After a disastrous market in 2022, many strategists claimed that the 60/40 portfolio, which holds 60% of assets in stocks and 40% in bonds, was dead. In its place, some strategists suggested investors consider the 25/25/25/25 portfolio, or 25x4 portfolio, which calls for dividing your assets evenly into stocks, bonds, commodities and cash.

"We believe the 25/25/25/25 portfolio will outperform the 60/40 portfolio in the 2020s," says Michael Hartnett, a chief investment strategist at BofA Global Research.

The simplest reason is that interest rates and inflation are higher than in decades past. The 60/40 portfolio worked best when inflation and interest rates were low or falling, says Hartnett. But this decade he expects higher inflation and interest rates, with added volatility, creating market conditions that are well suited for cash and commodities to outperform bonds and stocks.

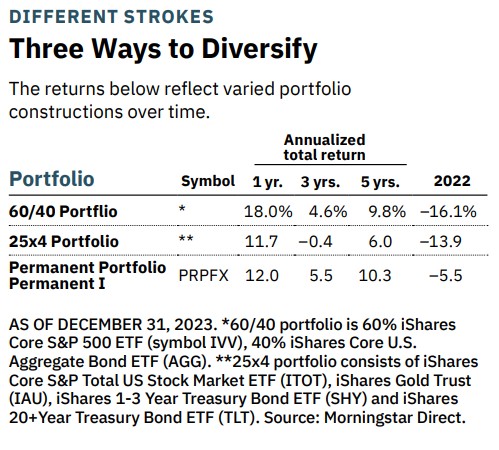

So far, though, that hasn't played out. Although the 25x4 portfolio did marginally better than a 60/40 portfolio in 2022, over longer periods, it has lagged. A 60/40 portfolio has gained 4.6% annualized over the past three years; a 25x4 portfolio has lost 0.4% on average per year.

Think twice before switching to the 25x4 portfolio

In short, don't count the 60/40 portfolio out yet. "Over the years, the 60/40 portfolio has held up for investors, and it's actually provided wonderful returns with low risk levels," says Jan Holman, director of adviser education at Thornburg Investment Management.

This isn't the first go-around for the 25x4 portfolio. It got its start decades ago by way of Harry Browne, the late investment adviser and two-time Libertarian Party presidential candidate (in 1996 and 2000). In Browne's so-called Permanent Portfolio strategy, investors held 25% in cash, 25% in gold, 25% in long-term bonds and 25% in stocks, rebalancing annually. The idea was that the four asset classes would help minimize risk no matter the market or economic condition.

Browne helped develop a no-load mutual fund tied to the 25x4 strategy called the Permanent Portfolio Permanent (PRPFX), which launched in 1982. But it's not a straight-up version of his approach. Instead, the fund is more "dynamic," says fund manager Michael Cuggino.

It targets an allocation of 30% stocks, 25% precious metals (20% in gold and 5% in silver) and 45% in bonds and cash (10% of which is denominated in Swiss Francs). The stock side of the portfolio includes a mix of real estate and natural-resources stocks, such as Prologis (PLD) and Exxon Mobil (XOM), as well as aggressive growth stocks, such as Nvidia (NVDA) and Meta Platforms (META). "The fund's goal is to outpace inflation," says Cuggino, a fund manager since 2003.

The fund's annualized 5.7% return over the past decade has indeed beaten the 2% average inflation rate over the period. And it has been far less volatile over that time than its peers (moderate allocation funds), which typically hold about 60% of assets in stocks. But 63% of its peers did better, generating an average 6.1% annualized 10-year return.

That's evidence that it's important to think through any allocation strategy carefully before you implement it. "Asset allocation should always be decided on an individual basis and in the context of a comprehensive financial plan, not based on a gimmick," says Gordon Achtermann, a certified financial planner in Fairfax, Virginia. As an alternative, consider a low-cost target-date fund. "You won't beat the market," he says, "but you won't get badly hurt, either."

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.