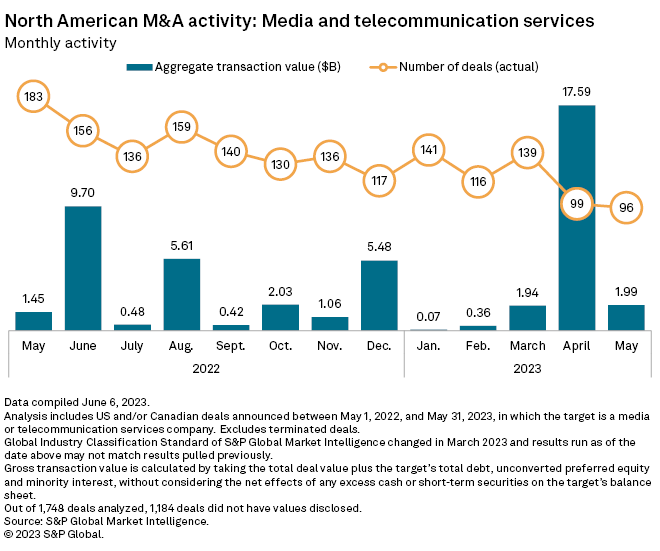

NEW YORK—Dealmaking in the U.S. and Canadian media and telecom sectors remain sluggish with U.S. and Canadian media and telecom companies involved in 96 M&A transactions in May that had a total value of $1.99 billion, according to S&P Global Market Intelligence data.

That is down from the $17.59 billion in April across 99 transactions, S&P said, marking a return to levels last seen in March. By comparison, 183 deals were announced in May 2022 with an aggregate value of $1.45 billion.

The three biggest media and telecom deals announced in May had publishing companies as targets, noted Mark Anthony Gubagaras and Darakhshan Nazir in a blog post for S&P Global Market Intelligence.

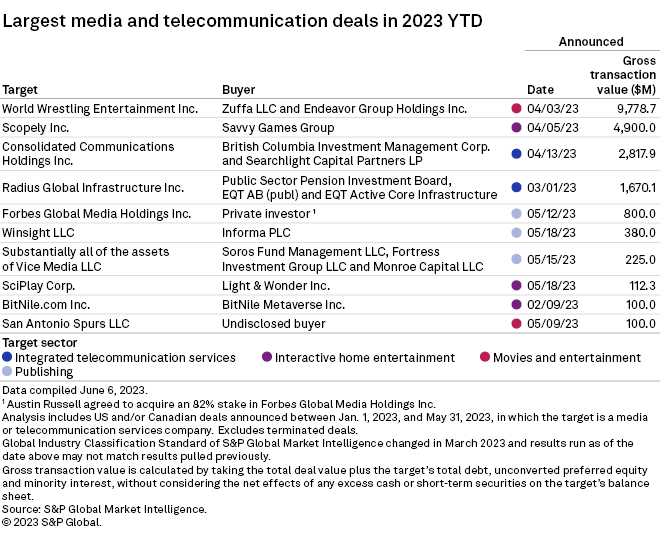

They reported that Luminar Technologies Inc. founder and CEO Austin Russell's bid to acquire an 82% stake in Forbes Global Media Holdings Inc. topped the sector's M&A list. The transaction values business media outlet Forbes at nearly $800 million.

“The second-biggest media and telecom deal was UK-based Informa PLC's $380.0 million purchase of Chicago-based Winsight LLC, a business-to-business event, data and media group focused on food service market insights,” the post said. “The sector's third-largest transaction was the proposed acquisition of Vice Media LLC by a group of its creditors for about $225.0 million. The deal includes taking on Vice Media's significant liabilities as the digital news company filed for Chapter 11 bankruptcy protection. Endeavor Group Holdings Inc. and Zuffa LLC's $9.78 billion purchase of World Wrestling Entertainment Inc., announced in April, remains the largest media and telecom deal in the year to date.”