Shares of Shopify (SHOP) are not reacting to the company’s planned stock split news the way that bulls were hoping.

While the stock is now up 3% on the day, it was down more than 1.5% shortly after the open. Still, the action is a bit muted.

Investors are hoping that Shopify stock eventually gets the love that we saw in Amazon (AMZN) and Alphabet (GOOGL) (GOOG) after those two announced stock splits earlier this year.

That said, the split announcements are not having the same impact as before.

For instance, stock split announcements for Tesla (TSLA) and Apple (AAPL) sent the share prices exploding higher in the summer of 2020. I’m of the opinion that Amazon would have seen its share price explode higher too, had it announced the split during a bull market, rather than in the throes of high volatility and a bear market in tech stocks.

The situation for Shopify stock is even worse.

When Amazon announced its split, the stock was 26% below its all-time high. When Shopify announced its 10-for-1 split, the stock was down 66%.

If management needs a catalyst, I don’t know if a stock split is it. I’m not discounting the psychological impact or the effect it can have on sentiment, but since it doesn’t have a fundamental impact on the company, it may very well not be enough to move the stock price in a meaningful way with the exception of a short-term bounce.

One could argue that Amazon stock rallied more than 20% in the weeks after the announcement. But it also came just days before the S&P 500 bottomed and ripped off an 11.5% gain as it rallied in nine out of 11 sessions.

Trading Shopify Stock

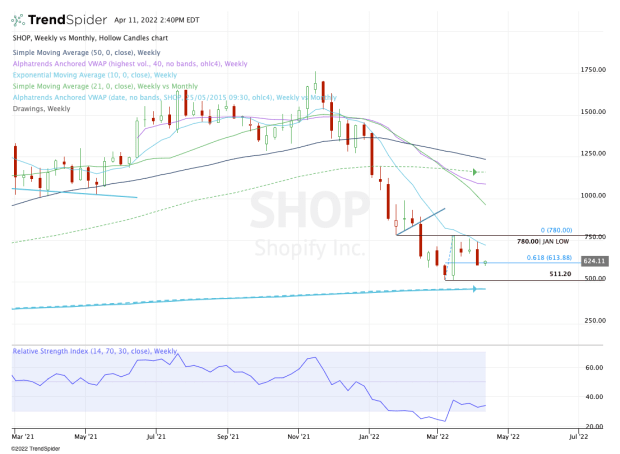

Chart courtesy of TrendSpider.com

Sorry for the long-winded approach, but the impact of a stock split is important in my view. It doesn’t fix anything or change the situation. It simply multiples the share count and divides the stock price. It’s arithmetic.

However, when sentiment is strong, investors gobble up this bit of “good news.” Heck, I like stock splits as much as the next trader. But in bear markets — like the one Shopify stock is in — I don’t think they have as meaningful of an impact because sentiment is so poor.

Allow me to also say that I really like Shopify stock and believe in its long-term potential.

So far though, Wall Street’s not buying it. If growth stocks rebound soon, Shopify will too. If it remains under pressure though, we could see this one retest the lows.

The stock is clinging to the 61.8% retracement of the current range after it failed to reclaim the $780 level and as the 10-week moving average remained as active resistance.

If we see a move below last week’s low that isn’t reclaimed, it opens the door back to the $500 to $511 area. The latter is the 52-week low. Below $500 and the VWAP measure anchored back to Shopify’s first week of trading is in play near $460.

For long-term investors, that’s likely a reasonable buying opportunity, provided Shopify falls that far.

On the upside, we could see a rebound back to the 10-week moving average, but until it’s reclaimed, it will remain as resistance. Above that is followed by the $775 to $780 zone.