Financial giants have made a conspicuous bullish move on Broadcom. Our analysis of options history for Broadcom (NASDAQ:AVGO) revealed 10 unusual trades.

Delving into the details, we found 60% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $174,276, and 7 were calls, valued at $483,580.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $120.0 and $195.0 for Broadcom, spanning the last three months.

Analyzing Volume & Open Interest

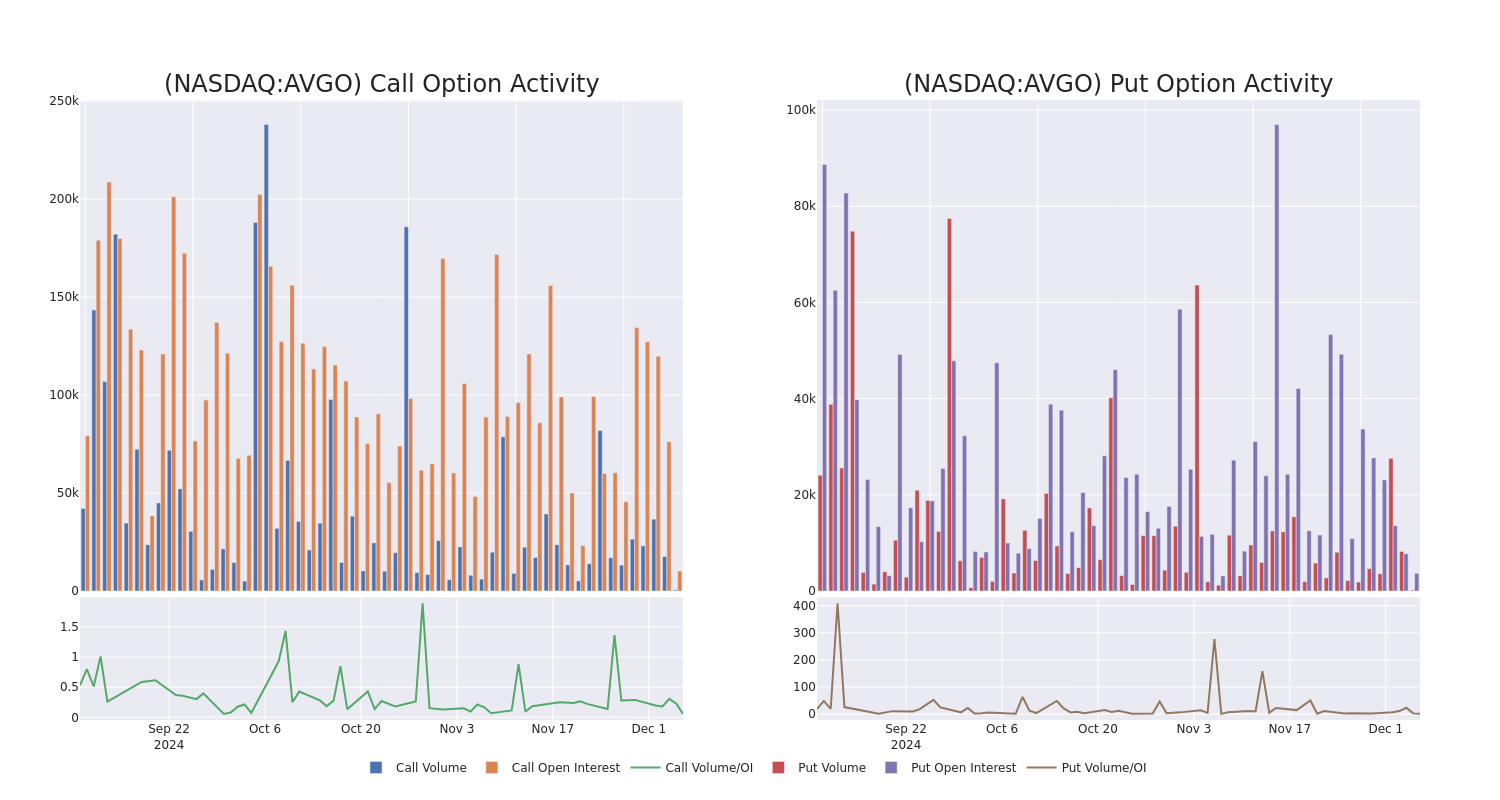

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Broadcom's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Broadcom's whale activity within a strike price range from $120.0 to $195.0 in the last 30 days.

Broadcom Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | CALL | SWEEP | BULLISH | 12/06/24 | $6.0 | $5.9 | $6.0 | $165.00 | $300.0K | 3.5K | 558 |

| AVGO | PUT | TRADE | BEARISH | 07/18/25 | $33.65 | $33.55 | $33.65 | $195.00 | $100.9K | 33 | 30 |

| AVGO | PUT | TRADE | BEARISH | 01/17/25 | $11.85 | $11.65 | $11.77 | $175.00 | $44.7K | 2.4K | 38 |

| AVGO | CALL | TRADE | BULLISH | 07/18/25 | $34.4 | $34.05 | $34.3 | $150.00 | $34.3K | 76 | 10 |

| AVGO | CALL | TRADE | BULLISH | 06/20/25 | $33.35 | $32.85 | $33.2 | $152.00 | $33.2K | 3.3K | 10 |

About Broadcom

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

In light of the recent options history for Broadcom, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Broadcom

- With a trading volume of 461,644, the price of AVGO is down by -0.51%, reaching $169.59.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 6 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Broadcom, Benzinga Pro gives you real-time options trades alerts.