A whale with a lot of money to spend has taken a noticeably bullish stance on Salesforce.

Looking at options history for Salesforce (NYSE:CRM) we detected 23 strange trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 43% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $1,031,311 and 9, calls, for a total amount of $395,022.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $350.0 for Salesforce over the last 3 months.

Volume & Open Interest Development

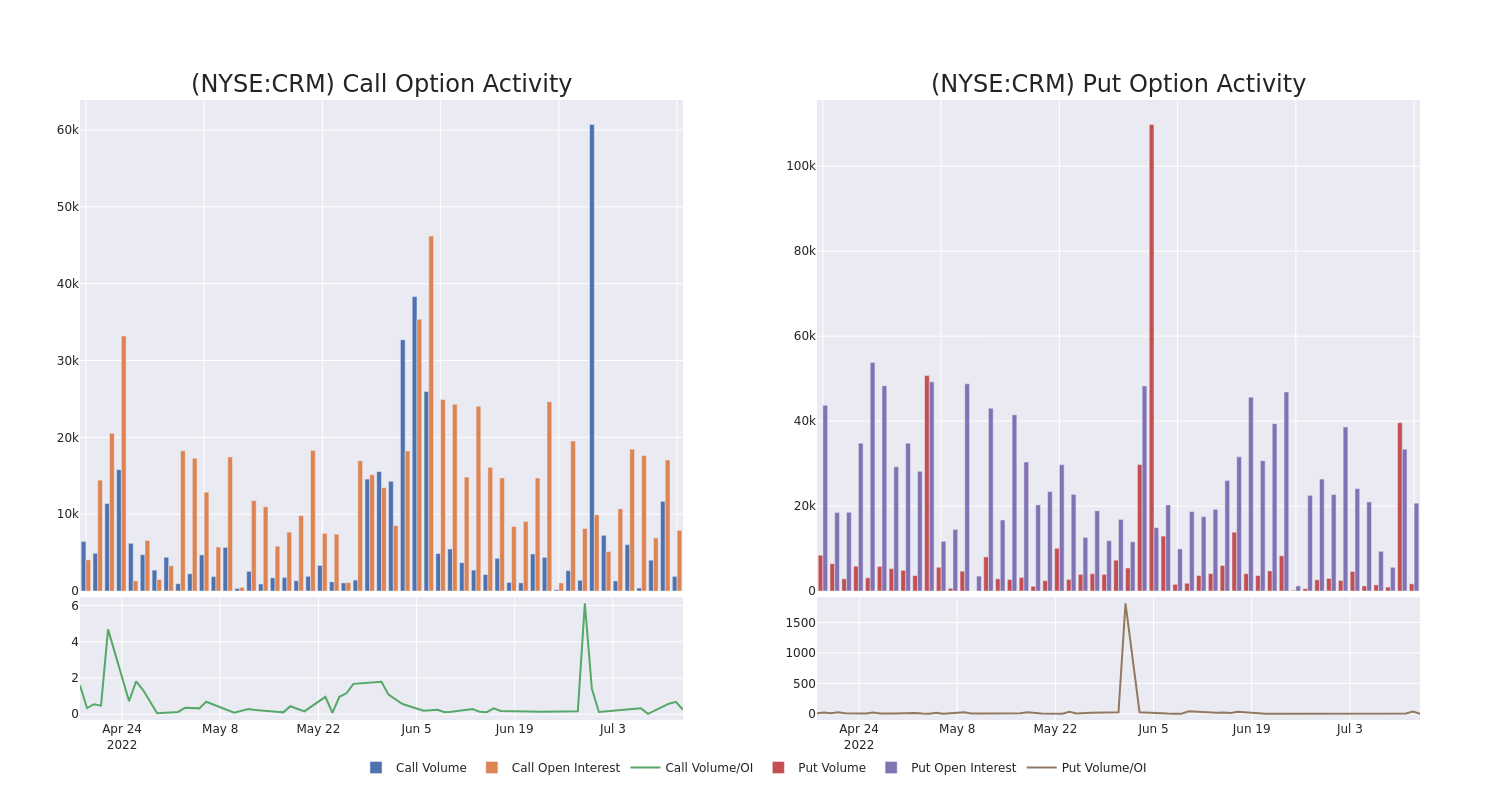

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Salesforce's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Salesforce's whale activity within a strike price range from $150.0 to $350.0 in the last 30 days.

Salesforce Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| CRM | PUT | SWEEP | BULLISH | 01/20/23 | $350.00 | $392.1K | 116 | 21 |

| CRM | CALL | TRADE | NEUTRAL | 08/19/22 | $160.00 | $121.3K | 519 | 106 |

| CRM | PUT | SWEEP | BEARISH | 07/15/22 | $172.50 | $94.9K | 1.3K | 145 |

| CRM | PUT | SWEEP | NEUTRAL | 07/15/22 | $172.50 | $93.6K | 1.3K | 265 |

| CRM | PUT | TRADE | NEUTRAL | 01/20/23 | $330.00 | $83.5K | 13 | 5 |

Where Is Salesforce Standing Right Now?

- With a volume of 3,242,102, the price of CRM is down -0.81% at $164.97.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 42 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Salesforce, Benzinga Pro gives you real-time options trades alerts.