AT A GLANCE

- Viewed as both an industrial and precious metal, silver can offer versatile risk protection for market participants

- Like gold, silver offers a historically low correlation to assets like stocks and bonds

When investors search the commodity space with an eye toward metals, they are often torn between investing in precious metals (gold, platinum) or industrial metals (copper, aluminum).

A bridge over this gap between precious and industrial metals is silver. When market participants analyze silver, they are looking at a precious metal and industrial metal at the same time. It's almost as if one is blending gold futures and copper futures into one contract.

Silver is a valuable precious metal that has been used as a form of currency and store of value for thousands of years. It is less expensive than gold, depending on the circumstances, which may make it more appealing. The lower price makes it more accessible for investors with smaller budgets who may be frightened by gold's four-digit price.

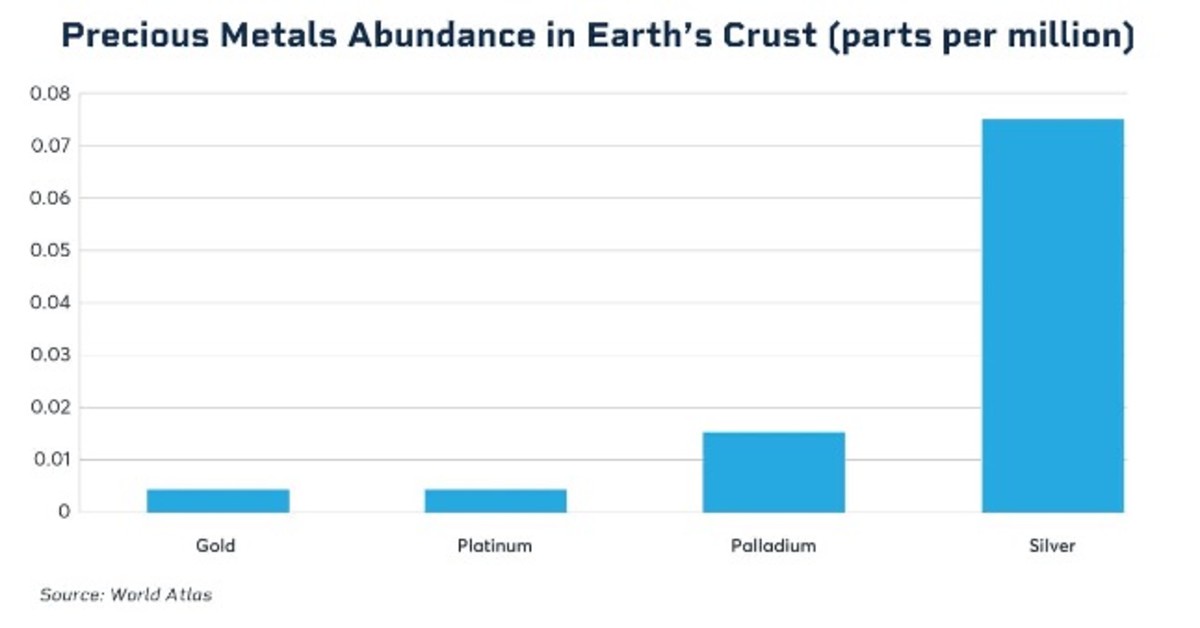

In addition, silver is more abundant in the earth's crust than gold, which can make it more readily available and potentially less susceptible to supply shocks and the volatility that accompanies those shocks.

Then there is the perception of precious metals as inflation hedges, which can support silver prices during economic uncertainty. While gold is most commonly cited as a safe haven metal, silver can be a viable investment option as well when determining the trajectory of inflation and Fed rate hikes, for example.

CME Group

Silver also has a variety of industrial uses. It is a highly conductive metal, making it an important component in many electronic and electrical products. It is used heavily in medicine, renewable energy (as in the production of solar panels), mirrors and water filtration systems. The demand for silver from these industries can help to support its value from an industrial perspective. Are we headed into a period with the possible acceleration of sustainable energy products and a home-building boom? If so, investors may consider how much silver will participate in this scenario.

Correlation to Equities, Treasuries and Currencies

Like gold, silver retains a relatively low correlation to assets like stocks and bonds. In the 180 trading days ending June 28, the July silver futures contract had a positive 58 correlation to the Dow futures, a positive 51 correlation to S&P 500 futures, a positive 39 correlation to Nasdaq 100 futures, and a positive 71 correlation to the 10-year note futures.

Silver does, however, have a historically strong inverse correlation to the U.S. dollar. Dollar volatility often equals silver volatility, but this would be true for gold, copper, and most other metals. Over the same 180 trading day period, silver futures have shown a negative 86 correlation to the dollar. If the Fed decides additional interest rate hikes are necessary, silver could be affected with more rate increases and a stronger dollar.

Silver is often overlooked when considering the best general metal to express a view on the direction of the economy or other asset classes. But like many well-constructed hedges, this versatile metal could also add versatile risk protection and mitigation for traders when appropriately used.

Rather than just abandon the metals space when the question becomes “precious or industrial?” Silver might be the perfect investment vehicle to answer that question.