Among all the things couples fight about, money is one of the most persistent topics. When you pair an extravagant spender with a penny pincher, there is bound to be trouble. If a couple can agree on how to spend their dough, things will likely be easier.

But, for this particular pair, money began causing big issues. A woman took to Reddit to share her financial woes and explain how her partner spent all her hard-earned cash. She finally reached her breaking point and decided to open a new bank account.

More info: Reddit

Woman realized she needed to separate finances after husband secretly emptied $1700 from their bank account to give to his parents

Image credits: Karolina Grabowska (not the actual photo)

The poster said she was always a “saver” and her husband was a “spender” who’d lend cash to his parents, it never bothered her earlier because they both earned money

Image credits: Thirdman (not the actual photo)

A few years back, he got into a car wreck, which meant he couldn’t work, and since then, their bills and debt mounted up

Image credits: Anete Lusina (not the actual photo)

The woman became the sole breadwinner, but despite their difficult financial situation, her husband lent over 10 grand to his family and took $1700 from their joint savings account

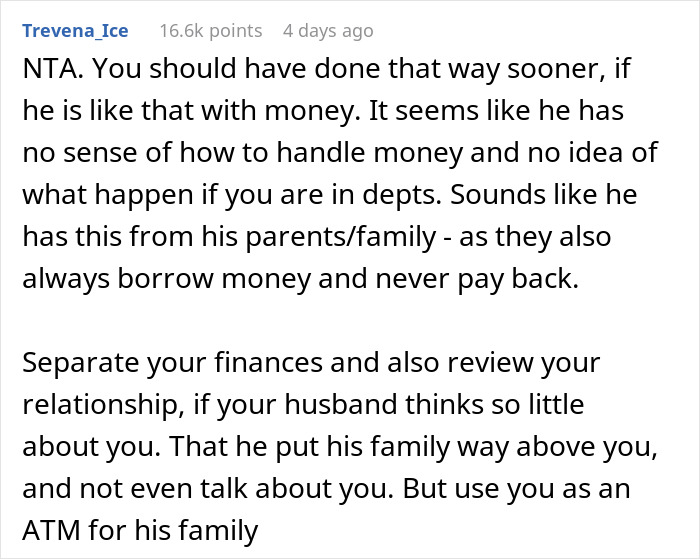

Image credits: u/EmotionalYear1372

When the poster found out that he had secretly taken out more money, she withdrew all the cash and made a new bank account that he didn’t have access to

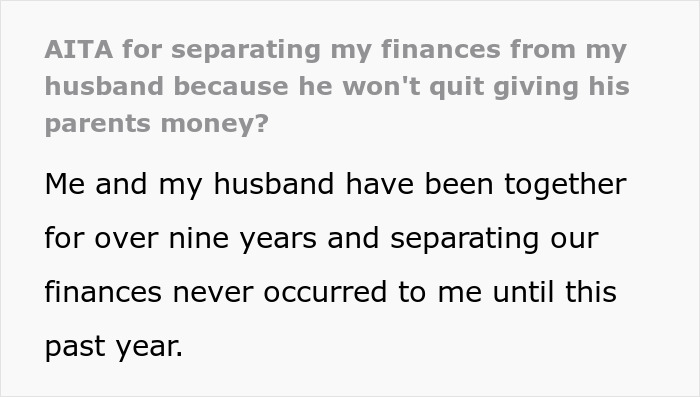

The author shared that she and her husband have been together for 9 years. Until this point in their marriage, she had no reason to keep their finances separate. She has always been the saver, and he has been the spender. On top of that, his family kept borrowing money and would never pay it back. These things did not bother her as much because both of them were earning money and living a comfortable life.

For some couples, conflict about money happens early in the relationship. Research shows that if partners have similar ideas about spending and savings, there would be fewer marital arguments. In fact, financial preferences can be a predictor of some aspects of marriage satisfaction, quality, and distress. When both people feel that they share in the decision-making process about money, the likelihood of divorce can also decline.

The woman mentioned that things changed after her husband got into a bad car wreck. He was not able to work and hence had to apply for disability. It took 4 years for the disability paycheck to come through. By then, their savings dwindled, debt mounted, and they even came close to losing everything. She became the sole earner of the household and had to save and pay off their debt. But she soon realized that her husband was still loaning big sums of their money to his family.

