As bonds have struggled, producing losses in client accounts over the past couple of years, we have had more clients ask the question: Should bonds still have a role in the portfolio?

Traditionally, the answer has been that bonds provide diversification and income. They zig when stocks zag, providing income for spending needs. In finance terms, bonds have “low correlation” levels to stocks, and adding them to a portfolio would help to reduce the overall portfolio risk. However, over the last two years, as the Fed has worked to aggressively raise rates, this correlation has increased. What we saw in 2022 was the bonds fell right along with (and nearly as much as) stocks.

Compound that with the current state of interest rates. One of the most basic investing truisms is you should pursue investments offering a higher interest rate over investments with lower interest rates for the same level of risk. It just makes sense — of course you would want to earn more interest. Another concept involves how soon you get your investment back (liquidity). All else equal, you would want to make shorter-term loans where you would get your principal back sooner rather than later. The only way that you would be willing to lend your money for longer is if you received more interest to do so.

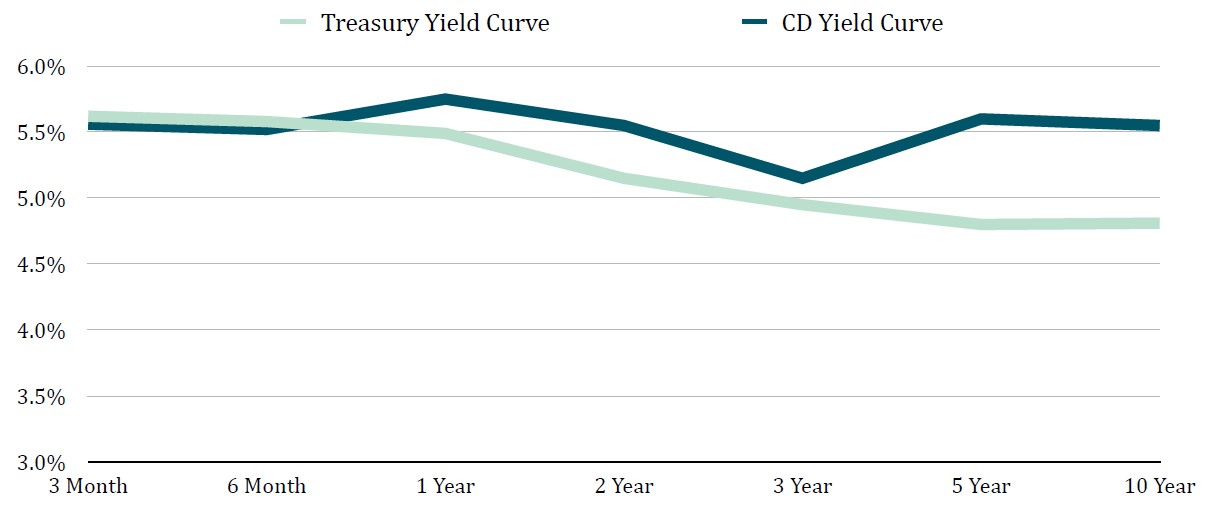

However, in today’s interest rate environment, investors are earning more on short-term bonds than long-term bonds, as you can see in the chart below. And investors are earning even more on federally insured certificates of deposit (CDs). As the chart below shows, one-year CDs currently pay 5.8% compared to only 4.8% for a 10-year Treasury bond.

Given all this, it seems like a no-brainer to invest in the short-term options and receive the higher interest rates and better liquidity that come with them. If bonds aren’t fully dead, why not at least eliminate the default risk of lending to companies and invest only in short-term CDs and Treasury securities? At first glance, this strategy seems brilliant and, frankly, “too good to be true.” And, of course, that is the case. This is where having a long-term investment approach comes in.

What happens a year from now?

To illustrate the point, let’s think about the longer term. What happens 12 months from now when the one-year CD matures? At that point, investors must look to reinvest the proceeds they receive. Most market pundits expect that the previously mentioned aggressive increase in interest rates by the Fed will at minimum slow the economy dramatically, if not push the U.S. economy into a recession.

If that happens, overall interest rates will fall as the Fed looks to reduce interest rates to stimulate economic growth. That makes it highly likely that investors won’t earn the current 5.8% rate if they reinvest their CDs next year.

For those who invested in a two-year CD and accepted the lower 5.1% rate, they don’t have this concern, known as reinvestment risk, for an extra year. The longer term of the current investment, the further investors can push out the concern over reinvestment risk.

When long-term bond prices will rise

Additionally, just as longer-term bonds fell when interest rates went up, the prices of long-term bonds will rise when interest rates go down. That is because investors looking to reinvest the proceeds from their maturing CDs are willing to pay extra for long-term higher rates, which are no longer available in the marketplace.

The result is that bonds in general, and long-term bonds in particular, tend to do very well after the Fed stops raising rates (the Fed left rates unchanged at its latest meeting, in December). A study by Capital Group that looked at how bonds performed after past Fed rate-hiking cycles provides room for optimism — that maintaining a bond position in your portfolio may once again provide positive returns, income and diversification benefits.

According to that study, bonds have provided returns of over 10% in the 12 months following the end of the rate-hiking cycle and have compounded at 7.1% over the next five years, well above the long-term average of 4.8%.

Bonds still play a critical role in portfolios

We still believe that bonds play a critical role in client portfolios and that beginning to shift to longer-term bonds could benefit investors over the long-term, given today’s higher interest rates. It is easy to take a short one- to two-year timeframe and wonder if the world has changed, but successful investing requires a long-term focus of seven to 10 years, incorporating full market cycles.

When you’re working with a financial adviser, they will be there to help you keep that focus and to best position your portfolio to generate the long-term returns necessary to achieve your financial plan. Bonds continue to play an important role in that goal.