Retail stocks lately have been quite strong -- not quite to the level that we’ve seen out of energy, but certain stocks in this group have been pretty impressive.

Specifically, I’m talking about Walmart (WMT) and Costco (COST). Despite marketwide volatility, both stocks have been roaring higher.

They hit new highs on Thursday, as Costco led the way higher following its impressive March sales report.

Walmart is doing its part by working on its 11th gain in the past 12 sessions. Clearly, there are pockets of strength within the retail space, and traders are flocking to the few spaces that continue to exhibit relative strength.

So how do we trade such strength? I like rotations and pullbacks.

Trading Walmart Stock

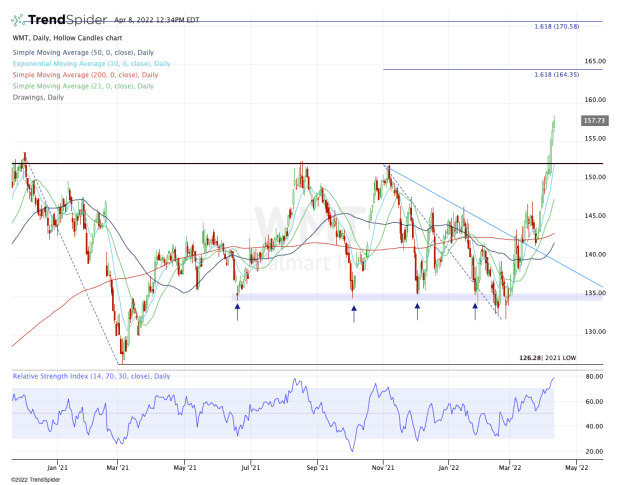

Chart courtesy of TrendSpider.com

Walmart stock has been absolutely incredible and as a result, the bulls are looking for a pullback to buy.

When I look at the chart above, I see a very clean breakout at the $152 area. If we get a mild pullback to this level, it may give buyers a great opportunity to get long.

That’s especially true because they’ll know pretty quickly whether support will fail or hold. It's a clear-cut level and if it fails, $150 or lower is in play. If it holds, the stock should be pretty responsive to this area.

I would especially like it if this dip would time up with a pullback to the 10-day moving average. If buyers show up here, it shows that longs have active control in Walmart stock.

Trading Target Stock

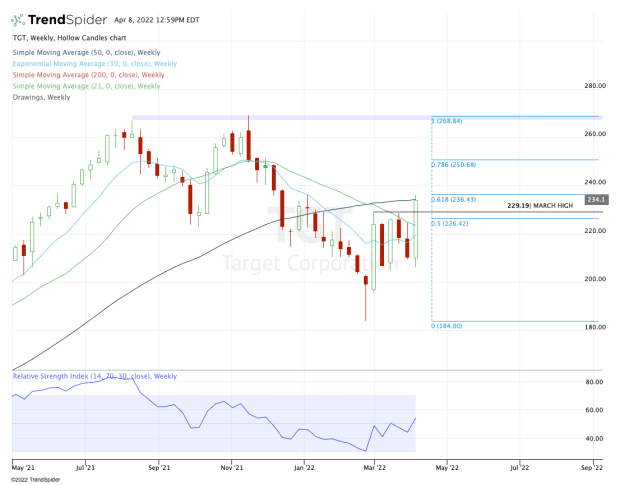

Chart courtesy of TrendSpider.com

Walmart is a pullback name to watch, while Target (TGT) stock is a rotation trade. Specifically, it’s enjoying a monthly-up rotation over $229.19.

The stock poked its head above this level on Thursday, then slipped lower by the close. But Friday’s action left no doubt. Target stock gapped above this level, then held above it through this morning’s dip.

The stock already hit the first upside target near $236. That’s the 61.8% retracement of the current range and the 200-day moving average.

But when we look beyond the daily chart, the potential really opens up. Above the first target area could open the door all the way up to $250, which is the 78.6% retracement. If Target can get above that, we could be looking at a potential return to the highs.

I don’t want to be too optimistic with Target, but it’s a high-quality retailer. With Costco and Walmart making new highs, it’s not crazy to think that Target will be close behind.