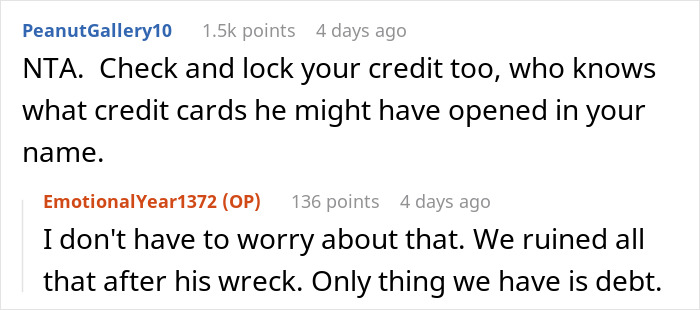

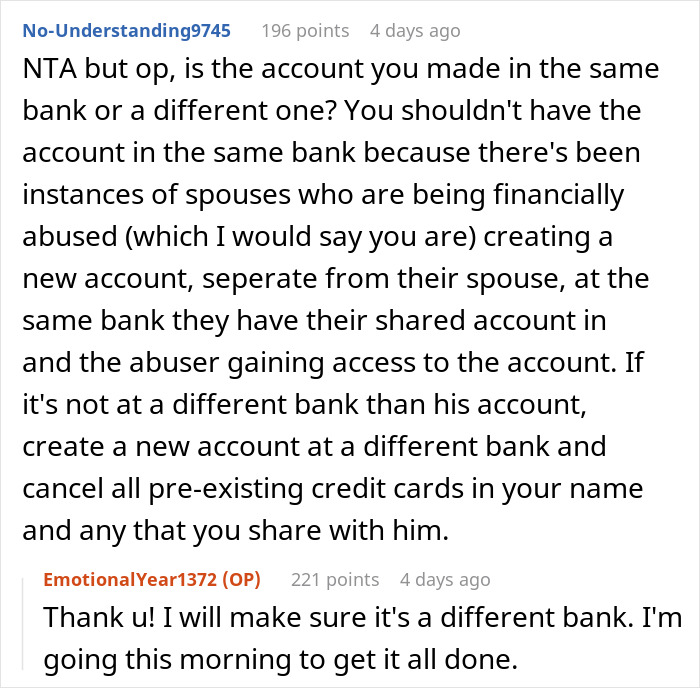

He even took money without asking out of their savings account, which she found out about later. When commenters accused the poster’s husband of stealing the cash, she said, “we are married, it’s a joint account and legally also his. He has a disability check that goes to it and I have a paycheck but it was solely my money in the savings account but unfortunately his name is on it too.”

Image credits: Tima Miroshnichenko (not the actual photo)

