Samsung was the only major memory maker that did not cut the output of DRAM and 3D NAND when demand for these commodity ICs dropped due to softening of PC and smartphone sales last year. But as the company's profits plummeted in Q1 2023, it decided to reduce memory production to balance the supply and demand situation on the market.

"We have cut short-term production plans, but as we project solid demand for the mid-to-long term, we will continue to invest in infrastructure to secure essential cleanrooms and to expand R&D investment to solidify tech leadership," a statement by Samsung published by Bloomberg reads.

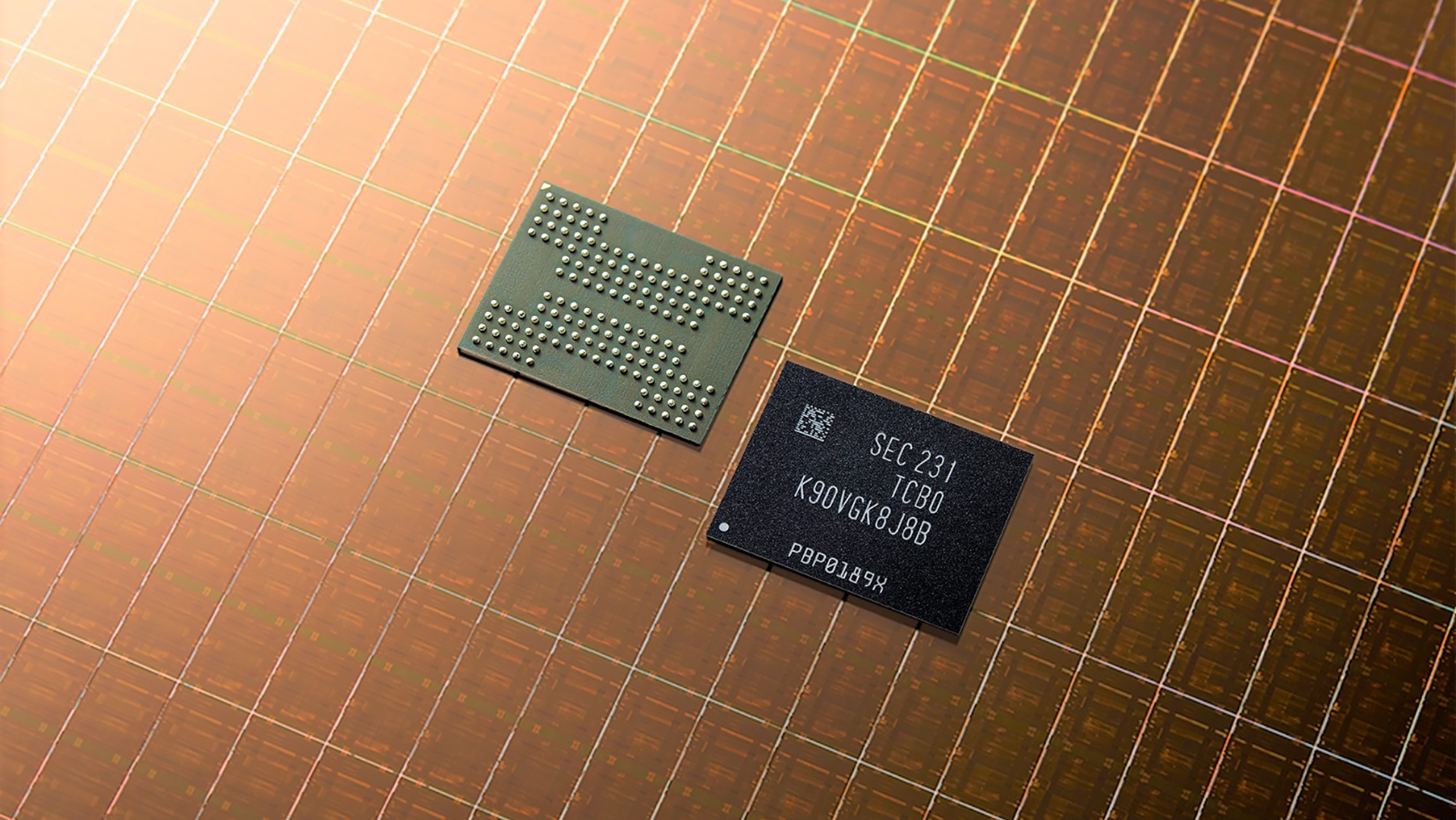

Samsung is the world's largest supplier of DRAM and NAND, and memory sales significantly contribute to the company's earnings. The company commanded a 45.1% share of DRAM market and a 33.8% revenue share of NAND market in Q4 2022, according to TrendForce.

While the company formally stated that it would cut memory production, it never revealed how significantly it intends to reduce wafer starts and memory bits output.

Most of Samsung's rivals reduced memory production on older technologies but continued to gradually ramp up memory production on newer fabrication processes. Typically, the latest nodes decrease chip costs and increase bit output per wafer, so in many cases, memory ramp on newer nodes more than offsets production cuts on older nodes regarding bits output.

However, analysts believe that Samsung's intention to cut down memory production will affect the demand and supply balance in the market and will at least slow down the collapse of memory prices in Q2 2023.

"Counterpoint expects that the utilization rate reduction [will] slow down the decline of commodity memory prices," Brady Wang, a senior analyst, told Nikkei Asia. "Still, this oversupply is due to weakening demand and high inventory, so Samsung's production cut is not expected to stimulate sales. Therefore, Counterpoint believes that the oversupply situation will continue until the third quarter when the market starts to deplete inventory for the fourth quarter seasonal demand."

Samsung's Q1 2023 revenue dropped to 63 trillion won ($48.877 billion), or 19% compared to the same quarter a year ago. The company's profit collapsed to 600 billion won ($450 million), or by 95% year-over-year, falling short of the 1.4 trillion won ($1.064 billion) average forecasted by analysts.