Has the bear-market rally ended and stocks are about to roll over? Or is this just a standard — albeit fast — correction amid the new uptrend?

My biggest issue with this being a new uptrend is simple: The Federal Reserve remains hawkish.

One of the top trading rules is “don’t fight the Fed.” While it’s true that the stock market has a historical tendency to go up rather than down — climbing on an annual basis roughly eight out of every 10 years — the nuances of a bear market can be tricky to navigate.

Unlike the first quarter of 2020 or the fourth quarter of 2018, where the Fed pivoted to a more dovish, accommodative stance, Chairman Jay Powell’s Jackson Hole speech on Friday did little to signal that the Fed is looking to loosen its monetary policy and begin providing a surplus of liquidity.

Rather than providing liquidity, the Fed appears set to continue tightening. And that creates an issue for the stock market — particularly as we head into the notoriously volatile part of the year in September and October.

It can be dangerous to simply set the decision of whether we will make new lows. It creates a bias that can blind us to the most obvious developments.

With that in mind, let’s look at how the charts are setting up.

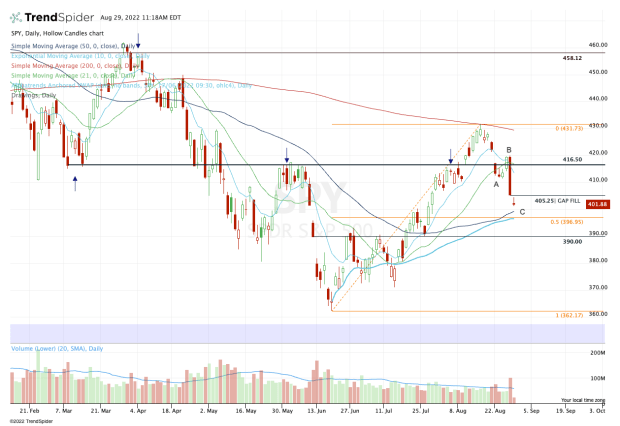

Trading the S&P 500 With the SPY ETF

Chart courtesy of TrendSpider.com

Earlier in the month, the SPDR S&P 500 ETF Trust (SPY) was struggling with the $416.50 area as resistance. That zone was significant resistance in late May and early June, after acting as support in the first quarter and early part of the second quarter.

After the breakout over this zone, the SPY ran right to the 200-day moving average, tagged it and then backed off. Could it really be so obvious for it to rally to the 200-day and fade?

Apparently so.

The SPY tried to reclaim the 10-day and 21-day moving averages — as well as the $416.50 zone — but last week failed to do so, with Friday’s action acting as a dagger to the bulls’ hopes.

We have now a correction pattern within the rally. I want to see how the SPY handles a test of the $396 to $400 zone. In that area, we have the 50% retracement, the 50-day moving average and the VWAP measure anchored back to the 2022 low.

In other words, this zone is key. On the upside, I’m watching the $405.25 gap-fill level, followed by the $410 to $412 zone and the declining 10-day moving average.

If the SPY can’t hold the $396 to $400 area, that’s a bearish development, opening the door to prior support at $390.

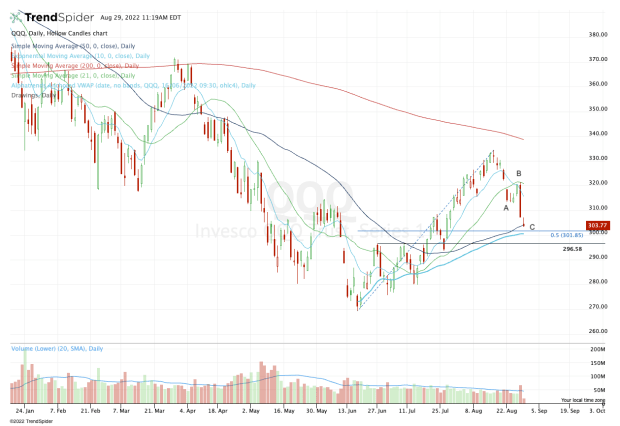

Trading the Nasdaq With the QQQ ETF

Chart courtesy of TrendSpider.com

The Invesco QQQ Trust Series QQQ has a pattern very similar to that of the SPY. But the QQQ has shown a bit more weakness, which is no surprise given tech’s higher sensitivity to interest rates.

As it pertains to the charts, the QQQ is already testing the 50-day moving average, but the $300 to $304 zone is critical.

Aside from the 50-day, the QQQ also finds the 50% retracement and VWAP measure in this zone. A break of this area opens the door down to $296.50, a former resistance level. Like the SPY, this area needs to hold if it’s tested; otherwise, the QQQ risks even more downside pressure.

On the upside, let’s see if the QQQ can reclaim the $307.35 level — Friday’s low.

Back above that and we could see a push to the $312 to $313 area, where we find the 50% retracement from today’s low to Friday’s high and a prior support zone from last week.

For now, we have a correction within an uptrend, but bears have the short-term momentum. If that momentum gains speed, we could see a bulk of the recent gains — or even all of the gains — eliminated in the next few weeks.

For the SPY, keep a close eye on the $396 to $400 zone, then $390. For the QQQ, watch $300 to $304, then $296.50.