Shares of the streaming platform fuboTV Inc. (FUBO) surged earlier this month as investors celebrated its latest quarterly report. The company clocked better-than-expected results in the first quarter. However, FUBO is yet to achieve profitability and does not anticipate positive cash flow until 2025.

Moreover, intense competition from streaming service giants and declining ad spending could bump its path to profitability.

In this regard, let’s explore the company’s key financial metrics to make an informed decision.

Analyzing FUBO’s Net Income, Revenue, Gross Margin, and Price Target

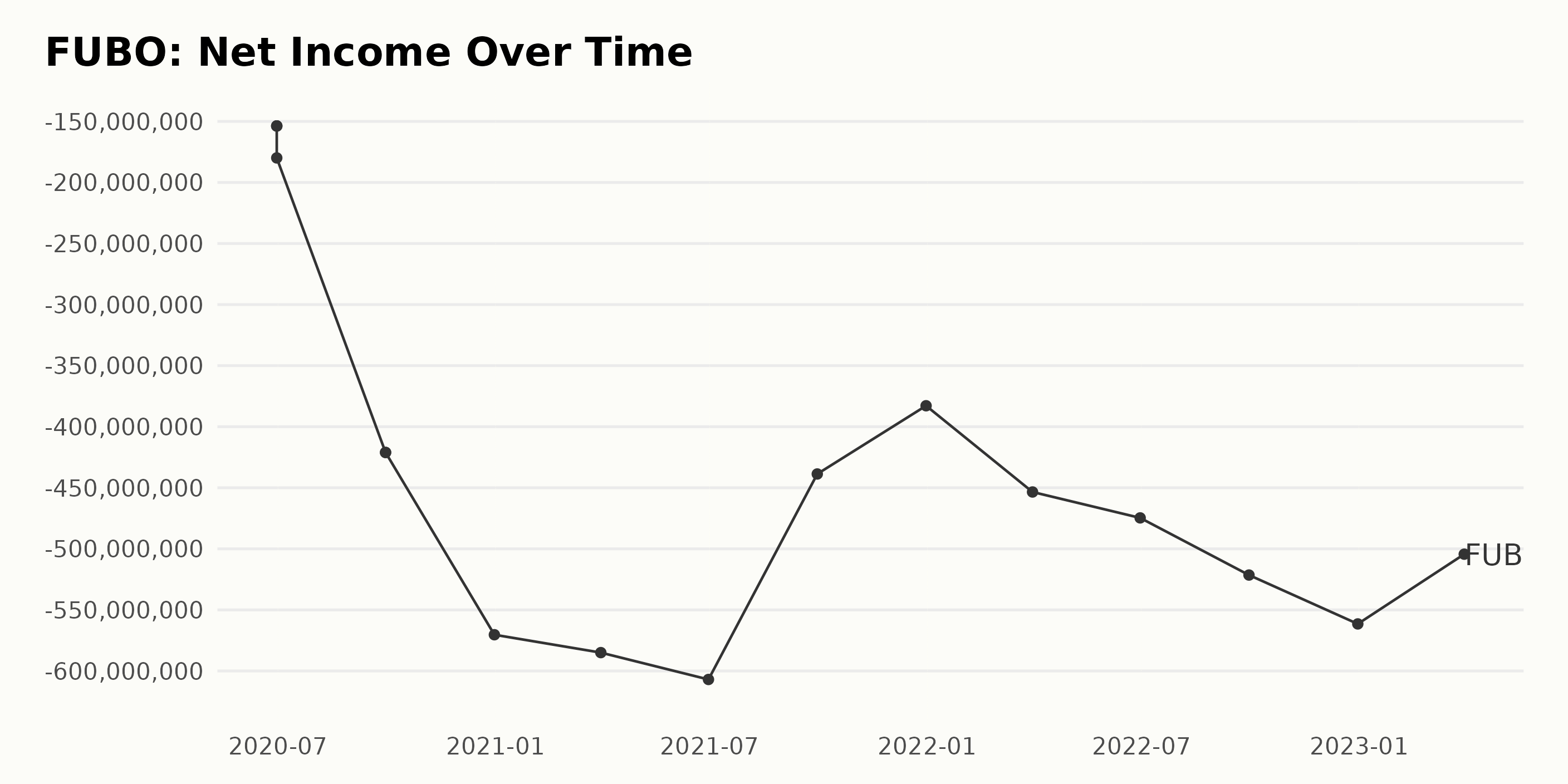

FUBO’s net income has generally decreased since June 2020, with a net income of negative $153.7 million. This was further reduced by the end of June 2021 to a negative $606.9 million. It then experienced more fluctuations before finally reaching a net income of negative $504.4 million by March 2023.

