Whales with a lot of money to spend have taken a noticeably bullish stance on Block.

Looking at options history for Block (NYSE:SQ) we detected 37 trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 32% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $173,000 and 34, calls, for a total amount of $1,658,006.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $85.0 to $140.0 for Block over the recent three months.

Volume & Open Interest Development

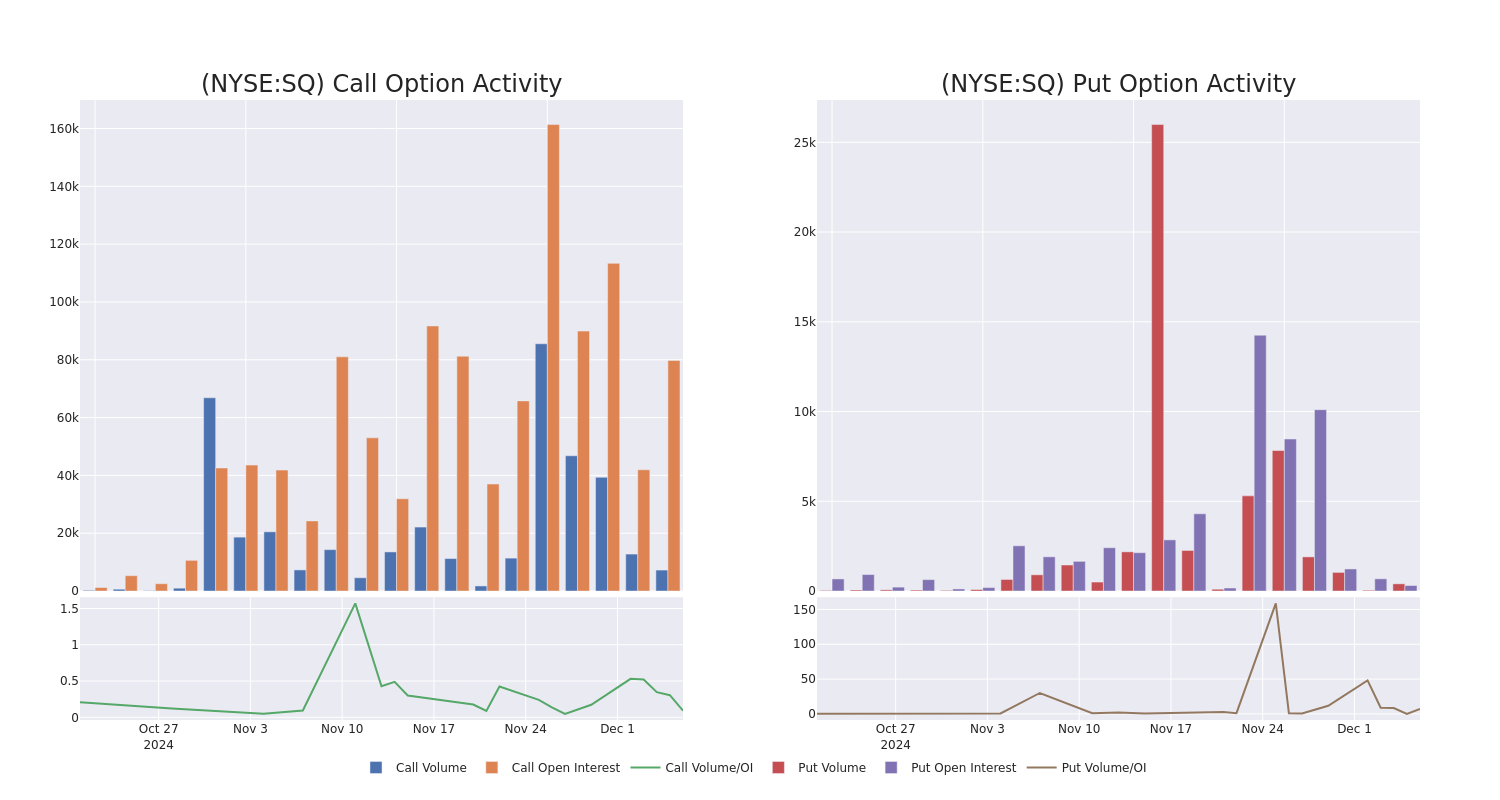

In terms of liquidity and interest, the mean open interest for Block options trades today is 2859.39 with a total volume of 7,468.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Block's big money trades within a strike price range of $85.0 to $140.0 over the last 30 days.

Block Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | SWEEP | BULLISH | 09/19/25 | $20.2 | $20.05 | $20.2 | $92.50 | $135.3K | 80 | 70 |

| SQ | CALL | SWEEP | BULLISH | 03/21/25 | $12.0 | $11.95 | $12.0 | $95.00 | $109.2K | 3.0K | 215 |

| SQ | PUT | SWEEP | BULLISH | 12/13/24 | $8.05 | $8.0 | $8.0 | $105.00 | $96.0K | 20 | 121 |

| SQ | CALL | SWEEP | BULLISH | 01/16/26 | $25.5 | $25.1 | $25.25 | $90.00 | $88.3K | 1.5K | 137 |

| SQ | CALL | SWEEP | BULLISH | 01/16/26 | $25.25 | $24.2 | $25.0 | $90.00 | $87.5K | 1.5K | 102 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

After a thorough review of the options trading surrounding Block, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Block Standing Right Now?

- With a volume of 4,505,925, the price of SQ is up 2.94% at $98.69.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 76 days.

Expert Opinions on Block

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $102.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * In a cautious move, an analyst from Piper Sandler downgraded its rating to Overweight, setting a price target of $83. * An analyst from BMO Capital downgraded its action to Market Perform with a price target of $100. * An analyst from Bernstein persists with their Outperform rating on Block, maintaining a target price of $120. * An analyst from Canaccord Genuity has decided to maintain their Buy rating on Block, which currently sits at a price target of $120. * Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Block with a target price of $90.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.