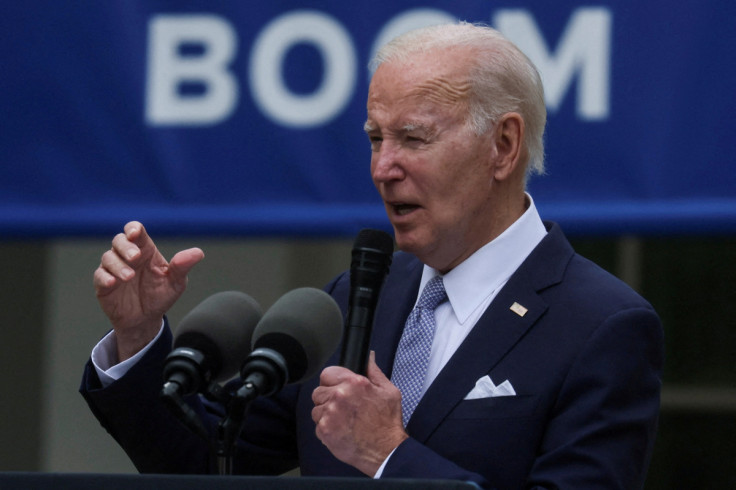

Amidst persistent concerns about inflation, small business owners are exhibiting a more positive outlook, fueled by increasing optimism surrounding the economy. The CNBC|SurveyMonkey Small Business Confidence Index has surged to its highest level since President Joe Biden assumed office, marking a significant uptick in sentiment among entrepreneurs.

According to the latest quarterly data released Thursday morning, 28% of small business owners view the current state of the economy as "excellent" or "good," representing a remarkable increase of five percentage points from the previous quarter and a substantial jump from 18% year over year. This surge in confidence solidifies the most optimistic outlook recorded by respondents since CNBC and SurveyMonkey began tracking this metric in Q2 of 2022.

The Small Business Confidence Index, with a reading of 47 out of 100, has reached its highest point since the inauguration of President Joe Biden in the first quarter of 2021. This surge signifies a growing sense of positivity among small business owners despite prevailing challenges.

The optimism observed in the Q1 survey, conducted online from Jan. 22 to Feb. 1, 2024, among a national sample of 3,119 self-identified small business owners, contrasts with lingering concerns about inflation. Despite significant progress in alleviating inflationary pressures, nearly a third of small business owners still identify inflation as the biggest risk to their businesses. This concern outweighs other key issues such as consumer demand, interest rates, labor shortages, and supply chain disruptions.

However, inflation remains a major concern but notes a cautious optimism among small business owners regarding inflation and overall costs. Confidence in the Federal Reserve's ability to control inflation has risen to 35%, the highest level since the beginning of 2022. Additionally, 29% of business owners believe that inflation has peaked, marking the highest level since the same period.

"We're kind of seeing a potential turn around the corner in terms of small business optimism," stated Sam Gutierrez, senior research scientist at SurveyMonkey. Inflationary pressures are also shaping small business owners' perspectives on the upcoming 2024 election. Sixty percent of respondents cite inflation and interest rates as their top concerns when deciding who to vote for in November.

John Morman, owner of Celtic Tides, a small business based in Lexington, Virginia, shares his firsthand experience grappling with inflationary challenges. Morman imports and sells items from Wales, Ireland, and Scotland, including kilts and jewelry. He mentions the multifaceted impact of rising costs on his business, from increased international freight expenses to higher procurement costs from suppliers abroad.

Despite facing cost increases of up to 15%, Morman has been reluctant to pass on these expenses to consumers, underscoring a common dilemma among small business owners striving to balance profitability with affordability for customers.

Morman's primary concern currently revolves around consumer spending, which he perceives as lackluster compared to previous years. Despite his cautious optimism for the year ahead, Morman remains vigilant about rising costs and their potential impact on business operations.

As entrepreneurs navigate these challenges, their resilience and adaptability remain crucial in sustaining economic growth and prosperity in the small business sector.