KEY POINTS

- The LEND Program is a high-yield alternative to traditional savings accounts

- Accredited investors can have their interest paid out in Bitcoin, giving them the chance to earn even more

- SALT is fully compliant with US regulations and all deposits are safeguarded

SALT Lending, the original crypto-backed financial services provider, today launched its SALT LEND Program, which is designed exclusively for accredited investors, individuals, or businesses looking to achieve higher returns on USD and stablecoin deposits (USDC, USDT).

The program offers returns of up to 10% and the coming option for interest payouts in Bitcoin. Investors are presented with a secure, high-yield alternative to traditional savings accounts, empowering them to maximize their cash-equivalent assets while retaining control of their accounts.

Offsetting Losses Associated with Inflation

Inflation has long been one of the biggest challenges for consumers. Traditional savings accounts struggle to keep pace with inflation, often leading to a gradual loss of value for investors.

With SALT's LEND Program, consumers now have an alternative that combines predictable cash returns with the growth potential of the world's largest cryptocurrency by market value, allowing investors to grow their savings faster than inflation.

The crypto market continues to evolve, and SALT is banking on this transformation with new opportunities for savvy accredited investors who want greater financial control and are seeking a path to break away from low-yield savings accounts.

"SALT has always been about empowering our community with innovative ways to grow their assets, and the LEND Program exemplifies this commitment by providing accredited investors with a high-yield alternative to traditional savings accounts," Shawn Oven, CEO and founder of SALT Lending, said in a press release shared to International Business Times.

Investing with Confidence

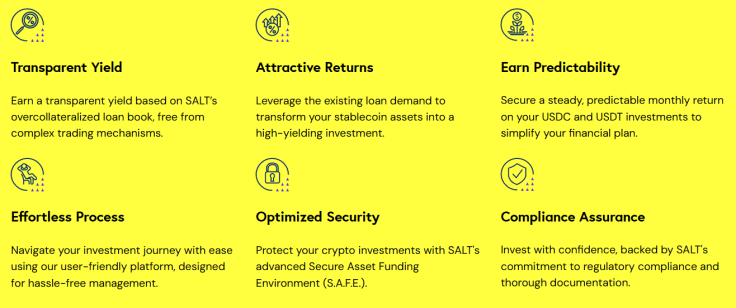

SALT Lending utilizes advanced security measures that include multi-signature processes and partnerships with some of the industry's most vetted institutional custody providers.

All deposits are safeguarded, especially since SALT operates in full compliance with U.S. regulations – a key point of interest among investors seeking secure yield avenues.

"This program is a continuation of our heritage at SALT, where tradition meets innovation to drive meaningful utility and yield for digital asset holders. We believe this approach doesn't just enhance individual portfolios—it strengthens the entire crypto ecosystem by setting a new standard for security, yield, and flexibility," said Owen.

How the SALT Lend Program Works

The program is open to accredited American investors. It is also available for select international investors. Deposits in USD, USDC, and USDT are accepted, with an annual yield of 10%.

Investors will receive monthly interest payouts in USD or BTC, giving them enhanced flexibility to tailor their returns to their financial goals. Following a 30-day holding period, investors can make withdrawals, offering both predictable returns and liquidity options.

Where $BTC Interest is Protected

Investors in the SALT LEND Program have the option of receiving interest in Bitcoin. This alternative allows investors to benefit from BTC's historical growth that has consistently outperformed traditional savings options.

Notably, Bitcoin's average annual returns would have offered 20 times the average in savings account yields over the last five years.

Another huge benefit is investors who acquire Bitcoin through interest payouts allows them to avoid the transaction fees that are typically incurred when purchasing the digital currency on an exchange.

Many crypto yield products depend on high-risk trading strategies. SALT's LEND Program is on a different route. It generates returns exclusively from its lending activity which ensures a lower-risk profile for investors. Investor deposits are used to fund secured loans, not volatile trading ventures.

Furthermore, investors who opt for the BTC interest payout are guaranteed that their payouts are held in full reserve and never leveraged, which means the Bitcoins are not exposed to additional risk.

"With the SALT LEND Program, we're able to offer accredited investors a compelling alternative to traditional savings accounts that's built on the foundation of our secure, over-collateralized loan book. This program provides investors with reliable returns and the coming flexibility to earn even more by receiving their interest in Bitcoin, giving them a unique edge in today's financial landscape," said Hunter Albright, the Chief Revenue Officer at SALT Lending.