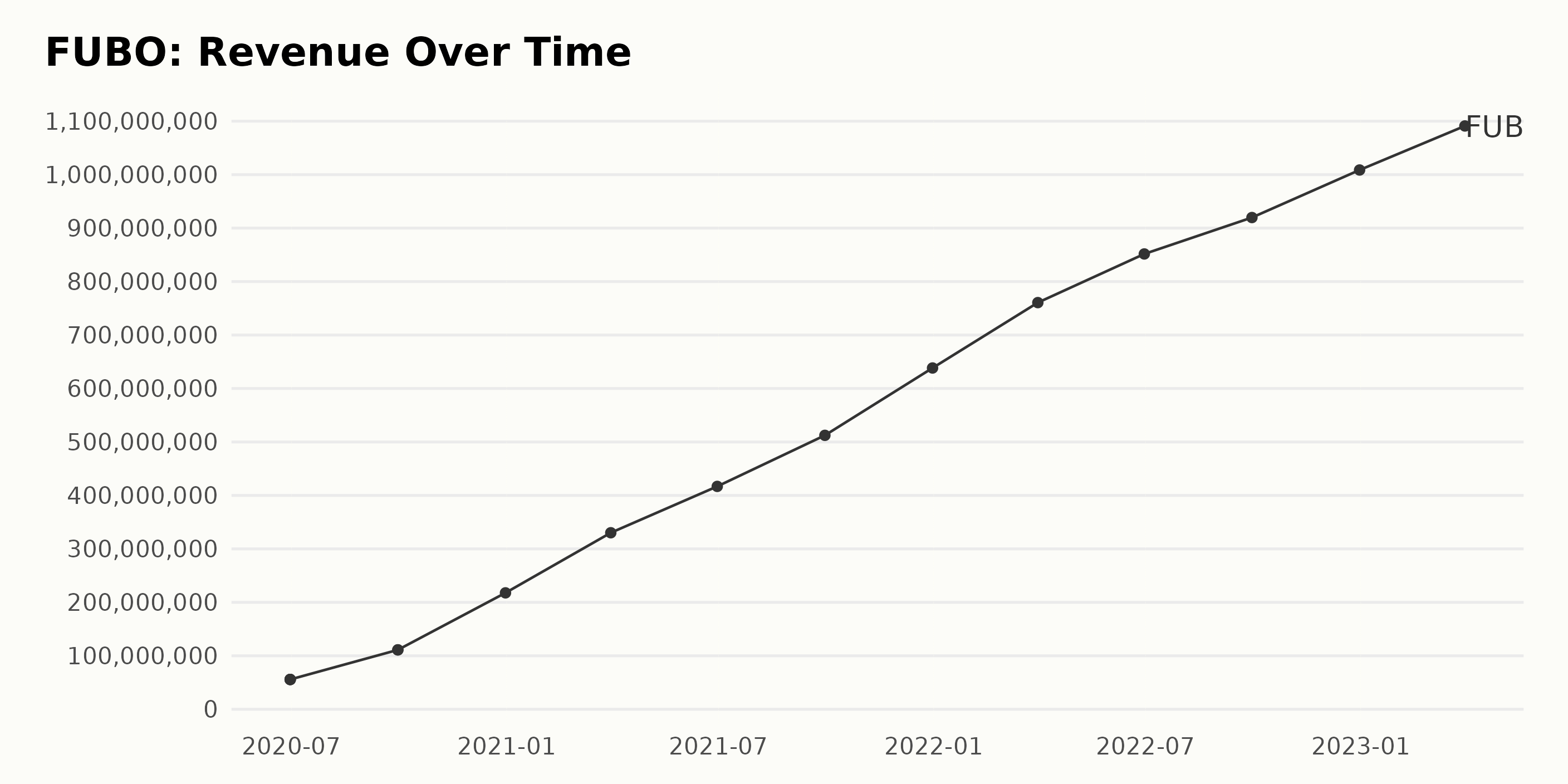

FUBO’s revenue shows a steady growth trend, with a growth rate of 86.48%. Its reported revenue has ranged from $55.74 million on June 30, 2020, to $109.11 million on March 31, 2023.

