Snowflake (SNOW) stock received a much needed lift from an analyst upgrade that cited a stabilizing revenue environment and SNOW's potential to benefit from the explosive growth seen in generative artificial intelligence (AI).

Stifel analyst Brad Reback on Monday raised his recommendation on Snowflake stock to Buy from Hold. He also lifted his price target to $185 from $145. Reback's new target price gives SNOW implied upside of about 16% in the next 12 months or so – something which shareholders in the downtrodden stock would certainly appreciate.

Snowflake, which is a cloud-based data warehouse firm, went public in September 2020, pricing 28 million shares at $120 a pop. The tech unicorn garnered such hype at the time that even Berkshire Hathaway (BRK.B) Chairman and CEO Warren Buffett – who usually eschews initial public offerings – bet on the blockbuster Snowflake IPO.

Today, Berkshire Hathaway owns 6.1 million shares worth $987 million at current levels. With a weighting of just 0.3%, however, Snowflake stock represents an essentially immaterial part of the Berkshire Hathaway portfolio.

Which is just as well considering how poorly SNOW has fared since growth stocks peaked out 18 months ago. Indeed, Snowflake stock remains 64% below its all-time closing high set back in November 2021.

Snowflake stock outlook

Stifel's Reback says that recent commentary from Microsoft (MSFT) and other third-parties leads him to believe that the "optimization headwinds" the group has felt over the past nine months are stabilizing. Snowflake is also heading toward easier year-over-year top-line comparisons. Between those two developments, Reback figures that "SNOW's revenue growth should stabilize in the high 30% range."

The analyst also notes that management's cost discipline should continue to drive margin expansion and higher free cash flow (the cash leftover after expenses, capital expenditures and financial commitments have been met).

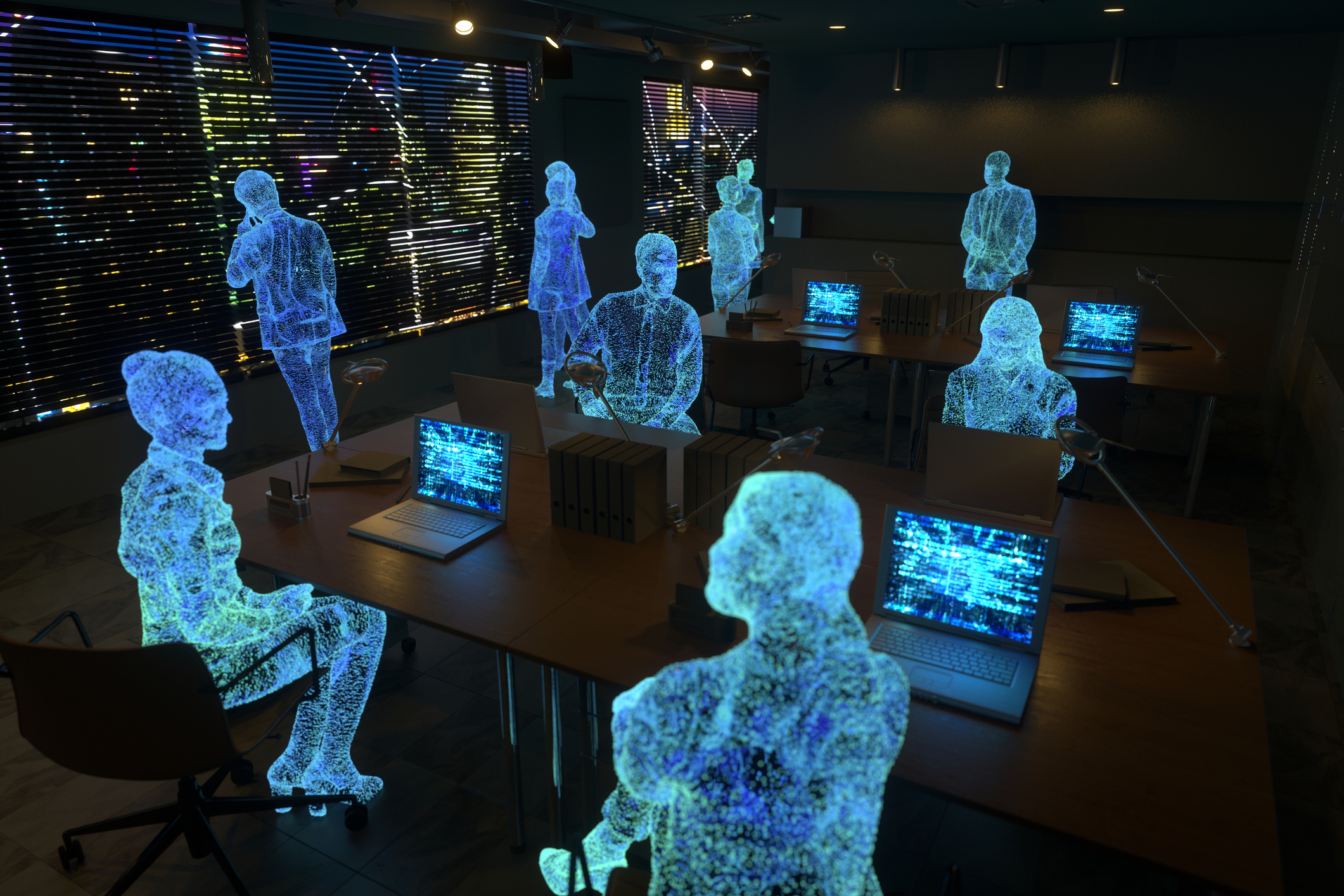

Perhaps most intriguing is the opportunity afforded by the sudden and explosive growth of generative AI services such as ChatGPT and Stable Diffusion.

"Snowflake’s leading cloud-based data platform helps organizations gain greater insights from structured and semi-structured data," Reback writes in a note to clients. "The company stands as a net beneficiary from the growth of the emerging generative AI-market, as Snowflake's data cloud platform contains the data necessary for organizations to effectively train these models for their respective operational needs."

The analyst has a fair bit of company on the Street, which gives Snowflake stock a consensus recommendation of Buy, albeit with middling conviction. Of the 41 analysts surveyed by S&P Global Market Intelligence, 17 rate it at Strong Buy, 10 say Buy, 12 have it at Hold, one says Sell and one calls it a Strong Sell.

Meanwhile, with an average price target of $184.95, the Street gives Snowflake stock implied upside of about 16% in the next 12 months or so.