In my first article of 2024, I listed thoughts from financial experts about last year and some of their predictions and concerns for retirement issues going forward into 2024. In their view, for example, artificial intelligence will grow and have an even bigger impact on our lives. The effects of COVID are waning but still with us, as seen in continued elevated mortality rates. There is talk that maybe — just maybe — traditional pensions will make a comeback as employers see their value in attracting and keeping employees.

In this article, I will discuss changes to retirement planning that offer possible solutions to three specific retirement concerns expressed by these experts: market volatility, long-term care expenses and income taxes. All of these subjects will be with us until the end of time. But let’s look at some ways to make them less worrisome.

Reduce risk from market volatility

Predictions for 2024. At the same time that we reported Morningstar has hiked its annual estimate of a safe withdrawal rate back to 4%, other observers also pointed out the stock markets can’t be predicted with any accuracy. As Morningstar itself posted, “Fluctuating market valuations and rising inflation could threaten the security of retirement plans.”

But there are ways to reduce your market volatility without pulling out of the market entirely.

Go2Income enhancement in 2024. As I discussed in my article Do You Have Enough Income to Retire? That Is the Question, you can allocate retirement savings between some basic investment portfolios and income annuities to reduce risk. To date, I’ve not included hybrid products that combine multiple features, since our planning deploys sophisticated allocation to synthesize the combined features. I call it the H20 solution.

While you can manage investment risk with sophisticated option strategies, there are products in the annuity space that can protect your original investment during bad markets while also allowing you to take advantage of the good times. And with a few of the key tax benefits of annuities. It’s called a fixed index annuity, or FIA, which allows you to minimize (or avoid) much of the risk of down markets. The negative is that you may not fully benefit from a boom either.

Just like other types of annuities, you purchase an FIA from an insurance company. It offers the tax-deferral benefits of annuities, but it has an interesting way of crediting returns to your account.

Advance preview of 2024. Our job is to look over the universe of asset classes and bring certain ones into our planning so that you can decide, along with your adviser, whether it fits into your retirement income plan. Later this month, Go2Income will add the FIA asset class to our offerings.

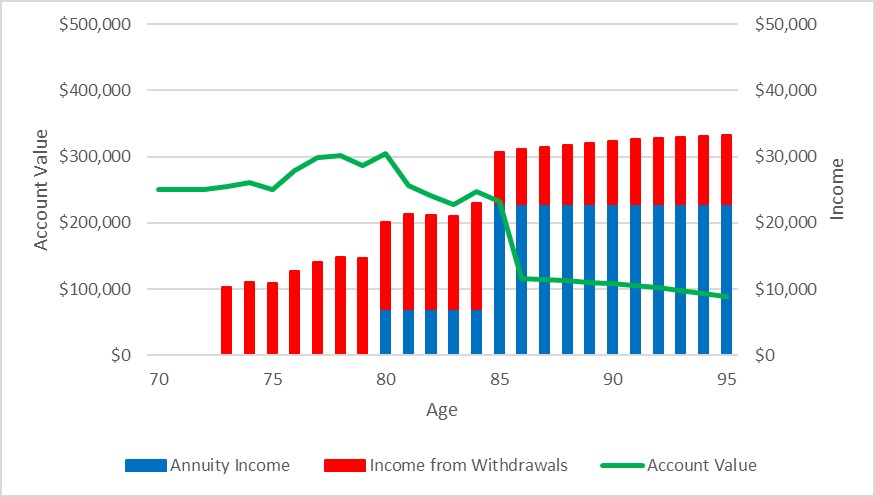

The chart below shows how an FIA might provide another source of income and account value when you include it in your plan. We will provide personalized reports with graphics like these when we launch.

How to pay for long-term care

Predictions for 2024. If you don’t already have insurance for long-term care, where will you find the money to pay for it? (Costs keep going up for consumers who already own such insurance, too.) Our three-generation family realized that after settling most planning needs, there still was a hole when it came to long-term care.

Go2Income enhancement in 2024. One surprising source of safe income and liquidity is your home — if you know how to access it. People over 65 with high incomes might have 20% to 25% of their wealth residing in the value of their primary residence.

This year, we’re introducing a program that allows consumers to incorporate home equity into their retirement income planning through a home equity conversion mortgage (HECM), also called a reverse mortgage. An HECM can help address key retiree concerns: lifetime income, liquidity, legacy and lower taxes.

Advance preview of 2024. In the first quarter, we’ll add the HECM asset class into our planning so you can include it in your analysis as part of your retirement income plan.