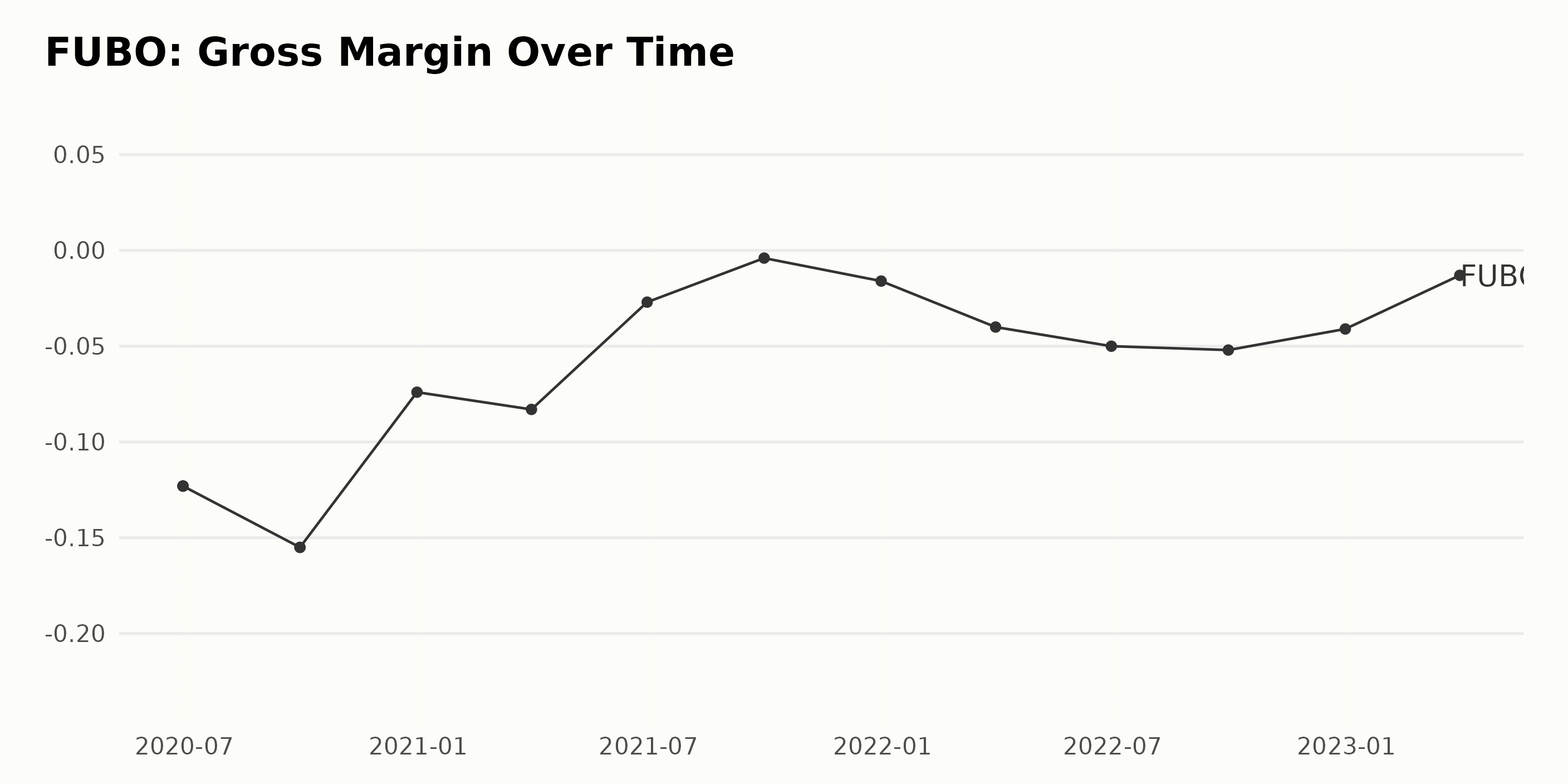

FUBO’s gross margin has fluctuated throughout the last two years, with an overall downward trend. The margin started at negative 12.3% as of June 2020 before dropping to negative 15.5% as of September 2020. After that, it rose to negative 7.4% by December 2020 before falling again to negative 8.3% in March 2021. Since then, there has been a steady recovery to negative 2.7% in June 2021. The most recent data from September 2021 stands at negative 0.4%.

