/Visa%20Inc%20gold%20card-by%20hatchpong%20via%20iStock.jpg)

Policy risk rattled the financial sector over the weekend after President Donald Trump announced late Friday, Jan. 9, a proposal to cap U.S. credit card interest rates at 10%. Markets reacted swiftly, sending large bank stocks down 1% to 3% on Monday as investors reassessed profitability across consumer lending.

Trump suggested the one-year cap would take effect on Jan. 20, though enforcement mechanics remain unclear. Banks and analysts warn that such limits could render sizable portions of the credit card business unviable, especially higher-risk accounts that rely on elevated interest rates to offset defaults.

The pressure is clear in the numbers. The national average credit card rate sits at 19.7%, according to Bankrate, with subprime and store-branded cards priced significantly higher. A hard cap would sharply compress margins, likely forcing issuers to restrict credit access, trim rewards, or restructure card offerings.

Against this backdrop, Visa (V), which derives its strength from transaction volumes rather than lending spreads, fell 1.9% on Jan. 12. The pullback invites investors to look past headline-driven volatility and consider whether Visa’s transaction-focused fundamentals remain as resilient as ever.

About Visa Stock

Headquartered in San Francisco, California, Visa is a global payments technology leader, facilitating commerce across more than 200 countries and territories. With a market cap of nearly $625.2 billion, Visa supports credit, debit, prepaid, and cash-access programs through nearly 14,500 financial institutions worldwide.

Visa’s shares have advanced roughly 6.83% over the past 52 weeks. However, recent macro uncertainty has weighed on performance, driving a 8.3% pullback over the past five trading sessions, underscoring market leaders remain sensitive to policy-driven volatility.

From a valuation standpoint, Visa is currently trading at 27.31 times forward adjusted earnings and 14.76 times sales. Both metrics sit above industry averages, yet remain below the company’s own five-year historical multiples, suggesting a discount.

Additionally, Visa has built a consistent income profile. The company has increased its dividend for 17 consecutive years and pays an annual dividend of $2.68 per share, yielding 0.78%. Its most recent dividend of $0.67 was paid on Dec. 1, 2025, to shareholders of record on Nov. 12, 2025.

A Closer Look at Visa’s Q4 Earnings

On Oct. 28, 2025, Visa delivered a solid fiscal 2025 fourth-quarter performance, reporting revenue growth of 11.5% year-over-year (YOY) to $10.72 billion, comfortably ahead of analyst expectations of $10.61 billion. The growth was powered by sturdy gains in payments volume, cross-border activity, and processed transactions.

A closer look highlights the breadth of momentum. During the quarter, service revenue increased 10% YOY, data processing revenue surged 17%, international transaction revenue climbed 10%, and other revenue jumped 21%. Moreover, client incentives rose 17%. Non-GAAP net income advanced 7% to $5.8 billion, while adjusted EPS increased 10% to $2.98, broadly matching forecasts of $2.97.

Looking forward, Visa has anchored its guidance on resilient consumer spending and sustained expansion across value-added services and product innovation. Management also emphasized growing opportunities in stablecoin-related capabilities.

CFO Christopher Suh stated, “We expect full-year adjusted net revenue growth to be in the low double digits,” citing incremental tailwinds from global events such as the Olympics and the FIFA World Cup. Management acknowledged macroeconomic uncertainty and elevated operating expenses but remained focused on scaling digital solutions and defending Visa’s global leadership.

Furthermore, analysts project continued earnings momentum. For the first quarter of fiscal 2026, EPS is expected to rise 14.2% YOY to $3.14. For full-year fiscal 2026, EPS is forecasted to grow 11.7% to $12.81, followed by an additional 13.2% increase in fiscal 2027 to $14.50.

