Shares of Roblox (RBLX) have been on an absolute tear in 2023. Similar to most other tech stocks, Roblox has gained significant momentum in recent months, surging 63% year-to-date, valuing the company at a market cap of $25.6 billion.

However, despite the recent uptick in share prices, RBLX stock is still trading 66% below all-time highs as investors remain worried about macroeconomic headwinds such as inflation, rising interest rates, geopolitical tensions, and supply chain disruptions.

So, let’s see if Roblox can continue its impressive rally in Q2 of 2023 and beyond.

What does Roblox do?

Roblox owns and operates a free-to-play platform that connects millions of global users daily. The platform consists of Roblox Client, an application that allows users to access or explore 3D digital worlds. Additionally, Roblox Studio is a free toolset enabling developers to build, publish and operate 3D experiences, while Roblox Cloud includes the services and infrastructure required to power the entire experience.

The content built by its community of developers powers the Roblox platform, which attracts users. Moreover, Roblox operates a social platform where users typically play with friends driving organic growth and engagement.

Once users join the Roblox platform, they can “immerse” themselves in the millions of experiences built by developers. Alternatively, creators and developers earn virtual currency called Robux as users pay for these experiences, virtual items, and engagement via micro-transactions. Robux can also be exchanged for fiat currencies through a developer exchange program.

More than 4 million developers and creators earned Robux in 2022, while 11,000+ developers qualified for the Developer Exchange Program. Roblox paid creators around $182 million in developer exchange fees in Q4 of 2022.

The ability to earn income encourages developers to create better content which in turn attracts additional users. Roblox ended 2022 with 56 million daily active users, or DAUs, across 180 countries. These users spent 49.3 billion hours on the Roblox platform, indicating an average of 2.4 hours per DAU each day. In the last year, the users explored around 19 different experiences on Roblox each month.

How has Roblox stock performed since its IPO?

Roblox listed on the NYSE via a direct listing at $45 per share. The pandemic acted as a massive tailwind for online entertainment platforms, allowing Roblox to increase sales from $508 million in 2019 to $1.91 billion in 2021. This rapid expansion revenue meant Roblox stock touched a record high of $135 in November 2021. However, as sales growth decelerated to less than 20% in 2022, the stock fell to a record low of $21.65 last December.

Analysts tracking the stock expect Roblox to increase sales by 15% to $3.3 billion in 2023 and by 14.4% to $3.8 billion in 2024. However, its adjusted losses are forecast to increase from $1.55 per share in 2022 to $1.75 per share in 2024.

So, RBLX stock is priced at 9x forward sales, which is quite expensive for a loss-making company.

What next for Roblox stock price and investors?

Roblox initially gained popularity among users below the age of 13, who still account for a large portion of the company’s user base. But in recent months, users between the ages of 17 and 24 have joined the platform at a rapid pace. In Q4, this demographic was the fastest-growing one on Roblox, rising 31% year over year, accounting for 22% of all daily active users. This shift in user demographic provides Roblox with an opportunity to grow sales as older users have additional spending power.

The number of users over the age of 13 accounts for 55% of total users in 2022, up from 40% in 2019. Roblox is optimistic about the increase in older users joining the platform over time as developers continue to create content for mature audiences.

So, higher spending by users will result in robust top-line growth for Roblox, allowing the company to reinvest resources which will further enhance user experiences and engagement rates.

The Roblox marketplace is another long-term revenue driver for the firm. Here, users can buy clothing and several other virtual items to customize avatars, creating another revenue stream for Roblox.

The final verdict

Roblox’s booking in Q4 was up 17% year over year at $900 million, providing investors with near-term revenue visibility. The company’s consistent growth in bookings allowed it to report adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $183 million, compared to $51 million in the year-ago period.

There is a good chance for RBLX stock to move lower in 2023, especially if market sentiment remains bearish. But I believe the company’s widening ecosystem of users and developers, its expertise in the social gaming vertical, and its improving monetization metrics make it a solid long-term investment.

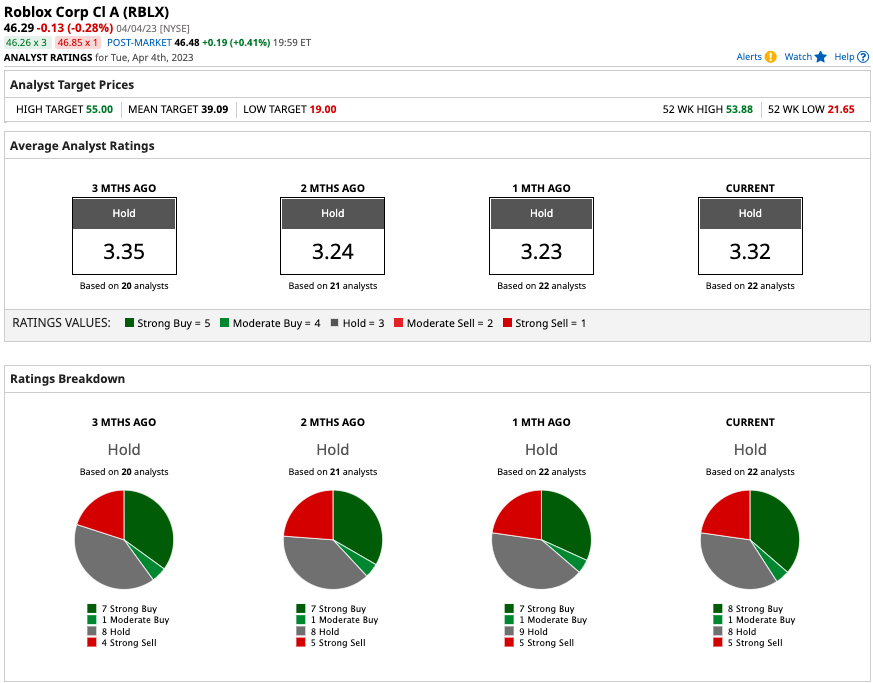

Wall Street analysts remain cautious about Roblox stock and expect shares to fall by another 15% in the next 12 months, given the mean target estimate of $39.09.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.