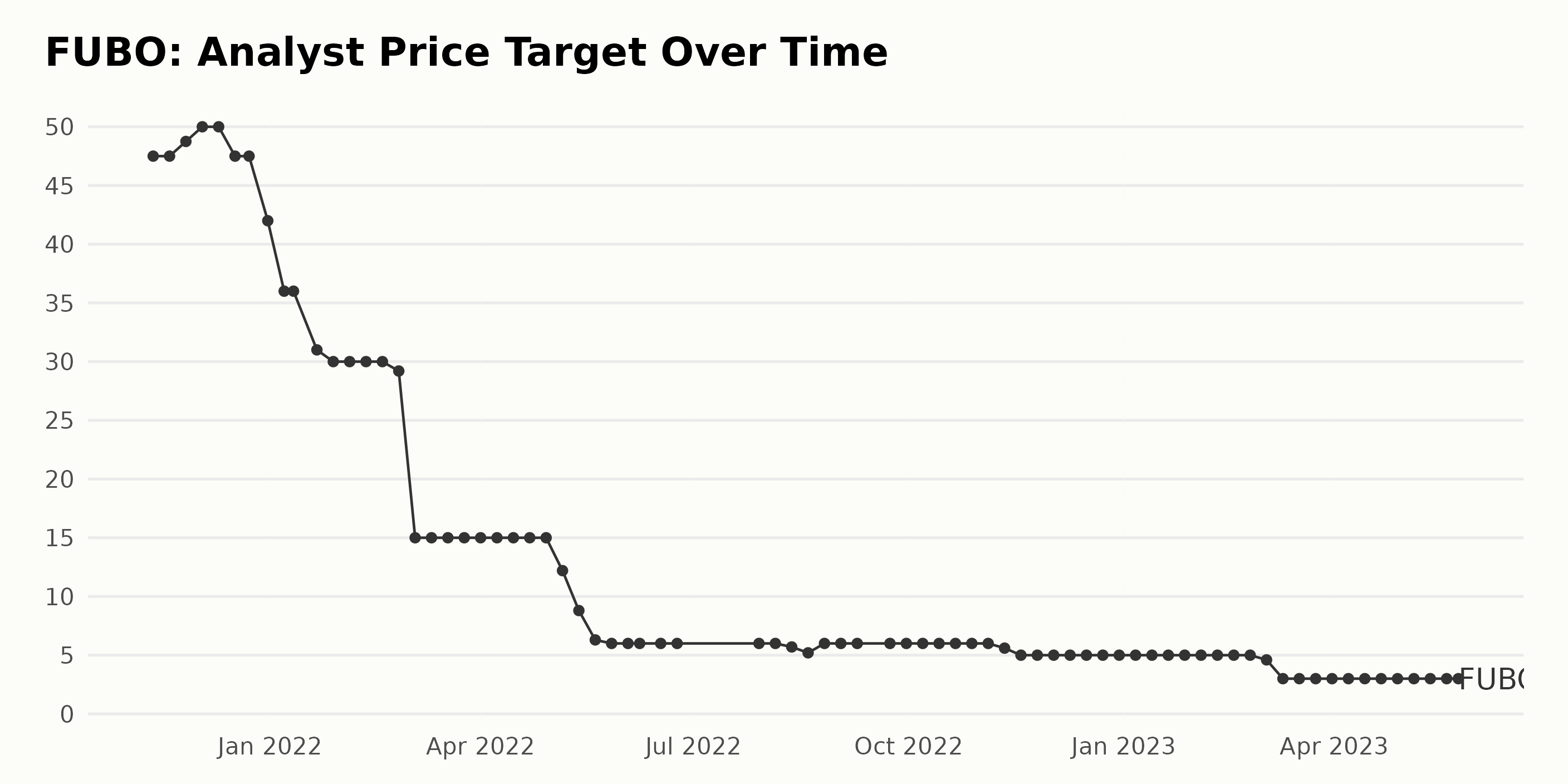

The Analyst Price Target of FUBO has fluctuated over the past several months. At its highest point, the price target was $47.50 on November 19, 2021. In the following weeks, a slight increase was seen to $48.75 on December 3, 2021. After this, there were several instances of an unchanged value of $50.00 over multiple weeks before it decreased to $47.50 on December 17, 2021. This value stayed the same until an abrupt drop to $42 on December 31, 2021. In the following months, the price target steadily declined to $3.00 on May 24, 2023, representing a 94% fall.