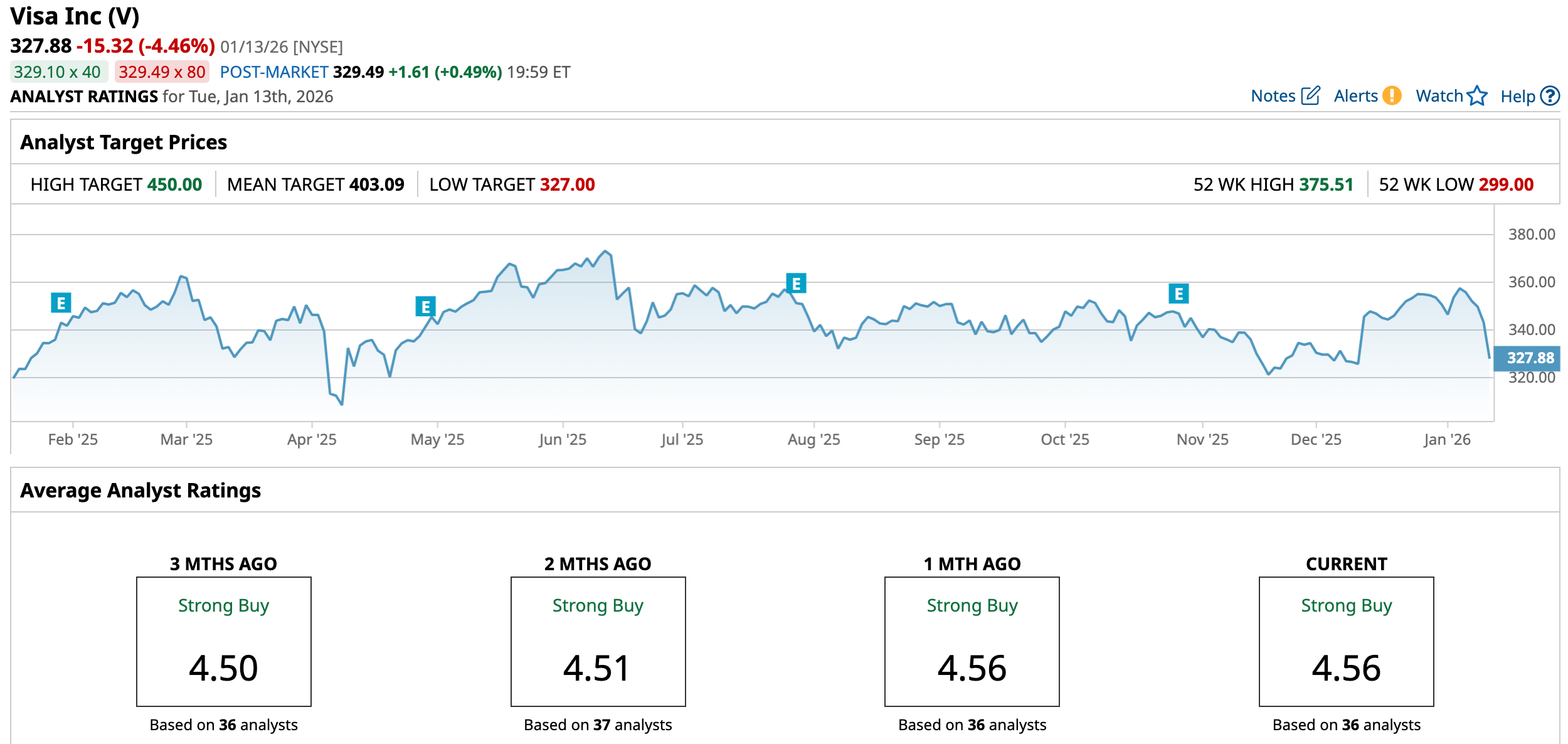

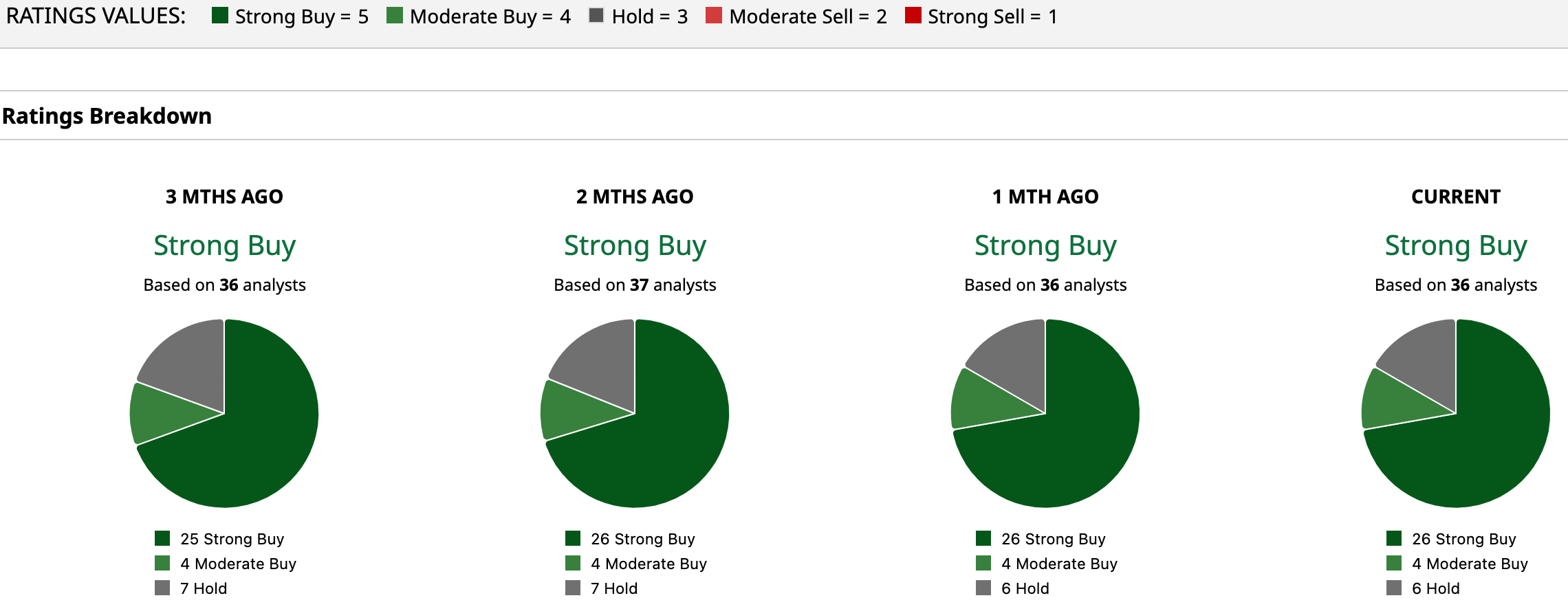

What Do Analysts Expect for Visa Stock?

Owing to sound fundamentals, Wall Street continues to express strong conviction in Visa’s long-term outlook, assigning V stock a “Strong Buy” consensus rating. Among the 36 analysts covering the stock, 26 recommend “Strong Buy,” four suggest “Moderate Buy,” and only six advise “Hold.”

Visa’s mean price target of $403.09 implies potential upside of 22.92% from current levels. Meanwhile, the Street-high target of $450 points to a possible gain of 37.25%, underscoring optimism around Visa’s prospects.