The explosive growth of smart TV proliferation globally has arrived hand-in-hand with consumer adoption of video streaming, but that growth is slowing.

According to data provided by TrendForce, global smart TV shipments are projected to decline for a fifth consecutive year, dropping below 200 million units for the first time in a decade.

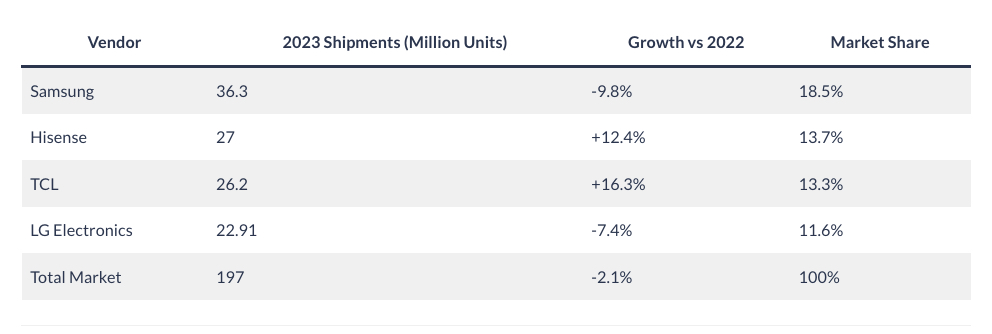

TrendForce estimates that shipments will tally at less than 197 million TVs in 2023, a 2.1% decline from the research company's 2022 tally (which was off nearly 4% from 2021).

"Consumer budgets are still constrained due to the current high-interest-rate environment, and the real estate bubble in China has suppressed TV demand," TrendForce said in its recent report. "Moreover, a significant increase in TV panel prices this year has led brands to scale down promotional events."

Notably, the report also includes interesting market share statistics, revealing that the long-gestating moment at which Chinese upstarts Hisense and TCL run down Korean incumbents Samsung and LG is at hand.

"Both Chinese brands have successfully raised their shipment volumes and market shares through low-cost export market strategies and localized production," TrendForce said. "Conversely, LG Electronics faced a downturn in OLED TV sales, with a nearly 30% YoY decline, leading to a 7.4% decrease in overall shipments to 22.91 million units."

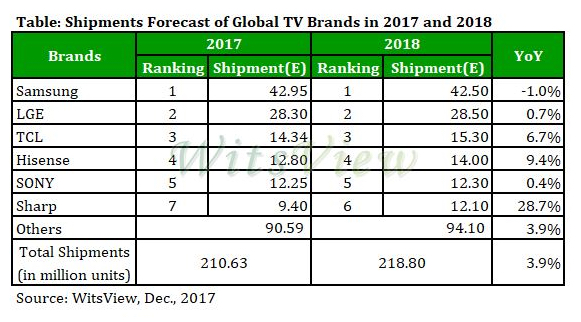

Samsung, which has led in smart TV market share for the last 17 years, has seen its annual shipments decline nearly 15% from five years ago. Meanwhile, Hisense and TCL have nearly doubled their global shipments over that span.

Of course, market share trends directly affect the important global gateway OS market, the closely associated battle between platform giants Samsung, Roku, Google and Amazon, among many other software suppliers.