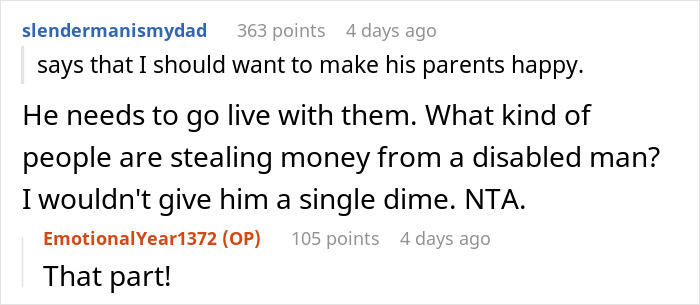

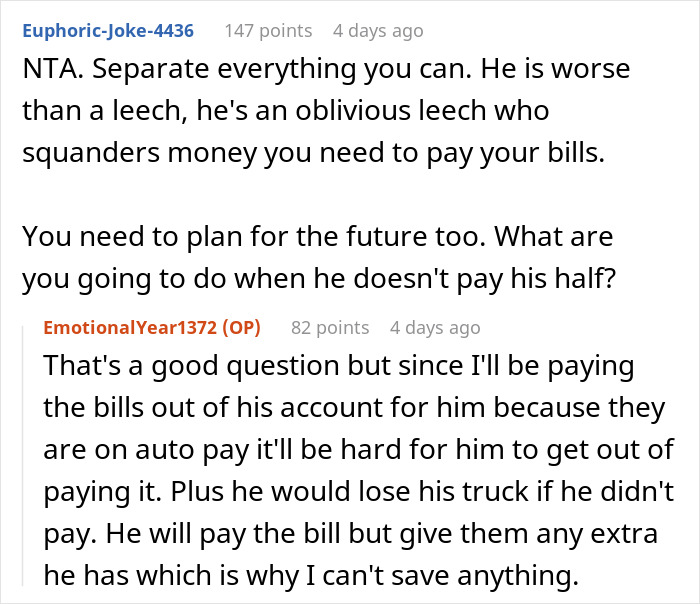

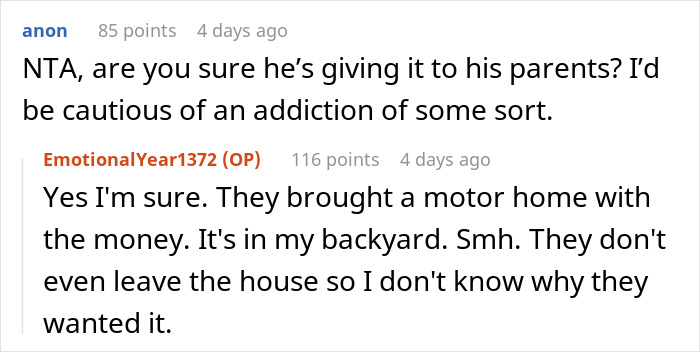

The woman said she was very mad when she realized he had lent money to his parents yet again. She felt annoyed that she had been working 60 hours a week all so that he could give the money away. Some people were concerned that her husband was using the money to fund an addiction and lying about giving it to his parents. The poster clarified that he wasn’t faking it and that his parents “brought a motor home with the money. It’s in my backyard. They don’t even leave the house so I don’t know why they wanted it.”

