Parenting is no walk in the park. It takes love, time, effort, patience and, of course, lots and lots of money. A recent study puts the average cost of raising a child from birth to age 18 at close to $240,000. And then there’s college. Should you decide to fund your kid’s tertiary tuition and extras, it could set you back hundreds of thousands of dollars more.

One single mom shared how she’s made many sacrifices over the years to save for her daughter’s college fund. Only for her daughter to threaten to cut contact contact with her once she starts studying. The mother is now considering keeping all the money, and spending it on herself and her son. But she’s not sure if she should. Bored Panda spoke to analyst and finance writer, Chip Lupo, from WalletHub for their take on the matter.

The mom and daughter both agree on the importance of education, and the daughter has always dreamed of going to a prestigious college

Image credits: Kaboompics / pexels (not the actual photo)

Their relationship became strained after the daughter started dating a new guy, and now her college fund is at stake

Image credits: MART PRODUCTION / pexels (not the actual photo)

Image credits: Good_Guest1421

Tertiary tuition doesn’t come cheap, no matter where you choose to study

Student loan debt in the United States totals $1,753 trillion. And over 43 million people have student loans to pay off. Recent data shows that “the average public university student borrows $32,362 to attain a bachelor’s degree.” It’s a lot of money to pay back once, and if, you start working.

Given those figures, it should come as no surprise that higher education is expensive. According to this report, the average annual cost of tuition and fees nowadays is just over $42,000 at private colleges, almost $20,000 for out-of-state students at public universities and close to $11,000 for in-state students at public schools in America.

But if you’re considering a prestigious university like Princeton or Harvard, you’ll be charged around $60,000 annually. And that’s just for fees. The total is actually closer to $95,000 a year when you factor in other expenses like housing, food and books.

“This significant investment often leads to substantial student loan debt,” said WalletHub analyst and writer, Chip Lupo during our chat. “Financial literacy remains a pressing issue, too, as nearly half of students think their education lacks adequate personal finance training, which compounds their stress over future debt and job security.”

Image credits: Pixabay / pexels (not the actual photo)

A few universities and colleges consistently come out as the “cream of the crop”

WalletHub compared more than 800 higher-education institutions across the U.S. The personal finance company looked at factors like student selectivity, cost & financing and career outcomes. Princeton came out as the top university, followed by Yale University, Harvard University, Massachusetts Institute of Technology and Dartmouth.

In terms of colleges, the top spot went to Swarthmore. Hamilton College came in second, followed by Amherst, Wellesley, and Harvey Mudd College. The top ten higher education institutions in America are all universities. “Universities tend to rank higher than colleges due to their inclusion of graduate-level programs, greater on-campus opportunities and higher earnings for students post-graduation,” reported Lupo at the time.

But that doesn’t mean you should discredit colleges. “There are still tons of high-ranking colleges, which offer their own advantages like smaller class sizes, more personalized learning and often safer campuses,” added Lipo.

Image credits: Pixabay / pexels (not the actual photo)

Experts are divided on whether prestigious colleges and universities are really worth the hefty price tag

“Graduates from elite schools tend to earn higher salaries, which could provide a good return on investment,” said Jenna A. Robinson, the President of the James G. Martin Center for Academic Renewal. Robinson added that return on investment varies considerably by major and career path.

Bill Coplin is a Professor of Policy Studies at Syracuse University. He believes the main advantage of Ivy League or name-brand schools is “you get to network with rich students and their parents.” And says the skill development is no better or “maybe worse” than other higher learning institutions.

“One of my graduates sent me an email telling me that the Harvard graduate who was hired when he was did not know how to run a copy machine. This may be a mundane skill but others like using Excel may not be there either,” said Coplin.

Image credits: Tima Miroshnichenko / pexels (not the actual photo)

The daughter might still have options, should she decide to follow through on her no-contact threat

Paying your way through college without your parents’ help is no easy task. But if Ella’s heart is set on a prestigious place of study, all is not lost. “Most Ivy League schools provide generous financial aid packages to low-income students. Many students do not pay the sticker price,” revealed Robinson.