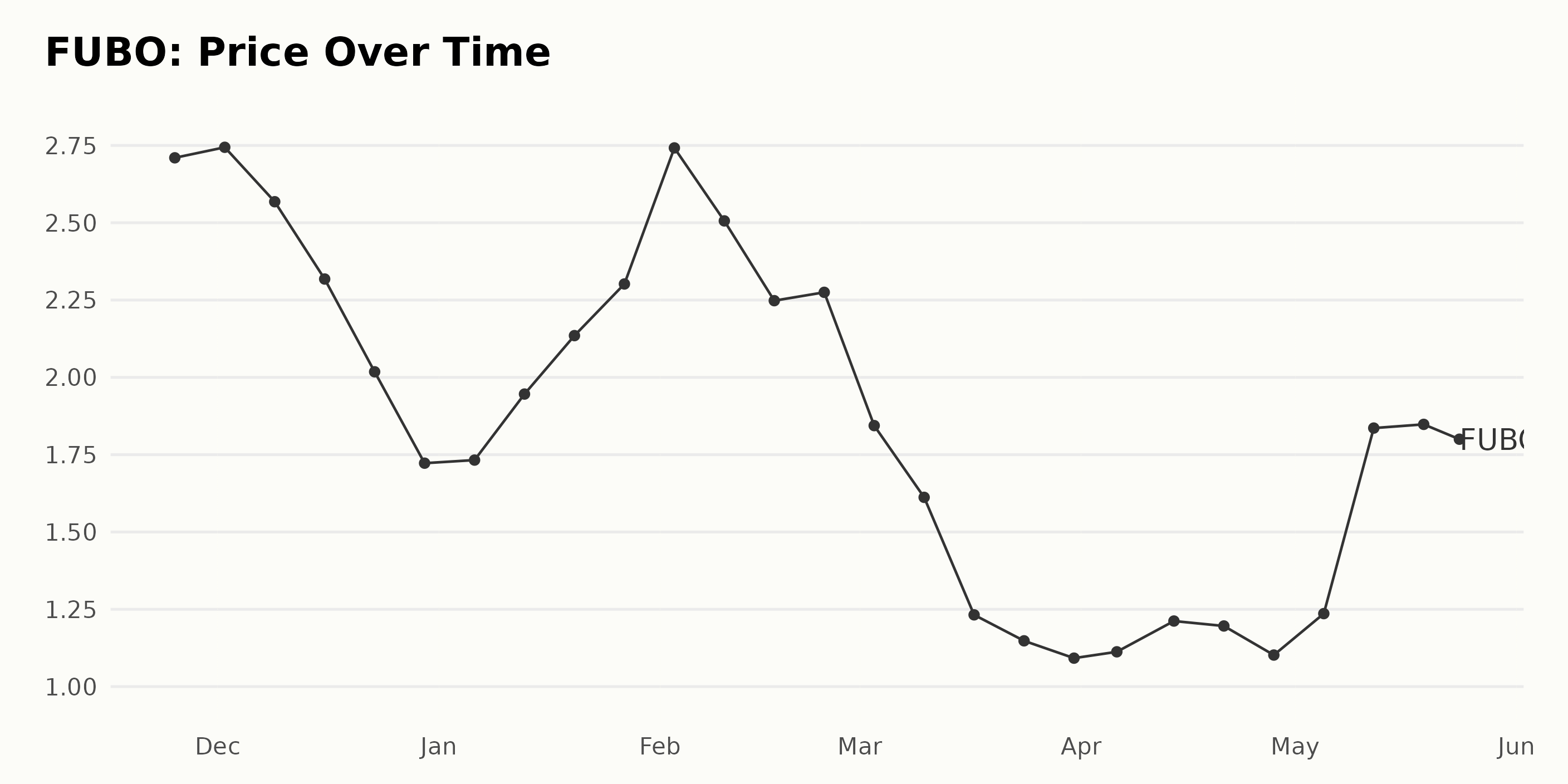

FUBO Share Price Is Declining Since November 2022

The data shows a downtrend in the share price of FUBO since November 25, 2022, starting with a price of $2.71 and ending with a price of $1.73 on May 23, 2023. The growth rate in the share price is decelerating, reaching its lowest point in mid-April 2023. Here is a chart of FUBO’s price over the past 180 days.

