It’s been one strong run for Robinhood (HOOD) stock over the past few days. From Monday’s low to this week’s high, shares climbed more than 34%.

While GameStop (GME) and AMC Entertainment (AMC) have been the two leaders lately, growth stocks, meme stocks and other beaten down names have been on the mend.

The question becomes, just how sustainable will this rally be?

I have my doubts, given the larger trends in play. That being said, I also believe many of these stocks were deeply (and unfairly) oversold.

On the other hand, it’s hard to figure out where Robinhood fits in all of this. It has the revenue growth to justify its status among growth stocks, but its valuation will likely be a concern given the bumpiness of the current market.

Let’s go right to the chart.

Trading Robinhood Stock

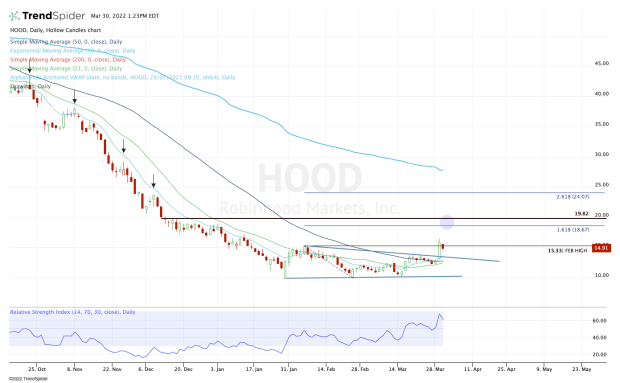

Chart courtesy of TrendSpider.com

Unlike most other growth stocks, Robinhood has actually traded pretty well since bottoming in January. Not that it’s tacked on big-time gains by any means, but it mostly consolidated in a tight range for the better part of two months.

There was solid support at the $10 level while shares were contending with the 10-day and 21-day moving averages, although it struggled with the 50-day.

It was a mixed bag, but that’s better than most growth stocks can say. Even the Ark Innovation Fund (ARKK) made new lows in February and March despite its largest allocation being in Tesla (TSLA), which has performed well.

This week, Robinhood stock erupted through downtrend resistance (blue line) and the 50-day. The stock even traded up through last month’s high, although it’s back below that mark with today’s ~7% dip.

From here, bulls need to see Robinhood hold its short-term moving averages as support. It would be constructive to see it stay above that prior downtrend resistance mark as well.

Should it break below all of these marks, then $10 could be back in play.

On the upside, I have my sights on the $18.50 to $20 area. There it finds a key level and the 161.8% extension of the current range. If it can push above that, then $24 could be on the table.

Lastly on the upside, I’m watching the VWAP measure that’s anchored all the back to its IPO date from July 2021.