High-rolling investors have positioned themselves bearish on SoFi Techs (NASDAQ:SOFI), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SOFI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for SoFi Techs. This is not a typical pattern.

The sentiment among these major traders is split, with 25% bullish and 62% bearish. Among all the options we identified, there was one put, amounting to $31,875, and 7 calls, totaling $443,494.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $14.0 and $20.0 for SoFi Techs, spanning the last three months.

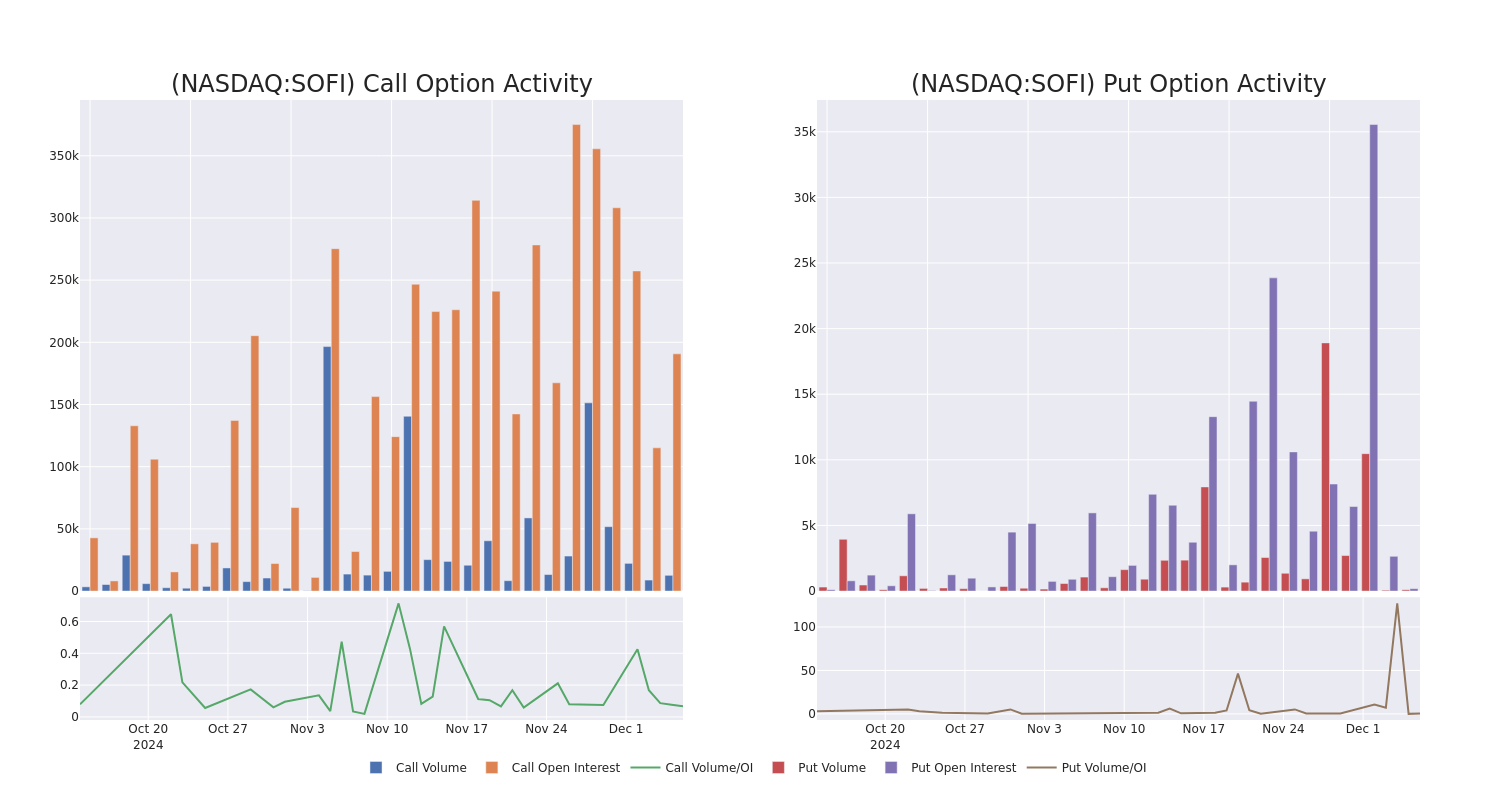

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for SoFi Techs options trades today is 31816.17 with a total volume of 12,738.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for SoFi Techs's big money trades within a strike price range of $14.0 to $20.0 over the last 30 days.

SoFi Techs Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SOFI | CALL | TRADE | BEARISH | 04/17/25 | $2.89 | $2.77 | $2.79 | $15.00 | $215.6K | 11.9K | 1.2K |

| SOFI | CALL | TRADE | NEUTRAL | 06/18/26 | $10.65 | $0.65 | $5.7 | $15.00 | $57.0K | 6.1K | 100 |

| SOFI | CALL | SWEEP | BEARISH | 01/17/25 | $2.01 | $2.0 | $2.0 | $14.00 | $49.8K | 18.2K | 1.9K |

| SOFI | CALL | SWEEP | BEARISH | 01/17/25 | $0.37 | $0.35 | $0.36 | $20.00 | $34.3K | 38.5K | 3.2K |

| SOFI | PUT | SWEEP | BULLISH | 06/20/25 | $3.8 | $3.75 | $3.75 | $17.00 | $31.8K | 182 | 96 |

About SoFi Techs

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

In light of the recent options history for SoFi Techs, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of SoFi Techs

- Trading volume stands at 24,231,932, with SOFI's price down by -0.19%, positioned at $15.62.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 52 days.

What The Experts Say On SoFi Techs

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $16.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on SoFi Techs with a target price of $16. * An analyst from JP Morgan persists with their Neutral rating on SoFi Techs, maintaining a target price of $16.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest SoFi Techs options trades with real-time alerts from Benzinga Pro.