The silver-gold ratio dates to the first Egyptian pharaoh, Menes, who stated that two and one-half parts silver equals one part gold. Long before fiat currencies, gold and silver were money, a means of exchange, and hard currency.

Since gold and silver futures began trading on the CME’s COMEX division in the 1970s, the price of continuous contract gold futures divided by continuous contract silver futures was as low as 15.5:1 in 1979 and as high as 111.4:1 in 2020. The long-term average is 63.5:1.

The number of ounces of silver value in each ounce of gold value, or the silver-gold ratio, is a metric that can provide clues about the path of least resistance of prices. A falling ratio tends to be a bullish sign, while a rising ratio can portend lower prices. Since late August 2022, the ratio has been trending lower. The iShares Silver Trust product (SLV) tracks nearby silver prices.

Silver prices have corrected lower since April 2023

Nearby July COMEX silver futures reached a 2023 high at $26.435 per ounce on April 14, 2023.

The chart highlights the decline from this year’s peak that took the precious metal to a $22.785 low on May 26. Silver futures were near the $23.90 level on June 2.

The ratio has been falling

Calculating the silver-gold ratio requires dividing the price of nearby COMEX gold futures by nearby COMEX silver futures.

The ratio chart ({GCQ23}/{SIN23}) shows a pattern of lower highs since early September 2022. A declining ratio signals that silver is outperforming gold on a percentage basis. Since silver is the precious metal that attracts the most speculative trading activity, outperformance tends to be a bullish signal for the leading precious metals.

Technical support is just below $20

Silver futures have made lower highs since February 2022, but the pattern shifted to higher lows since September 2022.

The ten-year chart illustrates that keeping the bullish pattern of higher lows intact requires silver futures to remain above the March 2023 $19.83 bottom, which stands as critical technical support.

Three reasons for silver to rally

The most compelling factors supporting silver in June 2023 are:

- De-dollarization: The U.S. dollar has been the world’s reserve currency since the end of WW II. The bifurcation of the world’s nuclear powers since February 2022 threatens the U.S. currency’s position in the worldwide financial system. China is leading an effort to develop a BRICS currency that could challenge the dollar’s dominance. Since silver, gold, and most other currencies use the U.S. dollar as the pricing benchmark, de-dollarization causing a weakening dollar supports higher commodity prices, and silver is no exception.

- Interest rates: Rising U.S. interest rates since March 2022 have increased the cost of holding and financing long commodity positions. The short-term Fed Funds Rate rose from 0.125% in March 2022 to 5.125% in May 2023 as the central bank battles inflation with monetary policy tightening. Moreover, quantitative tightening has pushed rates higher for further maturities, putting additional upside pressure on rates. A rising interest rate environment has weighed on commodity prices. Meanwhile, the trajectory of rate hikes is slowing. As investors and trades become accustomed to the current climate, with inflation remaining at the highest level in decades, the appetite for silver could increase over the coming months.

- Two technical factors: The pattern of higher lows since September 2022 and the lower highs in the silver-gold ratio are technical buy signals for silver.

Bull markets rarely move in straight lines, and silver can be highly volatile. As of June 2, historical volatility on the one-year silver futures chart stood at the 20.50% level. The one-year metric on the gold futures chart was 11.63%, meaning silver price variance was nearly double gold’s historical volatility. If precious metals continue to post gains, and history is a guide, silver will outperform gold on a percentage basis on the upside.

SLV is an alternative to physical silver or silver futures

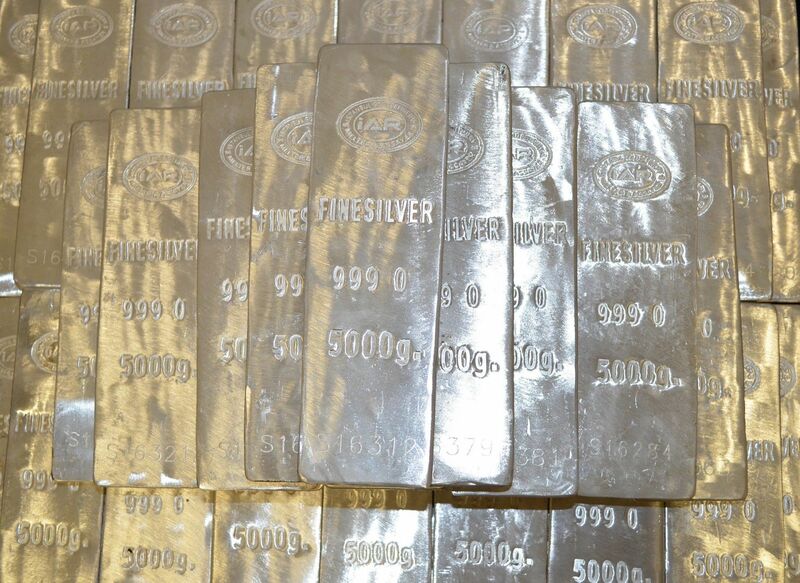

The most direct route for a trading or investment position in silver is the physical market for bars and coins. Silver is a bulky metal, and holding physical silver involves storage and insurance charges. COMEX silver futures are also a direct route as they have a physical delivery mechanism, but futures involve leverage and margin.

The iShares Silver Trust (SLV) is an ETF product that purports to hold silver bars. At the $21.77 per share level on June 2, the highly liquid SLV product had $10.99 billion in assets under management. SLV trades an average of more than 16 million shares daily and charges a 0.50% management fee. The most recent rally in the silver futures market took the July COMEX futures from $20.125 on March 10 to $26.435 on April 14, a 31.35% rise.

Over the same period, the SLV ETF increased from $18.38 to $23.89 per share or 30%. The ETF only trades when the U.S. stock market operates, while silver futures trade around the clock. The ETF can miss highs or lows when the stock market is closed for business.

Silver stalled after reaching a 2023 high in April, but the price action over the past weeks could lead to even higher highs later this year.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.