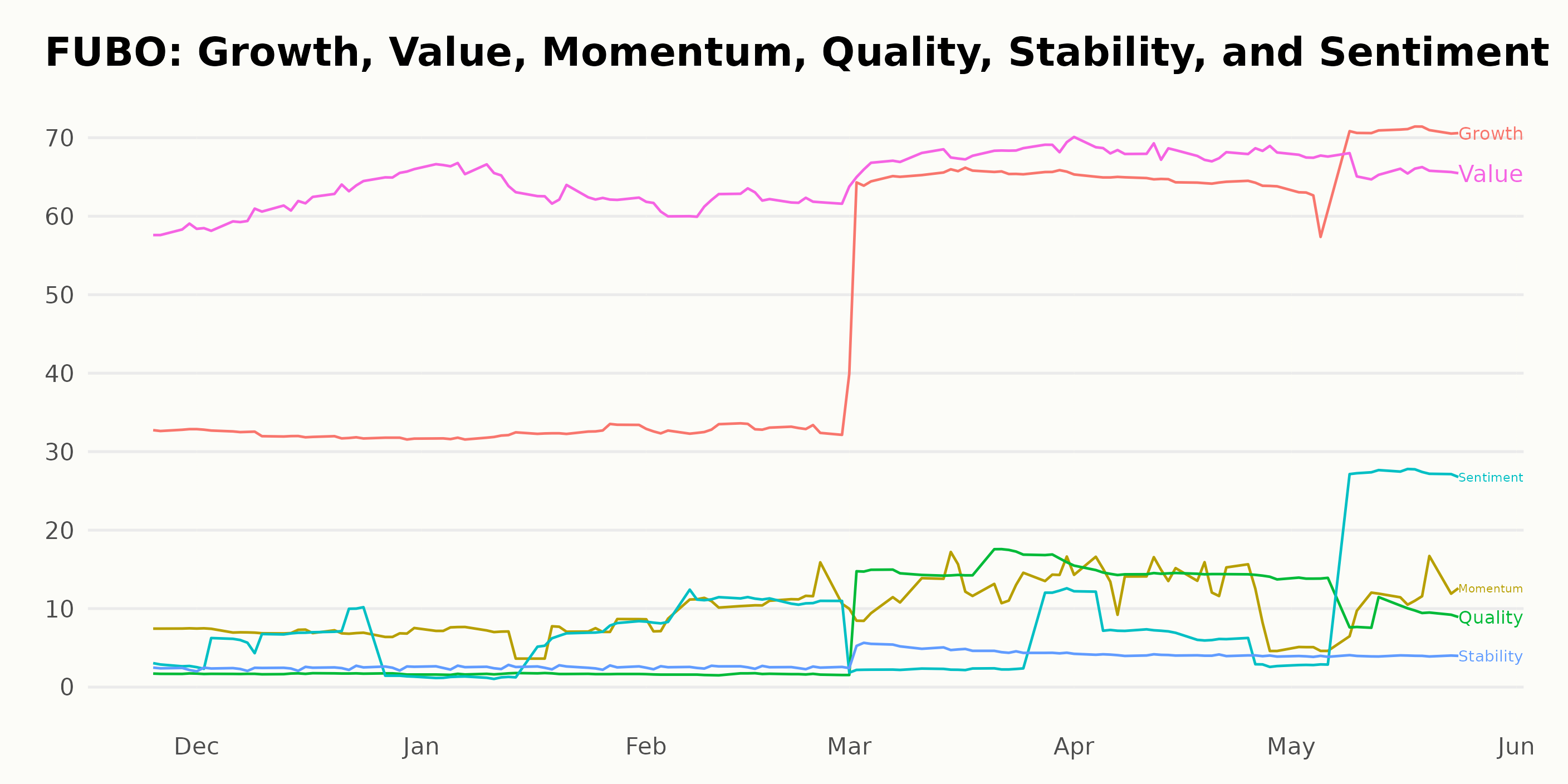

Unfavorable POWR Ratings

FUBO has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #10 out of 13 stocks in the Entertainment - Sports & Theme Parks industry. It has a grade of F in Stability and a D in Momentum and Quality.

Stock to Consider Instead of fuboTV Inc. (FUBO)

Other stocks that may be worth considering are Endeavor Group Holdings, Inc. (EDR), Emerald Expositions Events, Inc. (EEX), and Tencent Music Entertainment Group (TME) -- they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please

FUBO shares were trading at $1.70 per share on Wednesday afternoon, down $0.03 (-1.73%). Year-to-date, FUBO has declined -2.30%, versus a 7.73% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

Should You Be Watching fuboTV Inc. (FUBO)? StockNews.com