Ella could look into things like federal financial aid, scholarships, grants or student loans. “Scholarships and grants are ideal as they don’t require repayment,” recommended Lupo during our chat.”Work-study programs offer income without heavy time commitments, and part-time jobs can also provide supplemental income. Student loans are another option, though it’s wise to consider federal loans first, as they tend to offer better rates and repayment options.” Lupo also suggested attending community college for the first year or two, saying it can “significantly lower costs before transferring to a four-year institution”.

Ella’s mom revealed in the comments that her daughter doesn’t work so that she has the time to focus on her studies. But if the feud with her mom continues, she might just have to consider getting a job. She might also need to think about going to a cheaper college.

Image credits: cottonbro studio / pexels (not the actual photo)

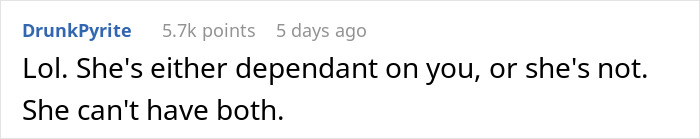

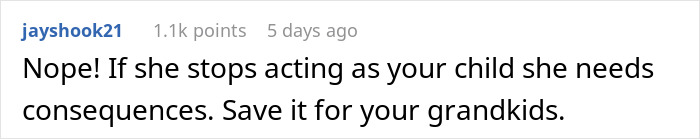

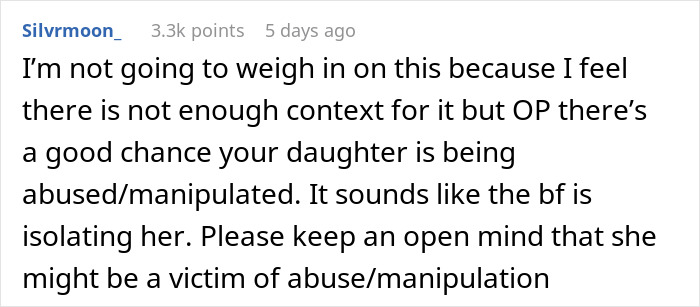

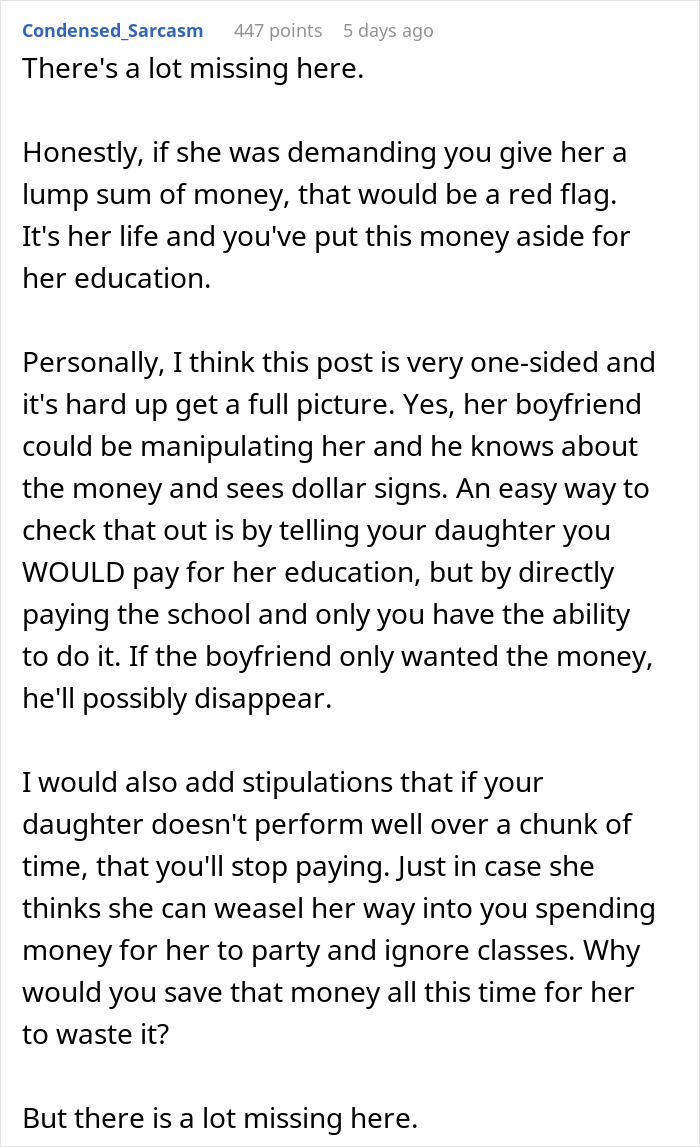

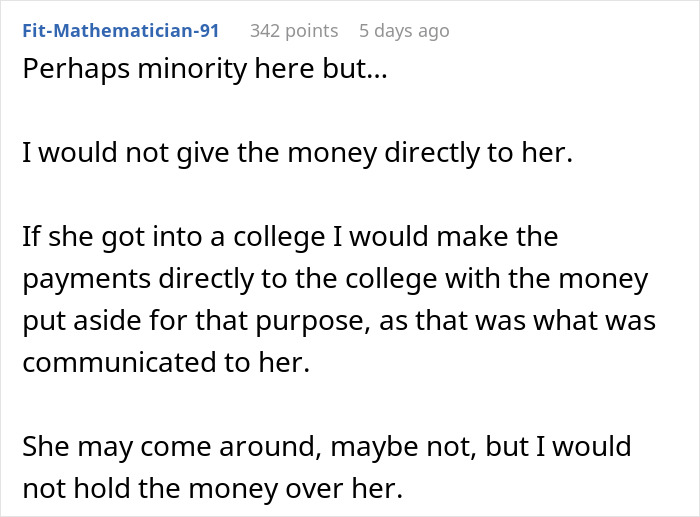

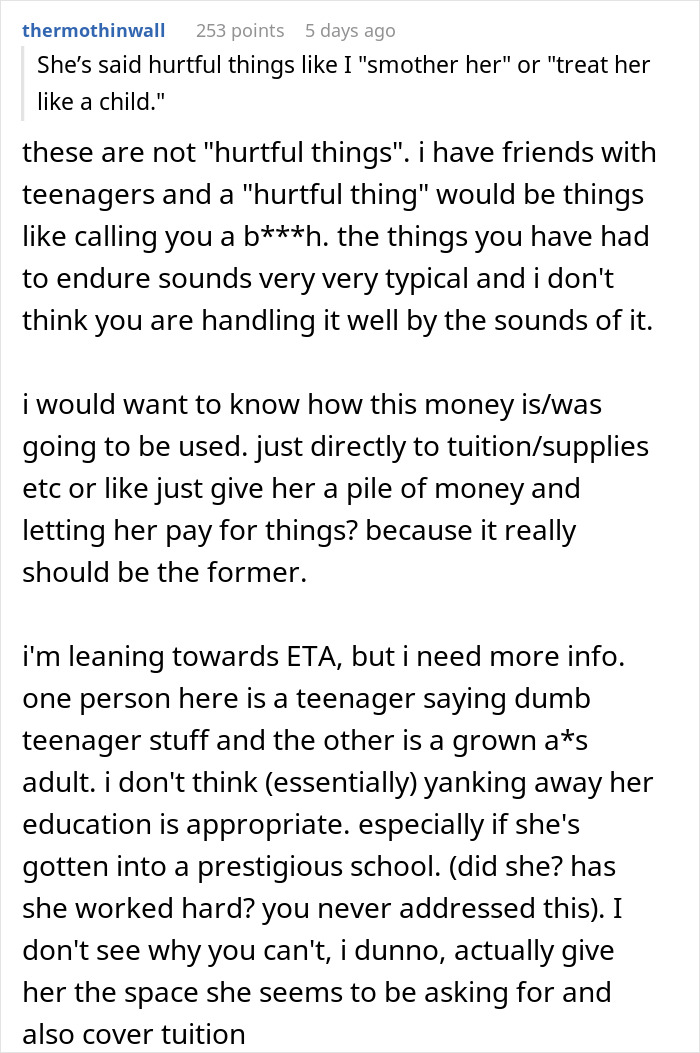

