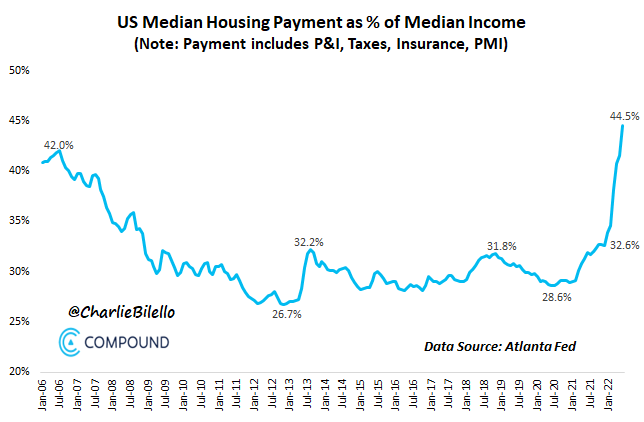

Last week, mortgage rates increased alongside hotter-than-anticipated inflation data, surpassing 6% for the first time since late 2008.

Next to high rates, the median American household would need to spend 44.5% of their income to make payments on a median-priced property in the U.S., according to data shared by Compound Capital Advisors CEO Charlie Bilello. This is the highest percentage on record dating back to 2006.

Despite the fact that rising rates will continue to stifle demand and drive down home prices, median home prices are still at all-time highs. Also, inventory is still too low, and homebuilder confidence is at multi-year lows. This suggests that there will probably be further drops in property prices, but it shouldn't be significant.

According to a National Association of Home Builders study, builders' confidence in the single-family home construction market has declined to its lowest level since 2020, which reflects the overall static of the economy.

The NAHB reports that the builder confidence level has dropped to 46 on an index scale. The NAHB index ranges from zero for very poor to one hundred for excellent.

The 46 number represents a sharp decline from the 83 level recorded in January of this year. The latest index rating has not been this low since the spring of 2014.

In a statement, NAHB chairman Jerry Konter said “buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of reach for many households.”

Konter pointed out that this month, 24% of home builders are reporting price reductions in response to market conditions, up from 19% in August.

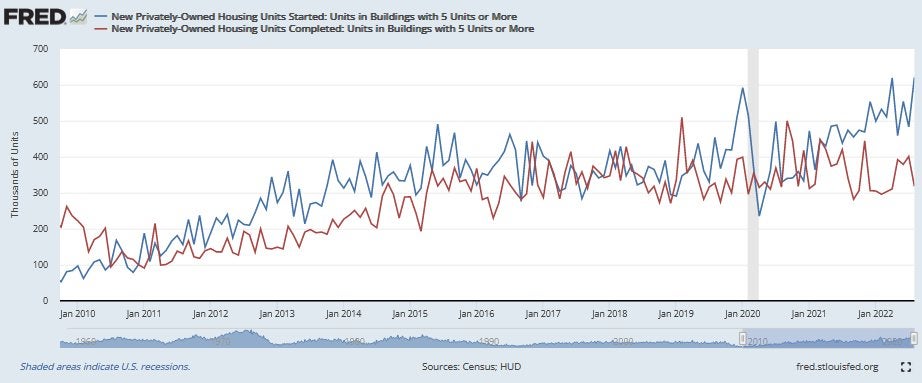

Starts gonna have to fall a lot quicker to clear inventory more quickly in SF. Completions grinding higher, but by no means surging as some have been expecting. pic.twitter.com/0Rhfen4Kp4

— Dustin Jalbert (@2x4caster) September 20, 2022

According to August residential construction data, single‐family housing units authorized by building permits were at a rate of 899,000; this is 3.5% below the revised July figure of 932,000.

Authorizations of units in buildings with five units or more were at a rate of 571,000 in August. Over the last two years, there has been a ramp-up in the construction of housing in buildings with five units or more, but completions are waning; this will put additional pressure on rents.