Solar stocks have been some of the best stocks to own this summer, with names like First Solar (FSLR) and Enphase Energy (ENPH) leading the charge higher.

These stocks rallied more than 140% from the May low to the recent high and helped power the Invesco Solar ETF (TAN) higher. These two stocks are the largest holdings in the ETF, with a combined weighting of more than 22%.

While the overall market is under pressure on Wednesday, solar stocks are getting hit quite hard.

Enphase Energy is down about 13% on the day, while First Solar stock is down roughly 6%.

We have traded these stocks exceptionally well so far this year, so let’s take an updated look at the charts.

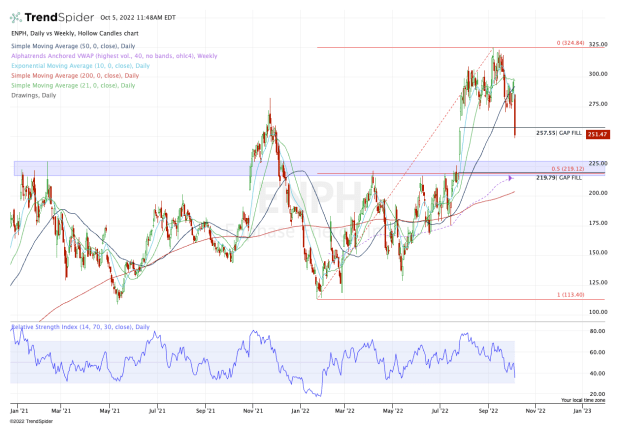

Trading Enphase Energy Stock

Chart courtesy of TrendSpider.com

Shares of Enphase Energy were already trading pretty well going into July, but then earnings sent this name soaring. It gapped higher on July 17, gaining more than 17% on the day. It gapped higher again on July 18, gaining more than 7% on the day.

Since then, it had been treading water above the $275 level as the stock was consolidating its recent gains.

With Wednesday's plunge, Enphase Energy stock has fallen right through the $275 level and hit the second of two main gap-fills, this one at $257.55.

Now trying to find its footing around $250, bulls will want to see a move back over $257.55. If it can do that, then the 10-day moving average and $270 to 275 area could be back in play on a bounce.

Otherwise, sub-$250 could usher in a test of the $220 area. In that zone we find the 50% retracement from the recent high down to the 2022 low, as well as the second gap-fill level. Lastly, the weekly VWAP measure comes into play in this area as well.

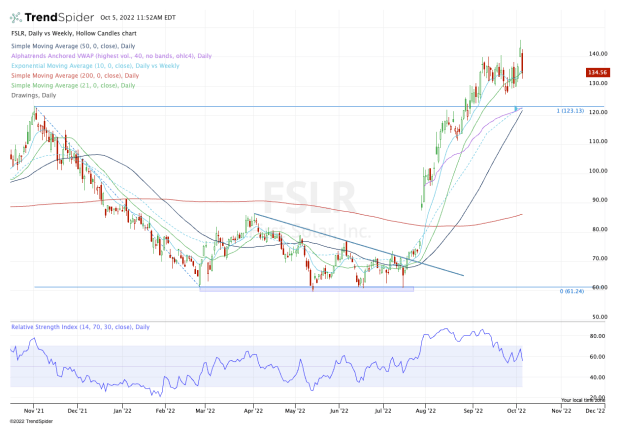

Trading First Solar Stock

Chart courtesy of TrendSpider.com

First Solar stock is a little more direct. Shares have support near the $130 level, but I’m looking for a bit larger of a decline for a better risk/reward setup.

This comes after the stock burst to new highs on the year on Tuesday, but is reversing lower on Wednesday.

Specifically, I am looking for a dip into the $120 to $125 area. There we find a plethora of levels that could help give this stock a boost. They include the 50-day and 10-week moving averages, the daily VWAP measure and the breakout level over the 2021 high.