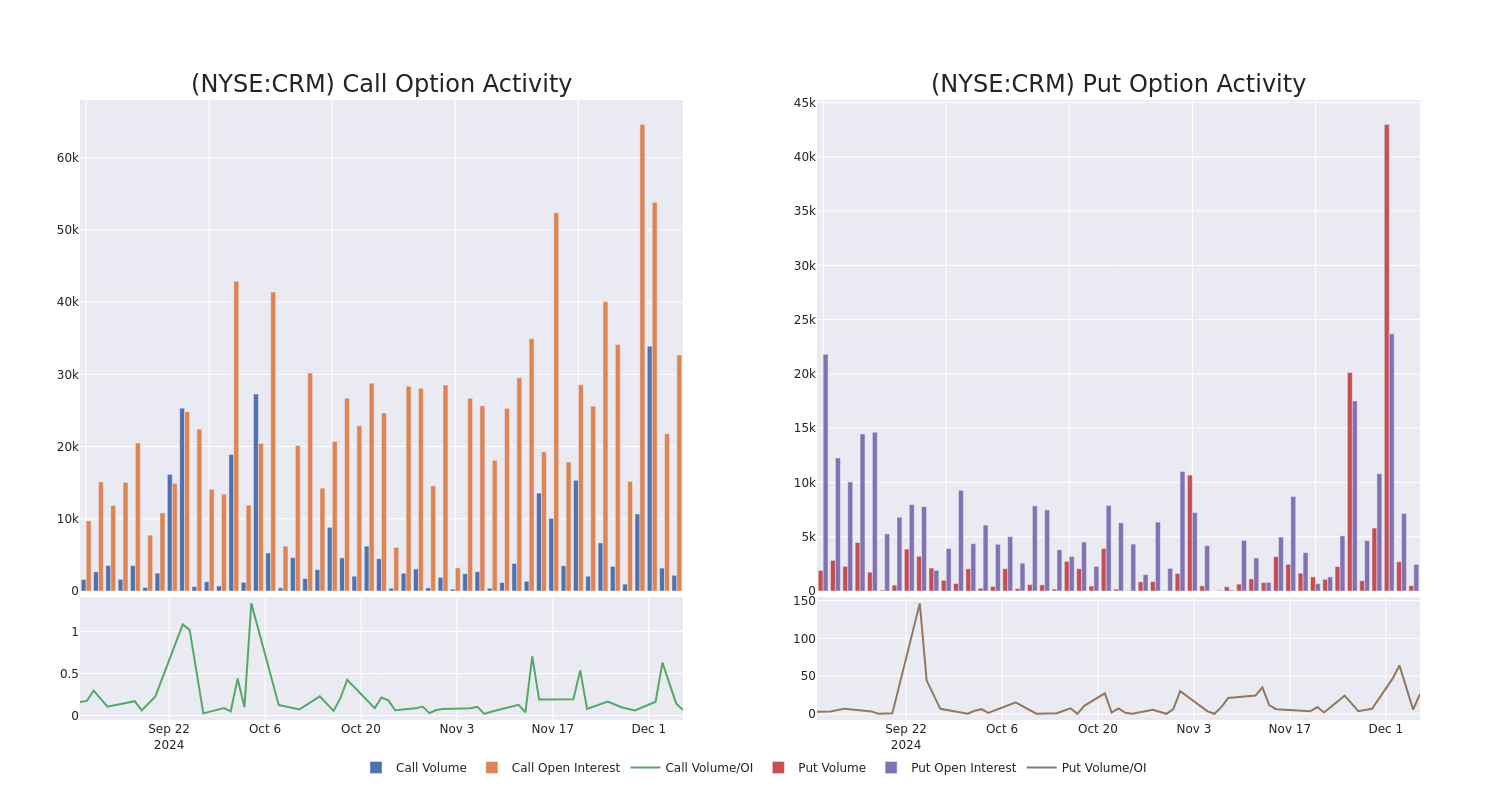

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Salesforce's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Salesforce's significant trades, within a strike price range of $220.0 to $400.0, over the past month.

Salesforce Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | TRADE | BEARISH | 01/16/26 | $133.9 | $132.65 | $133.0 | $250.00 | $133.0K | 595 | 12 |

| CRM | CALL | TRADE | BULLISH | 12/27/24 | $11.8 | $11.4 | $11.8 | $360.00 | $118.0K | 518 | 207 |

| CRM | PUT | SWEEP | BEARISH | 02/21/25 | $39.0 | $38.6 | $39.0 | $400.00 | $101.4K | 1 | 26 |

| CRM | CALL | SWEEP | BULLISH | 12/06/24 | $25.4 | $24.0 | $25.4 | $340.00 | $76.2K | 4.6K | 45 |

| CRM | CALL | TRADE | NEUTRAL | 03/21/25 | $30.35 | $29.85 | $30.11 | $360.00 | $75.2K | 1.0K | 26 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Having examined the options trading patterns of Salesforce, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Salesforce Standing Right Now?

- With a trading volume of 2,919,534, the price of CRM is up by 0.31%, reaching $362.51.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 82 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Salesforce options trades with real-time alerts from Benzinga Pro.