NEW YORK—Amid growing concerns about an economic recession and wider media trends that threaten local broadcast TV revenue, a new report from S&P Global Ratings argues that the financial state of local broadcasting is relatively secure and has issued a "stable" credit ratings outlook for local broadcasters.

The analysis comes at a time when despite widespread cord cutting has increased fears that broadcasters could see declines retransmission fee revenue.

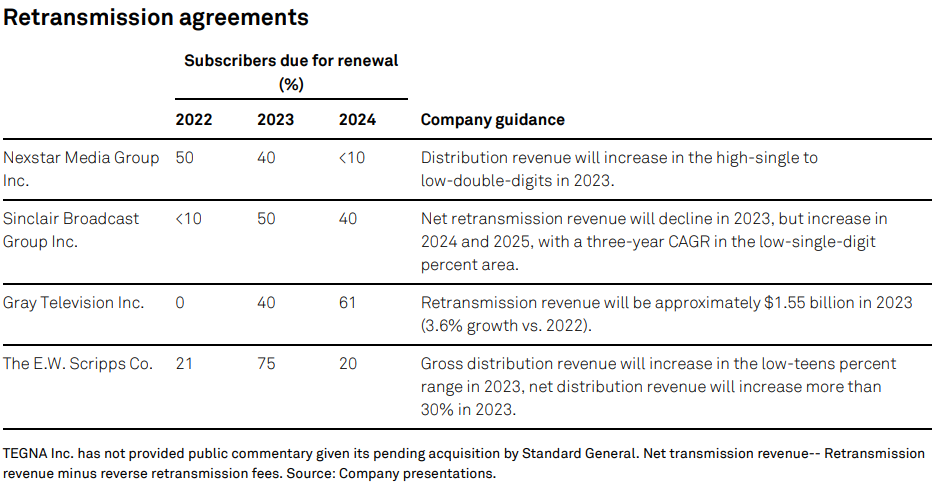

While retransmission revenue growth slowed significantly across the U.S. local TV industry in 2022, to around 3% from around 10% in the previous two years, S&P is predicting growth in retransmission revenue over the next two years.

S&P remains skeptical, however, that NextGen TV will provide significant new revenue in the near term and downplayed the potential upside from local sports in its financial analysis of local TV.

“We believe retransmission revenue will increase annually in the mid-single-digit percent area over the next two years,” explained Rose Oberman, credit analyst, S&P Global Ratings. “Our industry forecast assumes total pay-TV subscribers will decline more than 7% per annum over the next two years. This will be more than offset by local TV broadcasters negotiating higher retransmission rates during contract renewals with pay-TV distributors. We believe retransmission revenue growth will flatten after 2024 and potentially turn negative after 2025, as more moderate price increases during contract renewals (given declining TV audiences, weaker broadcast network content, and less exclusive broadcast network content) become insufficient to offset subscriber churn.”

The report noted that beyond 2025, “we expect retransmission revenue will eventually decline. However, we believe revenue declines will be manageable and no higher than in the low-single-digit percent area within the next five years. We believe broadcast TV will remain a key component of pay-TV distributors' video offerings as the broadcast networks will continue to carry key sports programming.”

Overtime that will reduce the importance of retransmission revenue, which currently represents more than 40% of total revenue for most local TV broadcasters, and make core advertising (excluding political ad spending) an increasing percentage of industry revenues.

The report also addressed the issue of whether NextGen TV/ATSC 3.0 will provide a significant revenue boost in the near terms. While NextGen TV could present revenue opportunities for datacasting and targeted advertising, the report said they were “skeptical as to what extent ATSC 3.0 can be monetized and do not expect to incorporate any benefit from it in our analysis until the industry has demonstrated an ability to sign and implement new contracts and generate meaningful revenue from it.”

S&P expects that “local TV broadcasters will benefit from $4 billion in high-margin political advertising revenue in 2024 given the U.S. presidential election to help reduce leverage. While we expect a shallow recession in 2023 will reduce core advertising by about 3% in 2023, we expect it will largely recover in 2024 as economic conditions improve. To the extent that retransmission revenue growth becomes negative over the longer-term, this could trigger a reassessment of our views on the sector.”

Looking ahead, the report also covered other potential revenue opportunities, including local sports. While acquiring sports rights could provide an opportunity to increase local advertising revenues over the next couple of years, the report doubted this would notably boost retransmission fees and noted that the cost of sports rights could hurt margins.

“Nexstar and E.W. Scripps could be in unique positions to acquire sports content, given Nexstar's 75% ownership of the CW Network and E.W. Scripp's ownership of the ION Television Network because they fully control those broadcast networks' programming,” the report said.

More information on accessing the report is available here.