Investors are piling into solar energy stocks and other green companies, thanks to the recently passed Inflation Reduction Act, which provides nearly $369 billion to bolster energy development and combat climate change. It's not clear how long the party will last, but it could extend into the wee hours and beyond.

A goal of the act — known as the IRA — is to strengthen energy independence, reduce dependence on Chinese imports, and reinvigorate the industrial sector. It's also designed to create American jobs and accelerate the transition to renewable energy.

It's the largest federal government spending increase on alternative energy in U.S. history. Further, its impact could last over the next decade.

"Years from now we'll look back on this as a time when the federal government made a commitment supporting the transition to clean energy and addressing climate change more broadly," Jon Hale, global head of sustainability at Morningstar, told Investor's Business Daily.

Solar Energy Production Will Triple

The Senate passed the IRA bill on Aug. 12. President Joe Biden signed the act into law on Aug 16.

A White House statement said the U.S. is on track to triple domestic solar manufacturing capacity by 2024. It sees passage of the IRA spurring greater interest in clean energy and solar energy stocks.

Hale noted that in the two weeks prior to the July 27 disclosure of Congress' IRA agreement, exchange traded funds in the clean energy sector had net outflows of $223 million.

But in the two-week period after the deal's announcement, investors rushed into this group of funds. ETFs attracted net inflows of about $433.6 million, Hale said. Morningstar tracks about 24 solar energy and other renewable energy ETFs.

Take Our Anonymous Survey And Tell IBD What Characteristics Are Most Important For Online Brokers

"The legislation makes it more likely that more investors will look at how to position their overall portfolios to account for climate risks and benefit from the inevitable transition to a low-carbon economy," Hale said.

Holding The No. 1 Spot

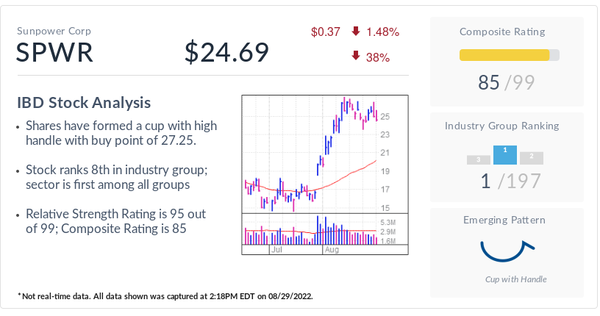

IBD's "Energy-Solar" industry group holds the No. 1 spot out of 197 industry groups tracked. IBD industry groups are a combination of companies in the same business.

The ranking of industry groups is based on a six-month price and performance average of the stocks in each group. The ranking is updated daily, published in the IBD Weekly newspaper and in data tables at Investors.com.

Stocks in the solar energy group include First Solar, Enphase Energy, Canadian Solar and Daqo New Energy.

Others are SolarEdge Technology, Jinko Solar and SunPower.

It's unclear how long the group can stay at the top of the IBD industry heap or whether these stocks are showing signs of slowing.

New Tax Credits For Solar Production

Key to the passage of the IRA bill was the Solar Energy Manufacturing for America Act. It creates new tax credits designed to rapidly expand solar production and bring key solar supply chains online. It also could accelerate the transition to clean energy, says Abigail Ross Hopper, president and chief executive of the Solar Energy Industries Association.

The act "will immediately spur private investments in production capacity across the solar supply chain, including batteries, helping to create thousands of manufacturing jobs and support our energy independence." Hopper said in written remarks when the act was passed.

Key beneficiaries of the bill include First Solar, which manufactures solar modules for residences and businesses worldwide.

"For the first time, solar manufacturers would benefit from a durable, long-term industrial policy designed to revitalize and expand domestic manufacturing and innovation at scale," First Solar CEO Mark Widmar said in a written statement.

Big Jump In Solar Energy Stocks

First Solar stock has soared 56% since the July 27 agreement to pass the IRA. Enphase Energy climbed 34% in that time, while SunPower jumped 66%. And Canadian Solar gained 29% as Sunrun surged 48%.

Brett Castelli, a Morningstar analyst who covers clean energy, says there are several factors for investors to consider.

For one, the act contains a 10-year extension of solar and wind tax credits, he said in a note to clients. Also, the 10-year provision provides enough time for clean energy firms to build new capacity, he wrote.

Other incentives designed to support new technology previously were not eligible for tax credits. The two areas that are likely to see the biggest benefits are hydrogen and energy storage.

In addition, the act provides incentives for the domestic manufacturing of solar panels and equipment. Providers largely imported those materials previously.

Incentives For Solar Panel Production

"The provisions in this law significantly increase the incentive to manufacture solar panels and inverters domestically," Castelli wrote.

Hale also said it's not too late for investors to jump on the green stock bandwagon.

"This is a long-term trend," Hale said. "Those still considering investing in renewable energy shouldn't worry about missing out on the initial news."

The act "includes important incentives that will, over time, lead to a renaissance in American solar manufacturing," according to the solar energy association. The remarks came as part of a white paper published on the group's website.

Further, the association went on to say, "As a direct result of the IRA, we expect to see significant new investments in domestic solar module, tracker, inverter and racking capacity within the next 2-3 years, followed by new investments in solar ingot, wafer and cell capacity within 3-5 years."

Please follow Brian Deagon on Twitter at @IBD_BDeagon for more on tech stocks, analysis and financial markets.