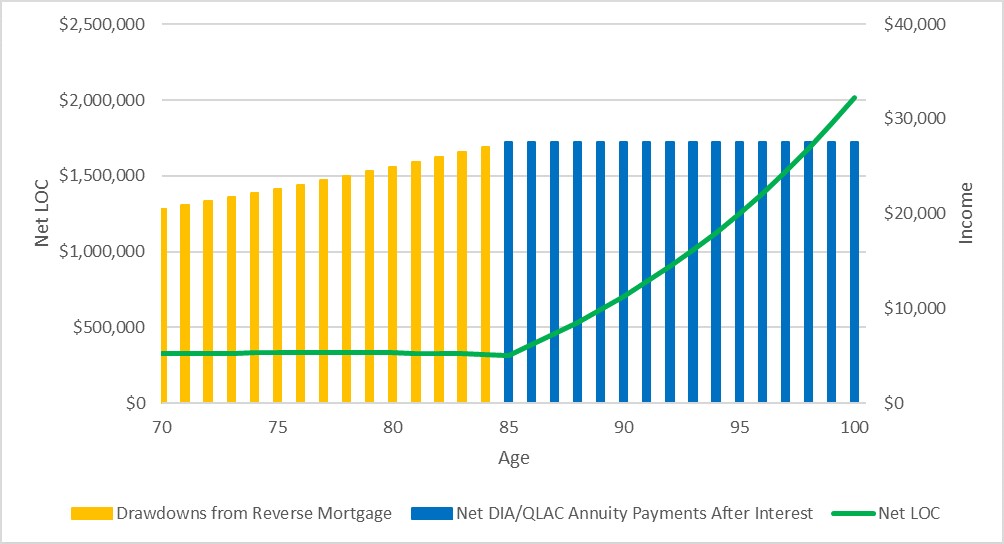

The chart below shows how a combination of HECM and an annuity, which together we call HomeEquity2Income, might provide more income and an available line of credit (LOC) when you add it to your plan. We will provide personalized reports with graphics like this when we launch.

Consider income taxes in your planning

Predictions for 2024. Changes to federal taxes are probably coming. Congress will be looking at the 2017 Tax Cuts and Jobs Act (TCJA) that expires in 2025 and trying to decide what to do. They might extend the existing provision, rewrite the entire tax code or, more likely, something in between.

The Brookings Institution released a report that describes the country’s tax situation as a “fiscal cliff.” Certain experts, for example, propose changes that “would restore fiscal responsibility” and raise $3.5 trillion over the coming decade. Whatever the outcome, I like to reduce taxes today using tried-and-true provisions that are often overlooked. Order a quote for an immediate annuity to see an example of this kind of tax benefit.

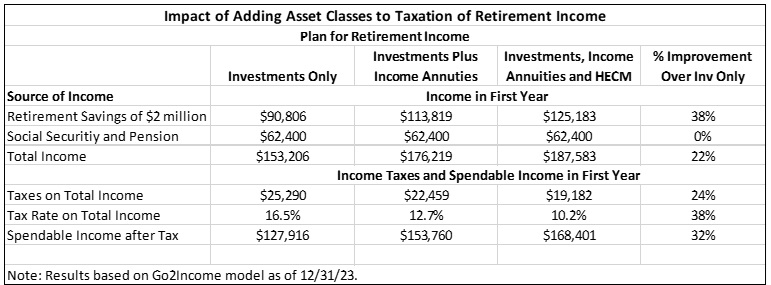

Go2Income enhancement in 2024. Whatever happens, we can help you prepare, by providing a calculation of estimated income taxes with your plan and by building in tax-smart sources of income. (Most plans look only at your pre-tax retirement income.)

We will provide a way for you to evaluate different scenarios for tax efficiency and decide whether you want to allocate more or less heavily into certain financial products — income annuities, for instance — from before-tax or after-tax savings. You can develop the plan that works best for you.

Advance preview of 2024. While not expected to launch until April, here’s an example of how the tax calculator together with the tax-favored asset classes can show how you can pay lower taxes even with more income.

Looking forward to a busy year

The only prediction I am comfortable making is that we will be surprised by more than a few things in 2024. Go2Income helps you ride out the ups and downs so that your retirement income plan remains safe and manageable.

And consider what may be the greatest benefit: Investors often sell all their holdings when markets crash. There is value in “staying the course,” even during scary economic times — and that’s why smart planning can help.

Visit Go2Income to order a plan for yourself at no obligation.