Millions of Sky customers faces rises of £43 extra a year from April, as the telecoms giant raises broadband and TV bills.

The firm today said that the average customer will pay an additional £3.60 a month from April, reports The Mirror.

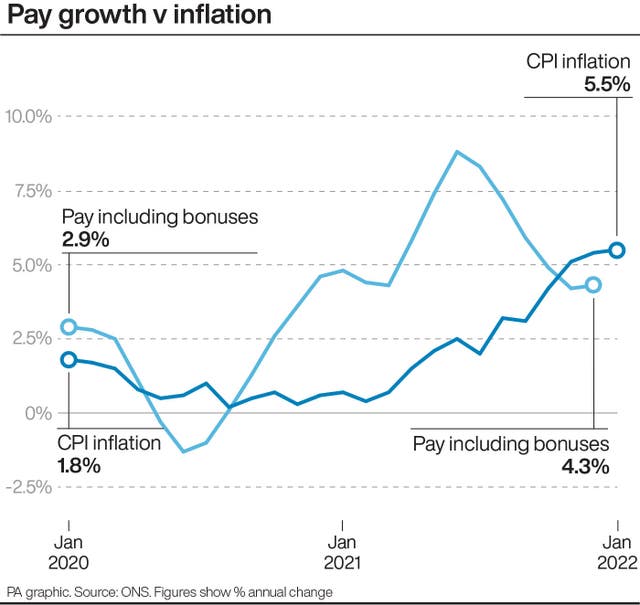

It comes as official figures today show the cost of living rose to another 30-year-high of 5.5% last month as prices continue to surge across the board for households.

UK inflation hit a fresh 30-year high after rising further in January as Britain remains in the grip of a tightening cost-of-living squeeze.

Official figures revealed that Consumer Prices Index (CPI) inflation reached 5.5% in January, up from 5.4% in December and again reaching the highest level since March 1992, when it stood at 7.1%.

The Office for National Statistics (ONS) said the cost of clothes and footwear pushed inflation higher last month, with the smallest January discounts in shops since 1990.

But inflation is soaring across the economy, with sky-high energy costs expected to drive CPI to 7.25% in April – the highest level since August 1991.

(PA Graphics)

The Bank of England increased interest rates earlier this month to 0.5% in the first back-to-back rise since 2004, and experts believe the base rate could hit 1% in May as policymakers battle to rein in rampant inflation.

Trade union Unison said January’s inflation data is the “stuff of nightmares”.

General secretary Christina McAnea said: “Households already feeling the pinch will be aghast at this latest hike in living costs.

“For many low and middle-earners, food, energy and transport are quickly becoming unaffordable luxuries.”

Britons are facing a triple whammy threat this spring, with Ofgem increasing its annual energy price cap by nearly £700 in April on top of widespread inflation due to recent supply chain pressures and the Government’s forthcoming National Insurance increase.

The Bank has warned that household income, after taking account of inflation, will plunge by 2% in 2022 – the sharpest drop since records began in the late 1940s.

(PA Graphics)

Chancellor Rishi Sunak has so far resisted growing calls for his tax rise to be postponed, instead offering support including a state-funded £200 discount on energy bills in October, which households will eventually have to repay.

Mr Sunak said: “We understand the pressures people are facing with the cost of living.

“These are global challenges but we have listened to people’s concerns and recently stepped in to provide millions of households with up to £350 to help with rising energy bills.”

Wages are already failing to keep up with inflation, rising by 4.3% in the most recent quarter, and interest rate increases will heap further pressure on households and firms.

Economist James Smith, at ING, said the inflation data in January, which was yet again higher than forecast by Bank experts, “will further cement expectations for additional rate rises at both the March and May Bank of England meetings”.

Rising energy prices and fuel costs have been the biggest factors in driving inflation to more than double the Bank’s 2% target, though food and drink prices and many everyday essentials have also been increasing.

(PA Graphics)

The ONS figures showed that clothing and footwear prices fell by 2.9% month on month in January, but the traditional discounts were far lower than a year earlier, when prices fell 4.9%.

Fuel prices remained eye-watering, with average petrol prices standing at 145.1p a litre last month, but eased back slightly from the records seen in November and December.

The data also showed that the Retail Prices Index (RPI) measure of inflation remained at its highest level since March 1991 – hitting 7.8% last month, up from 7.5% in December.

CPIH, which includes owner-occupiers’ housing costs and is the ONS’s preferred measure of inflation, was 4.9% in January compared with 4.8% in December.