/Republic%20Services%2C%20Inc_%20HQ%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Phoenix, Arizona-based Republic Services, Inc. (RSG) is a leading provider of environmental and waste management services. Valued at a market cap of $67.2 billion, the company offers non-hazardous solid waste collection, recycling, transfer, and disposal solutions to residential, commercial, industrial, and municipal customers.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and RSG fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the waste management industry. The company's strong operational footprint, customer retention, and focus on efficiency and environmental responsibility support consistent cash flows and long-term growth in the industry

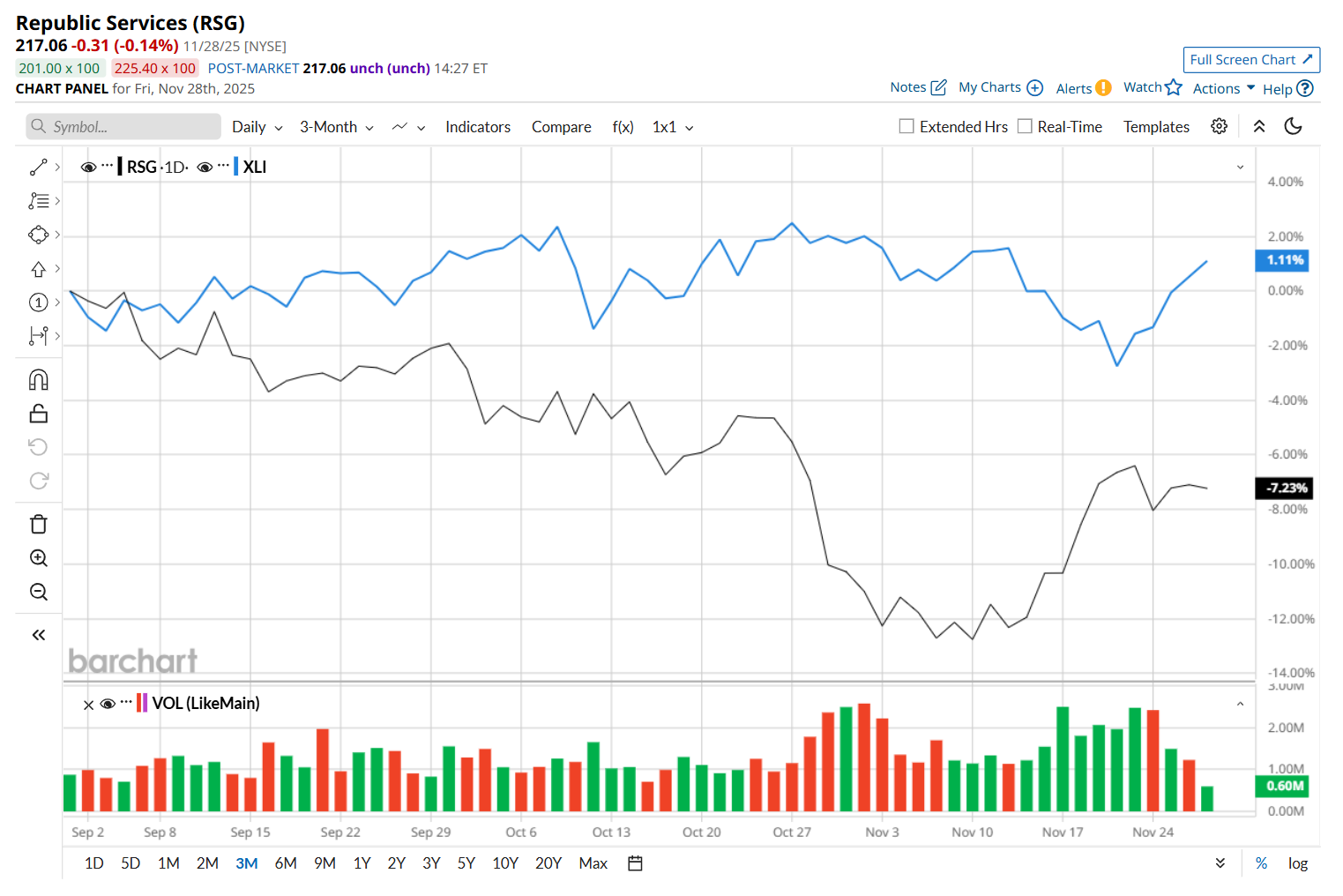

This waste management company has dipped 16.1% from its 52-week high of $258.75, reached on Jun. 3. Shares of RSG have declined 6.9% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) marginal rise during the same time frame.

Moreover, on a YTD basis, shares of RSG are up 7.9%, compared to XLI’s 16.6% return. In the longer term, RSG has decreased marginally over the past 52 weeks, trailing behind XLI’s 7.3% uptick over the same time frame.

To confirm its bearish trend, RSG has been trading below its 200-day moving average since early September and has remained below its 50-day moving average since late June, with minor fluctuations.

On Oct. 30, shares of Republic Services closed down marginally after its mixed Q3 earnings release. The company’s revenue grew 3.3% year-over-year to $4.2 billion but came in below analyst expectations, largely due to ongoing cyclical volume pressures. However, its ability to price ahead of cost inflation and its disciplined operational execution drove an 80-basis-point increase in adjusted EBITDA margin. This, in turn, contributed to a 5% year-over-year rise in its adjusted EPS to $1.90, which exceeded consensus estimates by a notable margin of 7.3%. This earnings beat likely helped cushion the negative market response to the modest revenue shortfall.

RSG has outperformed its rival, Waste Management, Inc.’s (WM) 4.6% drop over the past 52 weeks. However, it has marginally underperformed WM’s 8% rise on a YTD basis.

Despite RSG’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 27 analysts covering it, and the mean price target of $249.88 suggests a 15.1% premium to its current price levels.