Deep-pocketed investors have adopted a bullish approach towards AppLovin (NASDAQ:APP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in APP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for AppLovin. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 55% leaning bullish and 11% bearish. Among these notable options, 3 are puts, totaling $86,170, and 6 are calls, amounting to $479,110.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $170.0 to $375.0 for AppLovin over the last 3 months.

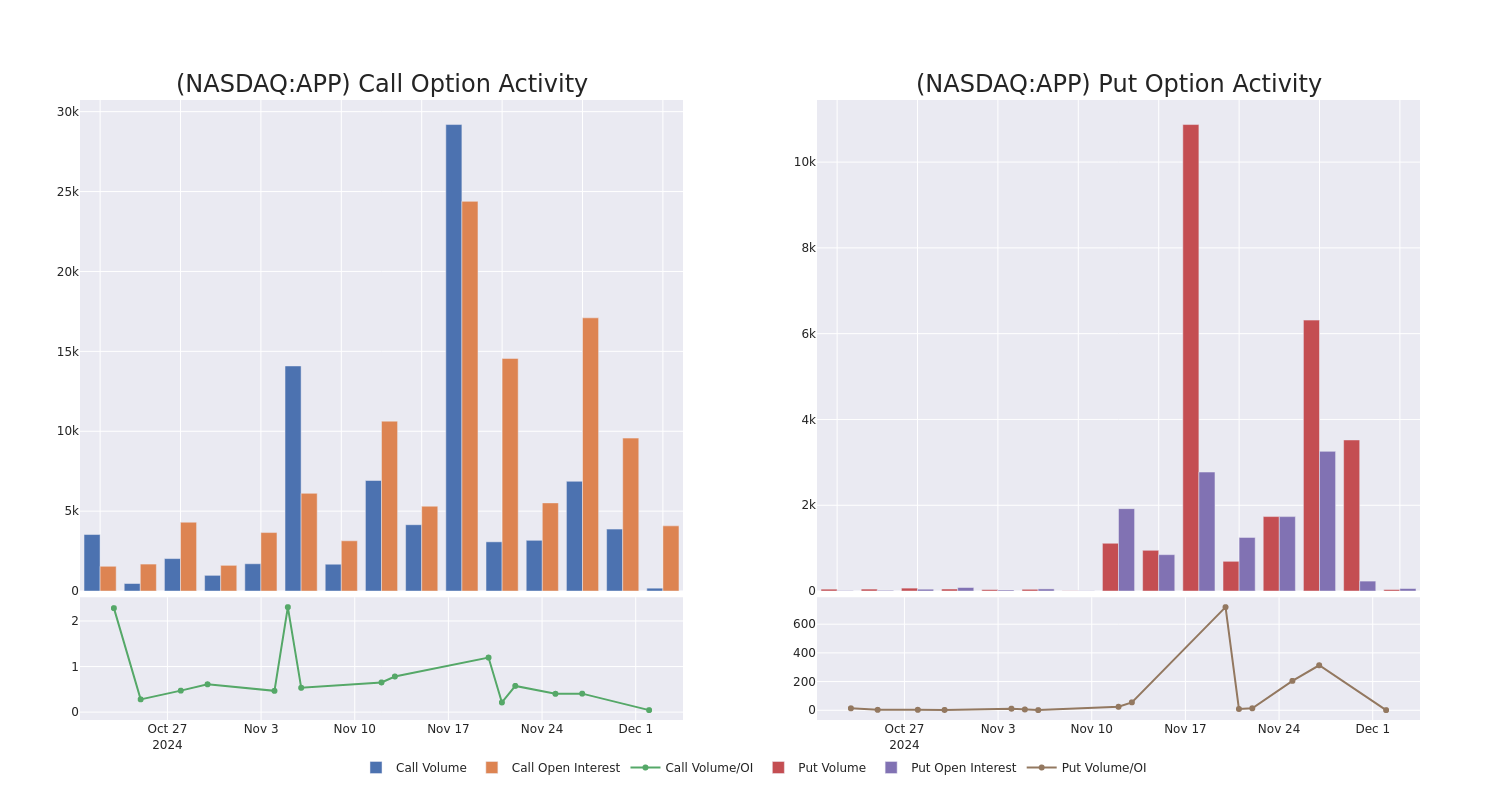

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for AppLovin options trades today is 517.38 with a total volume of 215.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for AppLovin's big money trades within a strike price range of $170.0 to $375.0 over the last 30 days.

AppLovin Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | TRADE | BULLISH | 02/21/25 | $58.2 | $56.6 | $58.2 | $320.00 | $291.0K | 281 | 51 |

| APP | CALL | TRADE | NEUTRAL | 03/21/25 | $54.5 | $51.4 | $53.1 | $340.00 | $53.1K | 77 | 11 |

| APP | CALL | TRADE | BULLISH | 01/17/25 | $26.9 | $26.9 | $26.9 | $350.00 | $40.3K | 2.4K | 19 |

| APP | CALL | TRADE | BULLISH | 03/21/25 | $175.8 | $172.5 | $175.0 | $170.00 | $35.0K | 703 | 2 |

| APP | PUT | TRADE | BULLISH | 03/21/25 | $57.5 | $56.0 | $56.0 | $350.00 | $33.6K | 14 | 6 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

Following our analysis of the options activities associated with AppLovin, we pivot to a closer look at the company's own performance.

Current Position of AppLovin

- Currently trading with a volume of 118,393, the APP's price is up by 0.51%, now at $338.47.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 72 days.

What The Experts Say On AppLovin

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $371.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Oppenheimer persists with their Outperform rating on AppLovin, maintaining a target price of $480. * An analyst from JP Morgan has decided to maintain their Neutral rating on AppLovin, which currently sits at a price target of $200. * An analyst from Piper Sandler downgraded its action to Overweight with a price target of $400. * Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for AppLovin, targeting a price of $400. * An analyst from B of A Securities has decided to maintain their Buy rating on AppLovin, which currently sits at a price target of $375.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest AppLovin options trades with real-time alerts from Benzinga Pro.