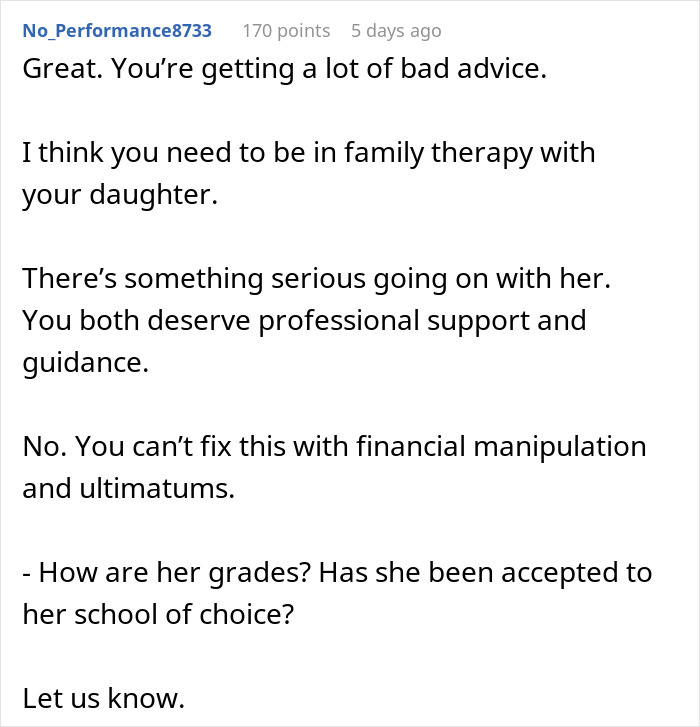

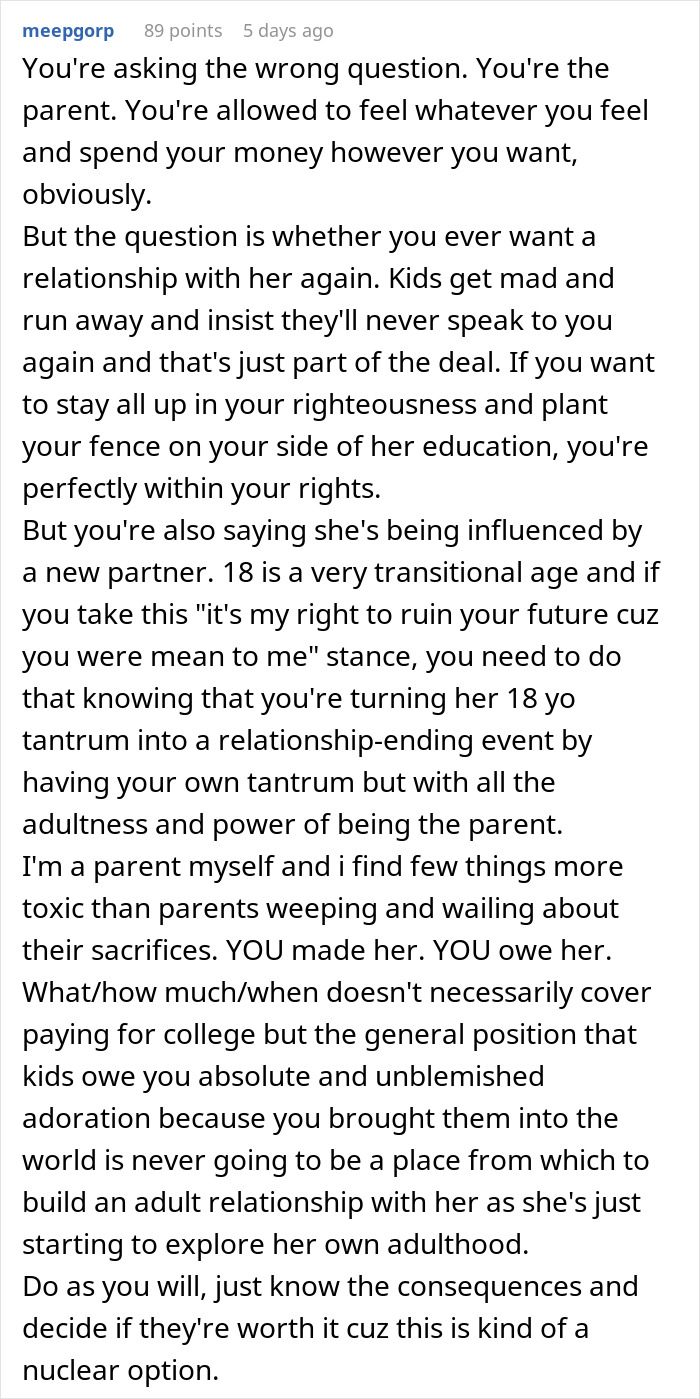

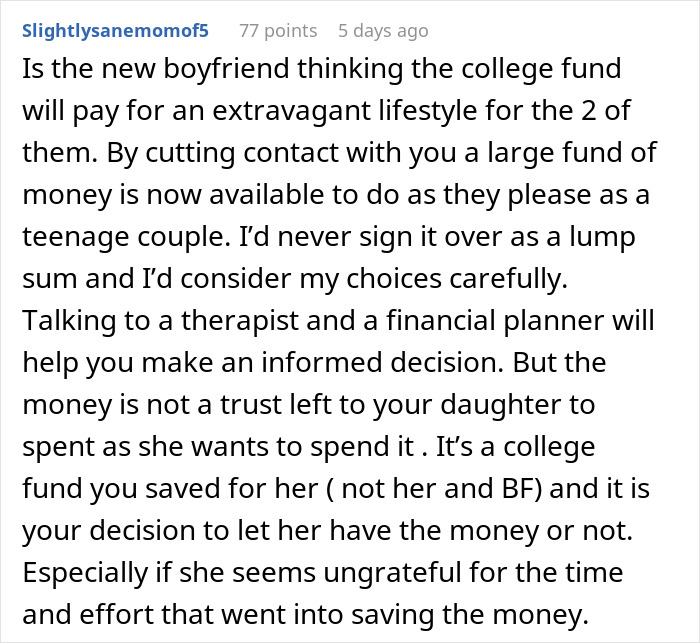

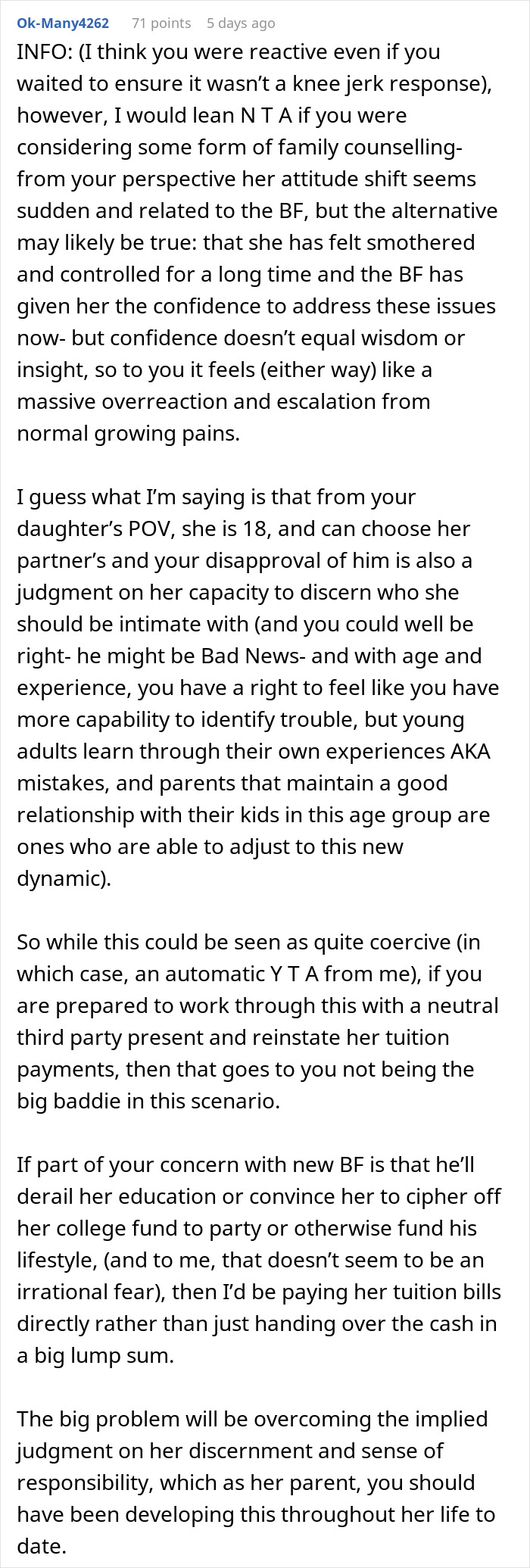

“She can’t have both”: Some netizens rallied behind the mom, saying her daughter needs to learn about consequences

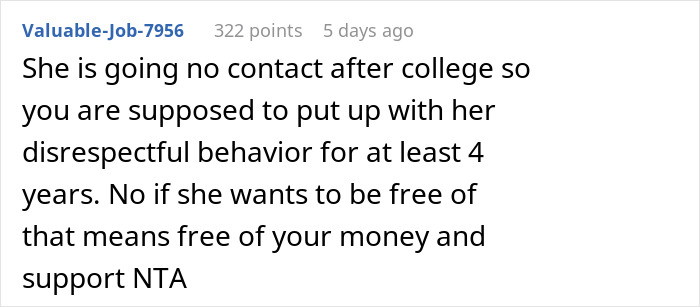

Some netizens said more info was needed to make a decision, while others felt both the mom and daughter were in the wrong

