Deep-pocketed investors have adopted a bullish approach towards Boeing (NYSE:BA), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 77 extraordinary options activities for Boeing. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 66% leaning bullish and 24% bearish. Among these notable options, 14 are puts, totaling $2,387,493, and 63 are calls, amounting to $2,860,084.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $250.0 for Boeing over the last 3 months.

Analyzing Volume & Open Interest

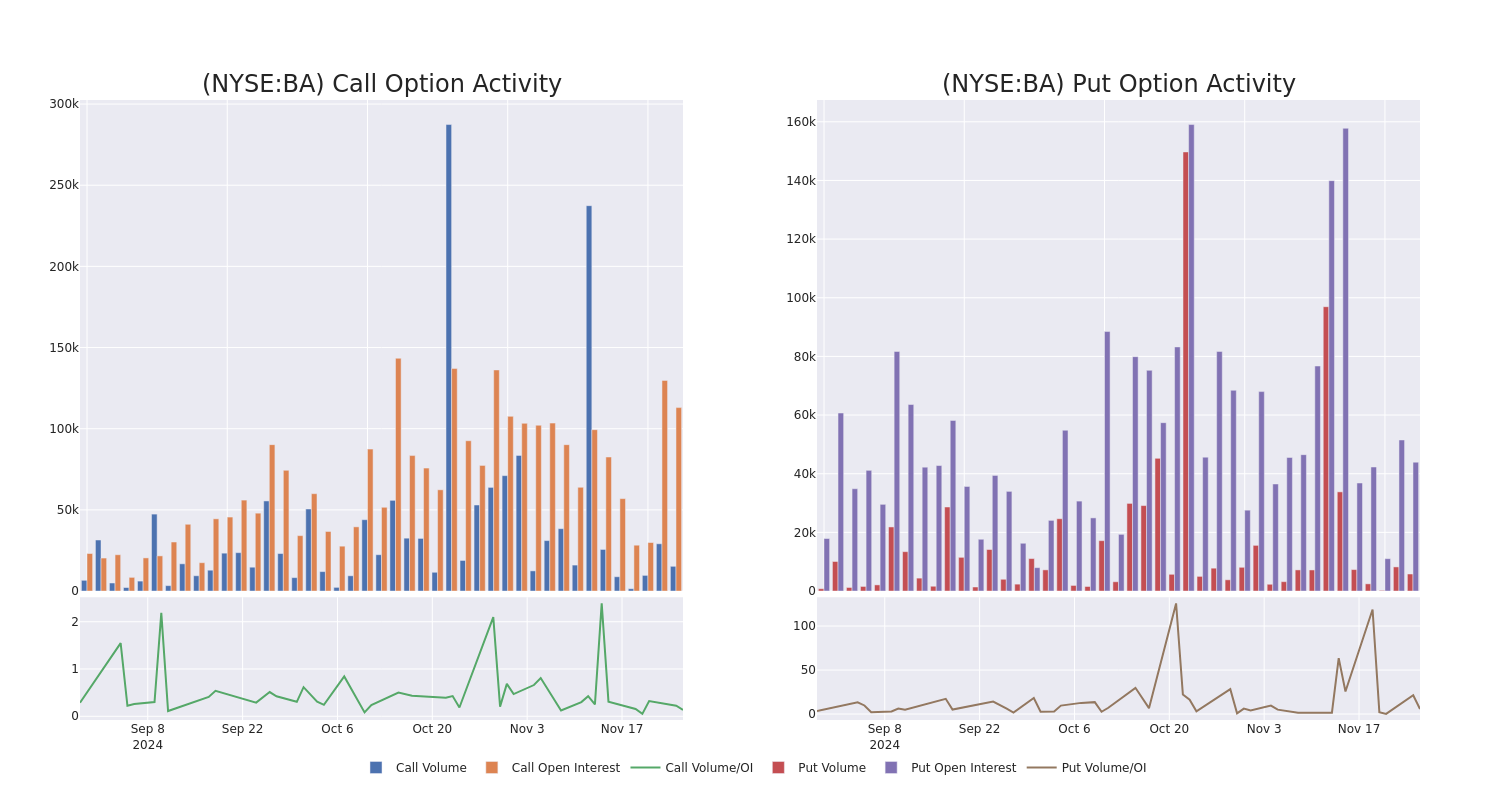

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Boeing's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Boeing's significant trades, within a strike price range of $90.0 to $250.0, over the past month.

Boeing 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BA | PUT | TRADE | BEARISH | 04/17/25 | $7.05 | $6.9 | $7.0 | $140.00 | $1.0M | 456 | 1.5K |

| BA | CALL | SWEEP | BULLISH | 12/20/24 | $17.85 | $17.75 | $17.75 | $135.00 | $175.7K | 398 | 113 |

| BA | CALL | TRADE | BULLISH | 03/21/25 | $10.05 | $9.85 | $10.0 | $160.00 | $99.0K | 2.0K | 201 |

| BA | CALL | TRADE | BULLISH | 03/21/25 | $40.95 | $40.8 | $40.95 | $115.00 | $81.9K | 28 | 20 |

| BA | CALL | TRADE | BEARISH | 03/21/25 | $31.4 | $31.3 | $31.3 | $125.00 | $78.2K | 218 | 59 |

About Boeing

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and Global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft, satellites, and weaponry. Global services provides aftermarket support to airlines.

Having examined the options trading patterns of Boeing, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Boeing

- With a volume of 5,859,759, the price of BA is down -0.93% at $151.67.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 64 days.

What Analysts Are Saying About Boeing

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $161.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Wells Fargo continues to hold a Underweight rating for Boeing, targeting a price of $85. * An analyst from JP Morgan persists with their Overweight rating on Boeing, maintaining a target price of $190. * Reflecting concerns, an analyst from Bernstein lowers its rating to Market Perform with a new price target of $169. * In a cautious move, an analyst from RBC Capital downgraded its rating to Outperform, setting a price target of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Boeing, Benzinga Pro gives you real-time options trades alerts.