Samsung Foundry has delayed mass production of chips at its Taylor, Texas, fab from the second half of 2024 to sometime in 2026 due to insufficient yields, reports Business Korea. The publication claims that yields with SF3 (3nm-class) process technologies, which rely on gate-all-around (GAA) transistors, are considerably lower than those of arch-rival TSMC. Samsung is reportedly trying to find a cure.

Samsung Foundry reportedly went as far as withdrawing personnel from the Taylor fab to cut costs, which could be part of the company's broader plan, reported by Reuters, to reduce its workforce in general. But Business Korea claims the workforce drawdown is due to a delay with its launch in 2026 as it is reconsidering its foundry strategy and refining process technology.

The company's agreement with the U.S. government to receive up to $6.4 billion in grants and loans under the U.S. CHIPS Act is now in jeopardy. The deal requires the plant to be operational, a condition unlikely to be met anytime soon, based on the report.

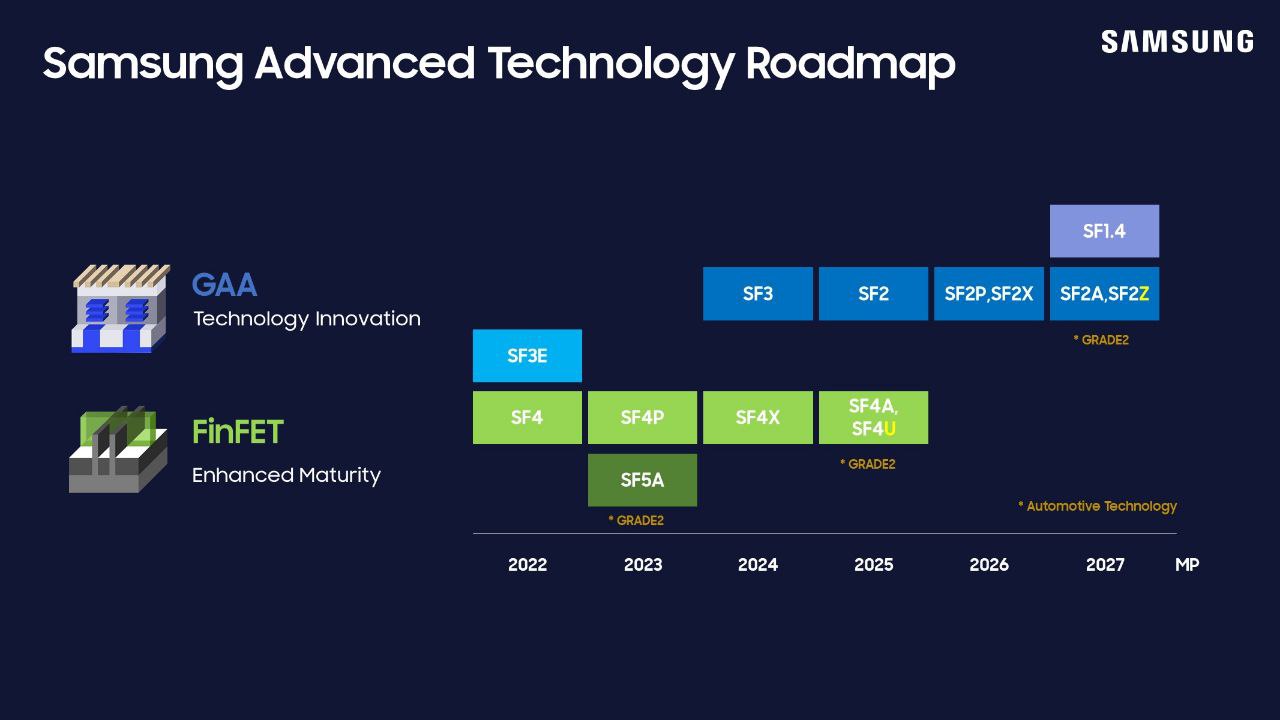

The Taylor fab was planned as a critical facility for producing chips at SF4 (4nm-class) process technologies and below, which in the case of the Texas fab timeline includes SF3 (2nd Generation 3nm) and SF3P (which is now called SF2 and formally belongs to 2nm-class nodes). But due to the insufficient yields, particularly with SF2/SF3P process technology, the company has reassessed production plans and staffing.

Samsung has left only a skeleton crew at the Taylor plant.

Rumors about insufficient yields at Samsung Foundry have floated around for years, and there are indirect indicators of yield issues, particularly in advanced fabrication technologies. Samsung's SF3E (1st Generation 3nm-class node) has been used only for cryptocurrency mining chips, a sign of high defect density that plagues the yields of big chips. Still, its successors SF3 and SF3P have been tapped for a data center and smartphone processor.

Yet reports on Samsung Foundry's yields are often confusing. Even the current Business Korea report claims that Samsung's yields with GAA-based nodes (i.e., 3nm-class and below) are 'around 10% to 50%.' Still, a few paragraphs earlier, the report claims that Samsung's yields at processes of 3nm and below are 'below 50%,' which essentially means that the article contradicts itself. Yields below 50% are often insufficient for mass production unless the chip design has many internal redundancies.

Samsung chairman Lee Yong has been proactive in seeking solutions for insufficient yields. Lee has met with key equipment suppliers, such as ASML and Zeiss, to address yield and process bottlenecks. These efforts have yet to produce significant improvements, however, leading to the decision to postpone mass production.

Experts point out that Samsung's struggles are not just technical. They highlight deep-rooted internal issues, including a slow decision-making process, excessive bureaucracy, and inadequate compensation, which are believed to bweakenSamsung's competitiveness. While the company is eager to spend tens of billions of dollars on production capacity, it does not spend enough on R&D and personnel.