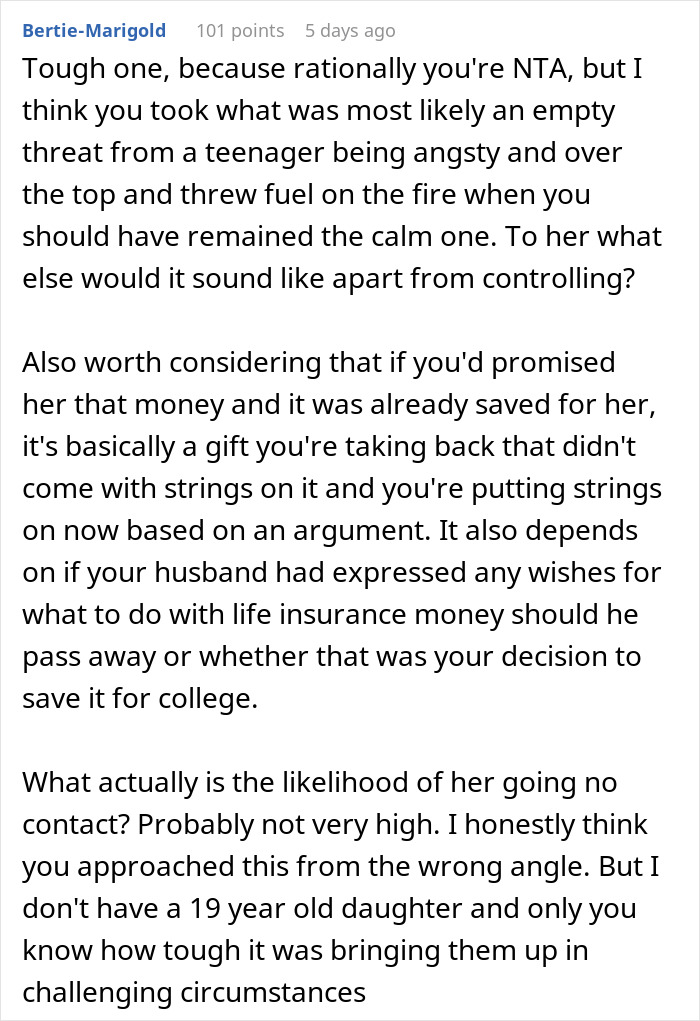

In an update, the mom said she’d decided to keep the money aside while she tries to “talk things out” with her daughter

Image credits: Kaboompics / pexels (not the actual photo)

Image credits: Good_Guest1421

Daughter Threatens To Go No-Contact With Mom, Is Shocked When Her College Fund Disappears Bored Panda.jpg?w=600)