Roku's stock isn't for everyone. The leader in streaming entertainment has taken shareholders on a roller coaster ride since covid-era lockdowns caused a surge in demand.

The company, which sells devices connected to televisions and televisions with Roku's software pre-installed, enjoyed rapid growth that catapulted shares 746% higher from March 2020's lows to its peak in July 2021. However, a bear market caused by recessionary worries last year resulted in Roku's shares falling by a whopping 92% through December 2022.

Those losses likely still weigh heavily on investors. However, the sky has brightened for shareholders in 2023, and shares just did something pretty remarkable that investors should pay attention to.

Roku's Streaming Hangover

The demand for streaming content was accelerated by covid-era lockdowns, causing a wave of interest in streaming services, high-definition devices, and televisions that was a boon to Roku's revenue.

DON'T MISS: Cathie Wood’s ARK Innovation ETF Gets A Surprising Price Target

For example, Roku's top line surged 81% year-over-year to $645 million in the second quarter of 2021. Leveraging that surge in sales growth against fixed costs meant that Roku's earnings per share jumped 249% that quarter to 52 cents.

However, it turns out a lot of that sales growth was the result of pulled-forward demand. As workers began returning to offices and consumers emerged from their cocoons, demand for Roku's solutions fell, taking its sales and profit with it.

In Q4 2022, revenue was flat from the previous year. It wasn't much better in Q1. Sales inched 1% higher. Worse, the company lost $1.70 and $1.38 per share in each quarter, testing investors' patience.

Roku's Stock Does Something Impressive

Last year's dismal sales and profit performance may set the company up for easier comparisons through the rest of 2023. The company's not out-of-the-woods yet, but analysts have recently increased their estimates for 2023 and 2024, offering hope that the worst may be behind it.

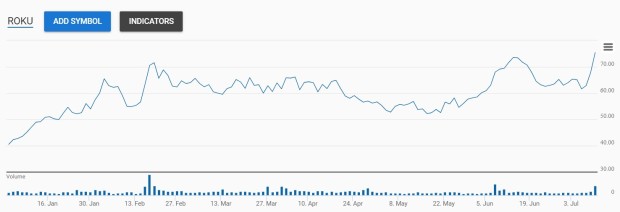

That potential hasn't been lost on investors. Roku's shares have rallied 97% higher since bottoming in December. The sharp increase in Roku's share price has forced the hands of those who were betting against the company by shorting its shares.

Those bearish bets may have come home to roost this week. As of June 15, 11.1 million shares were held short, down 14% from two weeks prior. It appears that the figure will be even lower when the data is updated, given shares have skyrocketed since June, including an 11% rally on June 11.

Importantly, the move up in Roku's shares has happened on much heavier than average trading volume. On average, Roku's shares trade 6.4 million shares daily. However, 19.7 million shares changed hands on the 11th.

The rally in Roku's stocks may continue, too. The jump lifted its share price to a new 52-week high, suggesting that buyers may emerge on future pullbacks in its share price.

What's Next For Roku's Stock

Consumer budgets have been strained by inflation. However, higher interest rates have slowed inflation over the past year, and unemployment remains low, providing some financial wiggle room.

Inflation-adjusted wages may improve if the jobs market remains strong and inflation retreats. That could be good news for Roku because it doesn't only benefit from device sales. It also makes money from advertising. Last year, ad budgets were hamstrung by economic worries. If those worries dissipate, profit-friendly ad revenue may rebound, aided by Presidential Election year ad spending.

The company announced a new ad collaboration with Shopify (SHOP) -) to exploit the potential tailwind. The click-to-buy deal lets consumers purchase directly from Shopify merchant ads using their Roku remote.

Perhaps, that will be the catalyst for shares to move meaningfully higher. Real Money's technician, Bruce Kamich, recently set a new price target for Roku. After reviewing point and figure charts, Kamich noted shares could have running room to $85, $109, and $121, representing gains of 12%, 44%, and 60%, respectively.

Of course, stocks don't rise or fall in a straight line, so there will likely be pullbacks along the way. However, as long as Roku's shares remain above $60, Kamich thinks those higher price targets will remain in play. If so, today's impressive move may signal further gains ahead.

Forget Roku: Sign up to see what stocks we’re buying now