Milpitas, California-based Sandisk Corporation (SNDK) develops, manufactures, and sells data storage devices and solutions using NAND flash technology. Valued at $84.5 billion by market cap, the company offers memory cards and readers, USB flash, micro SD cards, and digital audio players.

Shares of this flash memory titan have significantly outperformed the broader market on a YTD basis. SNDK has gained 180.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.5%. Over the past six months, SNDK stock is up significantly, surpassing the SPX’s 1.9% rise over the same time frame.

Zooming in further, SNDK’s outperformance is also apparent compared to the iShares U.S. Technology ETF (IYW). The exchange-traded fund has declined marginally on a YTD basis. Moreover, SNDK’s robust gains on a six-month basis outshine the ETF’s 12.6% returns over the same time frame.

Sandisk's outperformance is driven by strong demand for high-capacity SSDs, fueled by AI and data centers. Its BiCS8 tech and vertical integration give it an edge, with NAND prices rising due to tight supply. Strategic partnerships with hyperscalers and growing data center demand further boost prospects.

On Nov. 6, 2025, SNDK reported its Q1 results, and its shares surged 27.2% in the subsequent two trading sessions. Its adjusted EPS came in at $1.22, down 32.6% year over year. The company’s revenue increased 22.6% year over year to $2.3 billion.

For the current fiscal year, ending in June, analysts expect SNDK’s EPS to grow 821.4% to $16.40 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

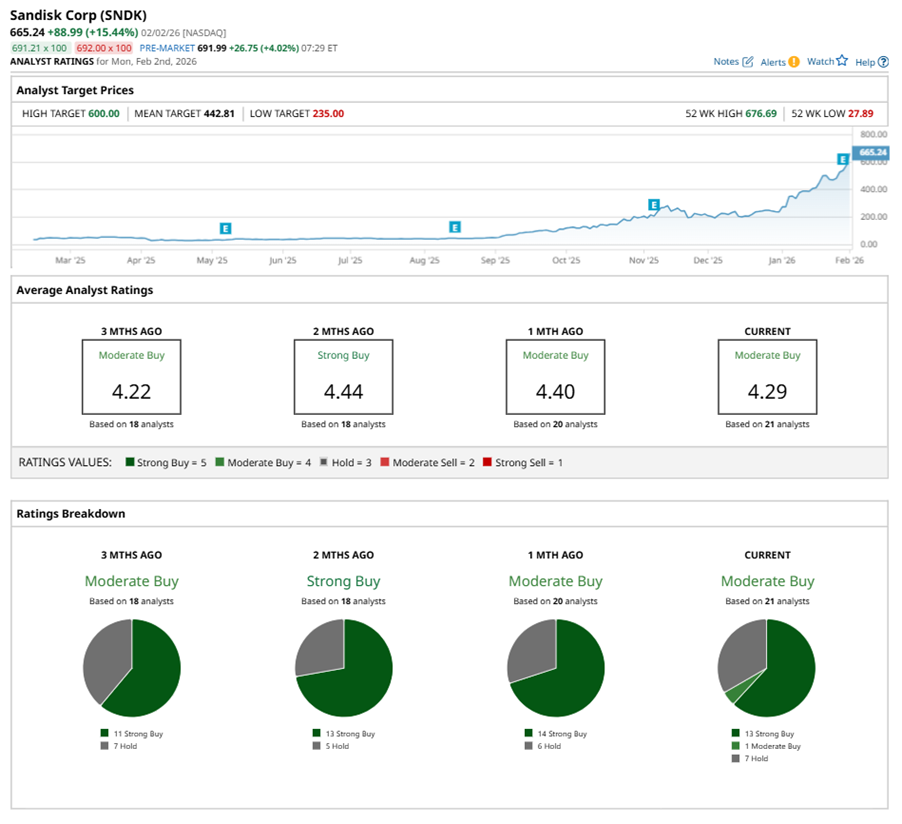

Among the 21 analysts covering SNDK stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is slightly less bullish than a month ago, with 14 analysts suggesting a “Strong Buy.”

On Jan. 30, Morgan Stanley (MS) analyst Joseph Moore reiterated a “Buy” rating on SNDK and boosted the price target to $690, implying a potential upside of 3.7% from current levels.

SNDK currently trades above its mean price target of $442.81 and the Street-high price target of $600, suggesting that the stock is relatively overvalued.