The warning signs regarding Samsung's chip business have been readily apparent for quite some time, but the severity of the company's troubles was realized yesterday. Samsung revealed its earnings for the first quarter of 2023, and it wasn't pretty. The company said revenue came in at 63.75 trillion Korean won ($47.6 billion), which was down 18 percent compared to Q1 2022, but in line with Samsung's previous guidance.

However, the South Korean chip and electronics giant said that operating profit during the quarter plummeted from KRW 14.12 million ($10.5 billion) during Q1 2022 to just KRW 640 billion ($476 million). To put that figure into perspective, Samsung hasn't reported an operating profit that low since Q1 2009.

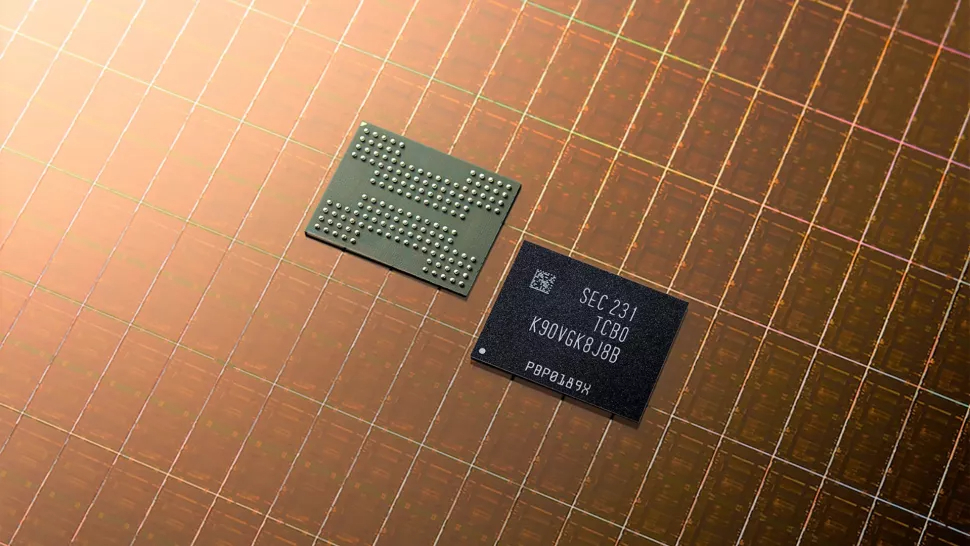

So, what went wrong during the preceding quarter? Well, Samsung's semiconductor business has traditionally been the company's significant revenue and profit generator. Samsung is a dominant player in this field, providing memory chips and NAND flash that are found in everything from computers to smartphones to tablets to IoT devices. And as we reported earlier this month, Samsung dialed back memory production due to low customer demand. It was speculated at the time that Samsung witnessed a 30 percent drop in orders during Q1 2023 and that inventory exceeded demand by 21 weeks.

Further compounding matters is that the oversupply has led to contract pricing for DRAM and NAND falling by as much as 24 percent and 16 percent, respectively, according to KB Securities. When you factor in that Samsung commands 45.1 percent of the DRAM market and 33.8 percent of the NAND market, the first quarter became a perfect storm of negativity for the company's financials resulting in a KRW 4.58 trillion ($3.4 billion) loss for its semiconductor business.

Samsung's LSI Business also fared poorly during the quarter, with the company noting that "earnings fell sharply in the first quarter due to a drop in demand for major products such as SOCs, sensors and DDIs."

Looking forward, Samsung says it will accelerate its shift from DDR4 production to DDR5 and LPDDR5x while also addressing the demand for HBM3. In addition, it will ramp production of QLC NAND to address the needs of customers in need of high-density storage products.

The Visual Display (TVs), Digital Appliances, and SDC (display panels for smartphones, laptops, automotive, etc.) businesses were also down year-over-year. However, the one bright spot for the company was its mobile business, which posted revenue of KRW 31.82 trillion ($23.6 billion) and operating profit of KRW 3.94 trillion ($2.93 billion). Samsung indicated that the successful launch of the Galaxy S23 series (including the premium-priced Galaxy S23 Ultra) bolstered the mobile business.

It should be noted that Samsung largely expects to see some recovery during the second half of the year for its businesses that were down in Q1 2023. The company also reiterated that it is already mass-producing first-generation 3-nanometer silicon and that its second-generation 3 nm products will enter mass production next year.