Carnival Cruise (CCL) opened 2.7% lower on Wednesday, fell as much as 4%, and then reversed higher. At last check, they were up 5.2%.

The rally follows a mixed earnings headline for the cruise operator.

A loss of 85 cents a share beat expectations by 4 cents a share, while revenue of $3.84 billion missed expectations by about $110 million.

Management seemed upbeat about business, even though the U.S. and global economy are staring down a recession amid a tightening monetary policy set by global central bankers.

Yet for Carnival, that doesn’t seem to be a big issue — at least for now.

Initially, the stock tagged its 2020 covid low this morning before reversing higher on the day.

As the business tries to forge ahead, can the stock finally set sail higher? Let’s look.

Trading Carnival Cruise Stock

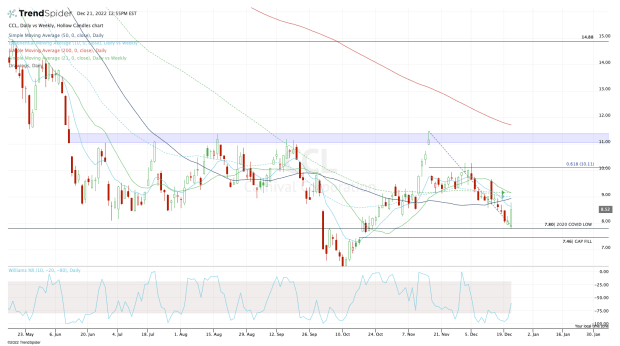

Chart courtesy of TrendSpider.com

Today’s reversal is quite impressive, particularly as Carnival stock rallies off the covid low. But it faces a ton of overhead measures that could act as resistance.

Between $8.70 and $9.10 lie the 10-day, 10-week, 21-day, 21-week, and 50-day moving averages, along with the daily VWAP measure.

That could act like a brick wall to the current rally, even if investors are feeling bullish after today’s earnings report.

If, however, the stock is able to push through this zone, that could open up quite a bit of upside.

Specifically, the 61.8% retracement up near $10 would be of interest, followed by the gap-fill at $10.96. The latter comes into play near $11, which has been a major resistance level for the past six months.

On the flip side, what happens if Carnival stock isn’t able to push through the $8.70 to $9.10 area? That keeps the $7.80 to $8 area in play.

If this zone fails as support, then the gap-fill at $7.46 follows. If the selling really intensifies, then the fourth-quarter lows are in play near $6.20.