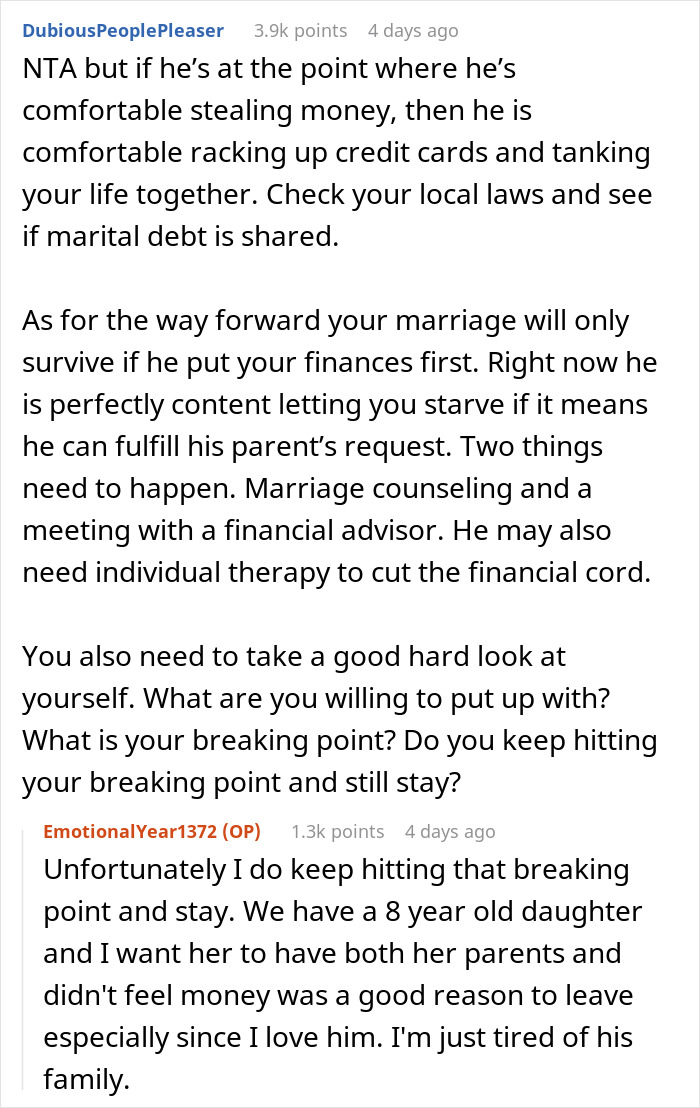

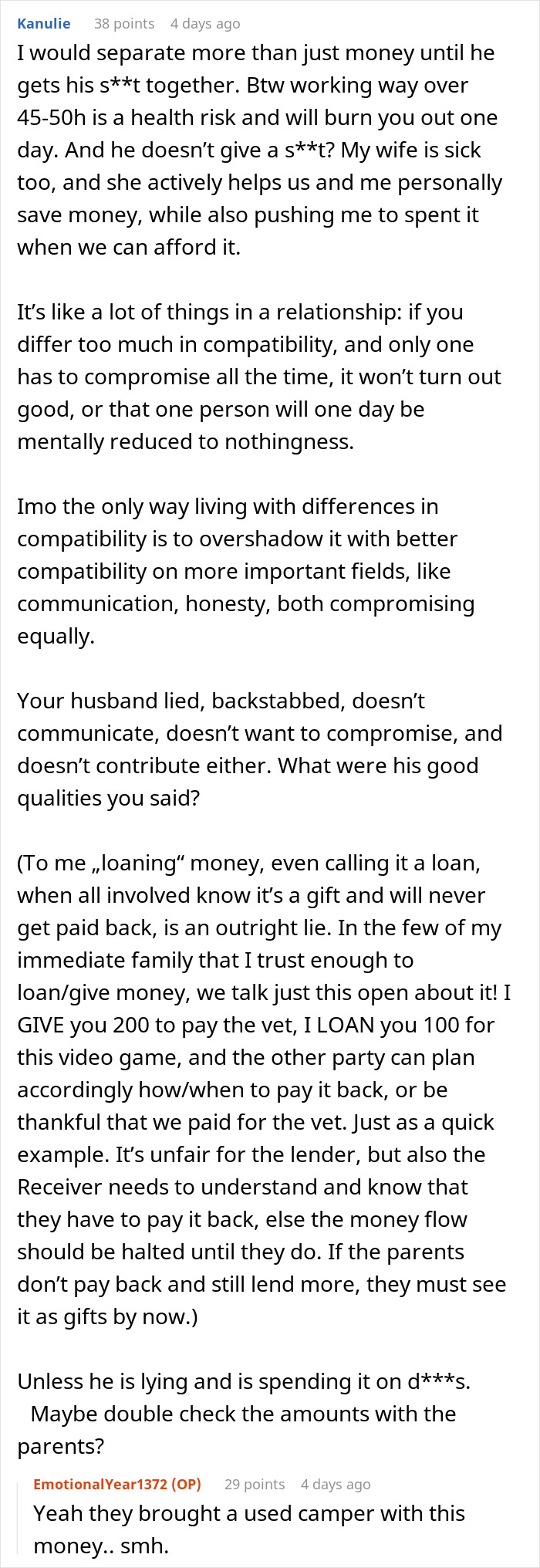

When she’d finally had enough of his horrible spending habits, the woman withdrew all the money from their joint account and separated their finances. People were enraged on her behalf and told her that such behavior was grounds for divorce. The poster stood up for her husband and said, “unfortunately I do keep hitting that breaking point and stay. We have a 8 year old daughter and I want her to have both her parents and didn’t feel money was a good reason to leave especially since I love him. I’m just tired of his family.”

In this case, maybe splitting up the finances might work out well for the woman because she and her husband manage money differently. In most cases, research shows that merging accounts might promote better financial alignment and increase transparency. Some experts also say that keeping separate accounts can create distance or distrust among partners if they already don’t communicate openly about their finances.

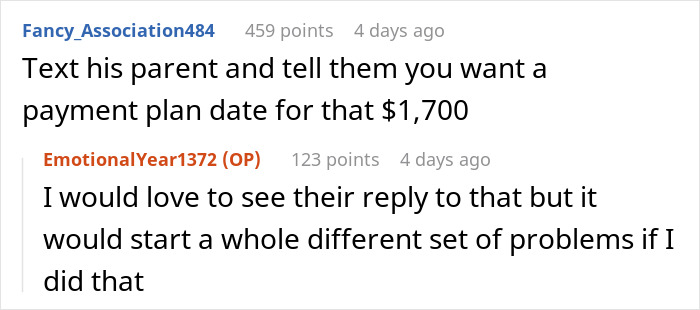

Money matters can be quite emotional, as they are often tied to a person’s self-worth and belief systems. That’s why it’s important to handle the situation tactfully. Instead of waiting for things to escalate, the woman stood up for herself and decided to draw a clear boundary with her husband. People were glad she made the decision, and they also told her to contact his parents and set up a payment plan for the $1700 he had given them.

Do you think the woman did the right thing by opening a new bank account? What would you have done if you were in her position? Share your thoughts in the comments.

People had lots of questions about the woman’s marriage, and she took the time to answer a lot of their doubts