/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

With AI-backed demand, memory maker stocks are in overdrive. SanDisk (SNDK), after a strong 2025, has gone ballistic in the first few weeks of 2026. For year-to-date (YTD), the stock has returned 105%, and there appears to be no fatigue in the rally.

Of course, there are strong fundamental factors that back the rally. Reports indicate that SanDisk is likely to double the price of its high-capacity 3D NAND memory devices. Further, the surge in demand is not temporary, and Nomura Securities expects short-term shortages coupled with mid-term growth of demand to be driven by AI.

Therefore, SanDisk is positioned for strong growth, and with the expectations of price increases, EBITDA margin expansion is likely to be meaningful. Any intermediate correction will present a good opportunity for entry in SNDK stock.

About SanDisk Stock

Headquartered in Milpitas, SanDisk is a flash memory maker. The company operates in 30 countries globally and has more than 11,000 patent assets, which underscores the focus on innovation-driven growth.

Currently, SanDisk manufactures and provides data storage devices and solutions based on NAND flash technology. These flash storage solutions find demand for AI workloads in data centers, edge devices, and consumer segments.

For Q1 2026, SanDisk reported revenue of $2.3 billion, which was higher by 23% on a year-on-year (YoY) basis. With strong demand, SanDisk achieved its net cash positive milestone ahead of the guidance.

Considering the positive developments within the company and the industry tailwinds, SNDK stock has skyrocketed by 1,100% in the last six months.

Strong Growth Momentum

It’s worth noting that for Q1 2026, BiCS8 technology accounted for 15% of the company’s total bits shipped. With strong demand for high-capacity, power-efficient SSDs, it’s likely that BiCS8 technology will continue to drive robust growth.

Currently, the company has two qualifications underway with hyperscalers. Further, for the current year, engagement with five other hyperscalers is on the cards. This is indicative of the potential for top-line growth.

In Q1, SanDisk has also indicated that demand for its NAND products will continue to outpace supply. This creates a strong case for significantly higher pricing for the memory devices. For Q1, SanDisk reported adjusted free cash flow of $448 million. With the demand and pricing factor, FCF is likely to swell meaningfully over the next 12 to 24 months. This will support shareholder value creation.

From a demand perspective, it’s expected that investments in data centers and AI infrastructure will surpass $1 trillion by 2030. The tailwinds are therefore long-term in nature and will ensure a sustained growth momentum.

What Analysts Say About SNDK Stock

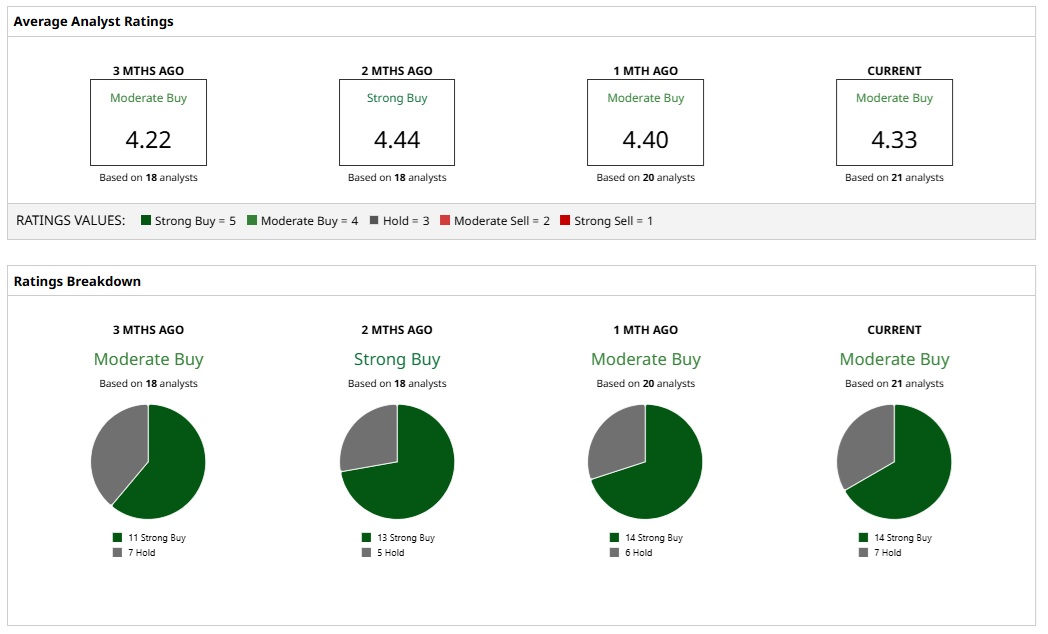

Based on the ratings of 21 analysts, SNDK stock is a consensus “Moderate Buy.” While 14 analysts assign a “Strong Buy” rating to SNDK, seven analysts have assigned a “Hold” rating.

Based on these ratings, analysts have a mean price target of $345.94 currently, which would imply a downside potential of 31%. However, with the most bullish price target of $580, the upside potential for SNDK stock is 15.7%.

While SNDK stock has skyrocketed in the last six months, there are two important points to note. First, SNDK stock trades at a forward price-earnings ratio of 35.6, which does not indicate stretched valuations. Second, Bernstein Société Générale recently doubled its price target for SNDK stock to $580. The reason being “unprecedented NAND shortages and price increases.”

The positive view is reaffirmed by RBC Capital Markets, which expects semiconductor revenue from AI applications to “grow from $220B in 2025 to more than $550B by 2028.” RBC has assigned a sector “Perform” rating to SNDK stock. Therefore, with robust growth visibility and potential for significant upside in cash flows, SNDK stock is worth considering on minor corrections.