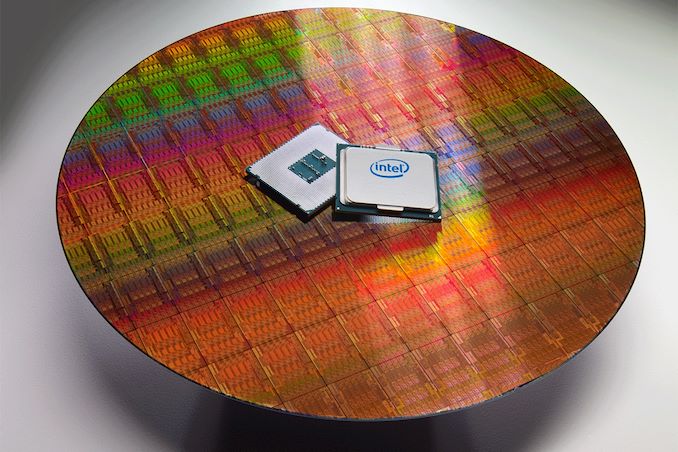

China has initiated a policy shift to eliminate American processors from government computers and servers, reports Financial Times. The decision is aimed to gradually eliminate processors from AMD and Intel from system used by China's government agencies, which will mean lower sales for U.S.-based chipmakers and higher sales of China's own CPUs.

The new procurement guidelines, introduced quietly at the end of 2023, mandates government entities to prioritize 'safe and reliable' processors and operating systems in their purchases. This directive is part of a concerted effort to bolster domestic technology and parallels a similar push within state-owned enterprises to embrace technology designed in China.

The list of approved processors and operating systems, published by China's Information Technology Security Evaluation Center, exclusively features Chinese companies. There are 18 approved processors that use a mix of architectures, including x86 and ARM, while the operating systems are based on open-source Linux software. Notably, the list includes chips from Huawei and Phytium, both of which are on the U.S. export blacklist.

This shift towards domestic technology is a cornerstone of China's national strategy for technological autonomy in the military, government, and state sectors. The guidelines provide clear and detailed instructions for exclusively using Chinese processors, marking a significant step in China's quest for self-reliance in technology.

State-owned enterprises have been instructed to complete their transition to domestic CPUs by 2027. Meanwhile, Chinese government entites have to submit progress reports on their IT system overhauls quarterly. Although some foreign technology will still be permitted, the emphasis is clearly on adopting local alternatives.

The move away from foreign hardware is expected to have a measurable impact on American tech companies. China is a major market for AMD (accounting for 15% of sales last year) and Intel (commanding 27% of Intel's revenue), contributing to a substantial portion of their sales. Additionally, Microsoft, while not disclosing specific figures, has acknowledged that China accounts for a small percentage of its revenues. And while government sales are only a fraction of overall China sales (as compared to the larger commercial PC business) the Chinese government is by no means a small customer.

Analysts questioned by Financial Times predict that the transition to domestic processors will advance more swiftly for server processors than for client PCs, due to the less complex software ecosystem needing replacement. They estimate that China will need to invest approximately $91 billion from 2023 to 2027 to overhaul the IT infrastructure in government and adjascent industries.