Fraudsters used the faces of dolls and mannequins to create fake IDs to scam the government’s largest Covid-19 relief programme.

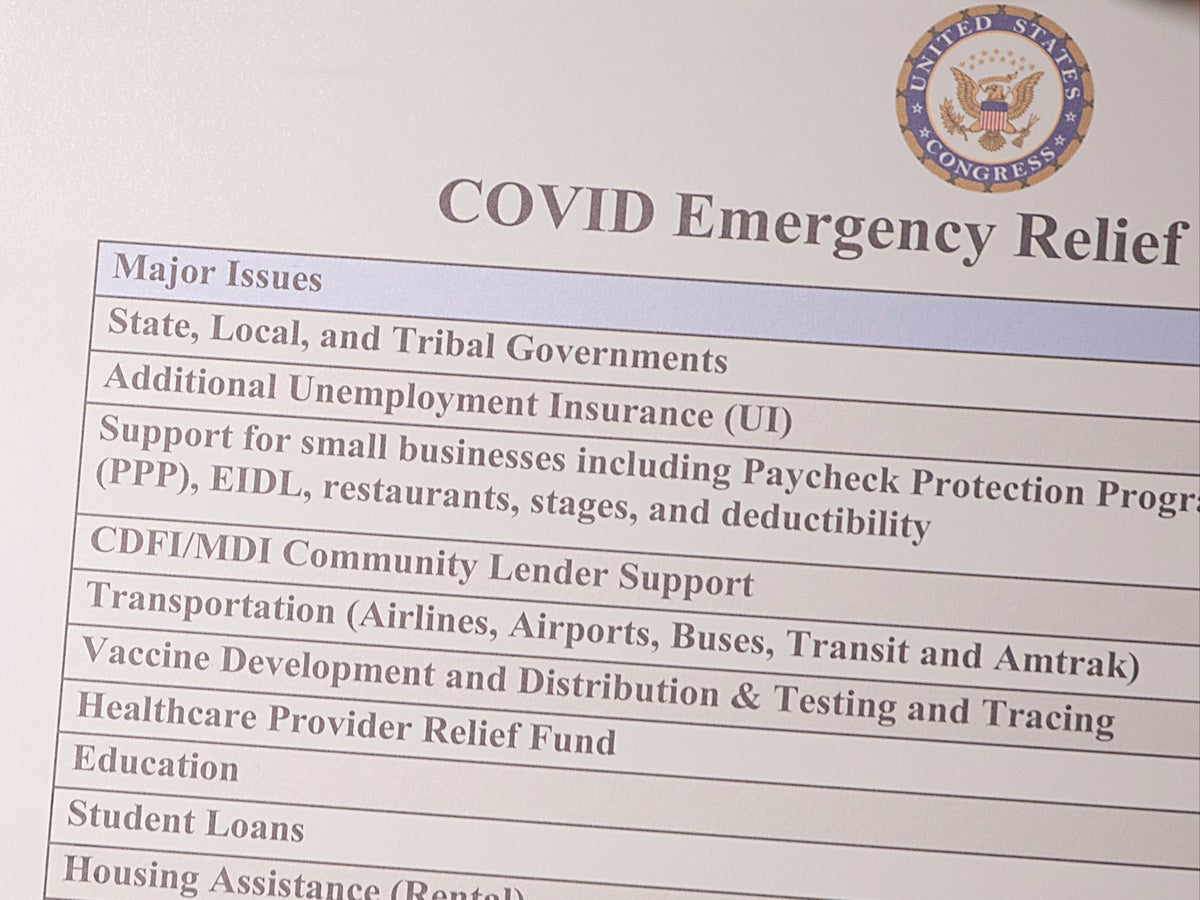

The scam using doll faces to create false IDs made up a small part of the estimated $80bn in fraud connected to the Paycheck Protection Program (PPP), according to The Messenger.

A House committee issued a report accusing financial technology companies – fintechs – of making the fraud possible.

The companies advertised themselves as tech-literate intermediaries who could aid those seeking to get government funds from approved lenders to small businesses in dire straits as the pandemic took hold of the country in the spring of 2020.

The firms claimed that their AI software could automatically check the picture IDs of applicants uploading submissions to PPP platforms.

But scammers who uploaded the faces of dolls got through the system and received funding.

The House report states that two fintechs, Womply and Blueacorn, facilitated a third of PPP loans in 2021 before being suspended by the Small Business Administration earlier this year.

A senior investigator at the watchdog Project On Government Oversight, Nick Schwellenbach, told The Messenger, “I don’t know if we’ll ever know the extent of the fraud enabled by Womply, but many of the companies that worked with Womply said it was significant.”

A lender who at one point engaged in a legal dispute with Womply said the company blamed a vendor for approving the IDs with doll faces as photos.

“We found doll heads and faces and all of that,” the anonymous lender told The Messenger. “But some of these got by because of the way the program was established, which was designed to get the money out the door.”

Both companies have been engaged in litigation with a number of lenders active in the programme.

Womply’s successor company, Solo Global Inc, has closed down, The Messenger noted.

Womply CEO Toby Scammell was convicted of insider trading and was banned from trading in securities. The House Select Subcommittee on the Coronavirus Crisis released a 130-page report following an 18-month investigation stating that Scammell resisted “providing information to federal investigators conducting PPP fraud investigations”.

The Independent has attempted to reach Scammell for comment.

Fastlane, a programme operated by Womply, received more than $2bn in fees, according to The Washington Post.

Congress found that Womply was one of two firms that facilitated most of the PPP fraud, processing more than $5m in loans for its own purposes.

Assistant professor of finance at the University of Texas at Austin, Samuel Kruger, told The Messenger that “Womply’s partner lenders had some of the highest rates of suspicious loans in our study, and a Congressional investigation into PPP fraud indicated that they had very poor due diligence for detecting fraud”.

“There were billions of dollars of fraud in the PPP program and Womply played a large role in facilitating this fraud,” he added.

Womply claimed that their AI systems could scan and confirm the faces of applicants against their driver’s licences and passports, but the lending companies working with the firm said found that the system could be tricked by the use of images of mannequins or by taking an ID photo and putting it on a doll.